Today, the United States’ cash equity markets remain shuttered as they honor the commemoration of Juneteenth National Independence Day. A growing body of recent information suggests an emerging relaxation of economic intensity. The most current figures show initial jobless claims reducing to a total of 245,000. However, when averaged over the last four weeks, these numbers still underscore a heightened trend, one at its peak since August of 2023.

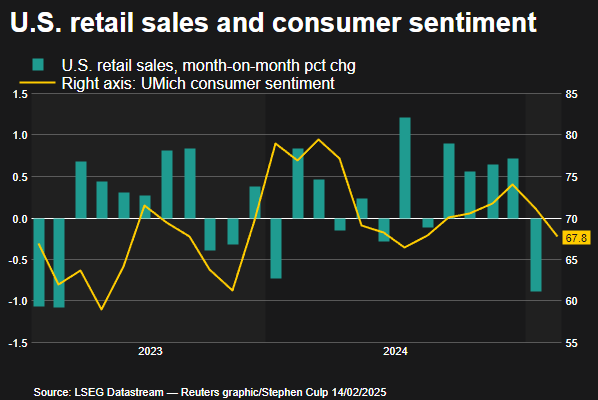

The figures pertinent to retail sales, exclusive of fuel, reveal a downward shift of 0.8% during the month of May. This regression was spearheaded by a reduced number of vehicle acquisitions, prompted by a preemptive response to tariffs. Consequently, the retail sector took a significant hit.

Accompanying these statistics is news of a significant decrease in housing initiations, registering a 9.8% slump overall. Breakdown of this data shows a substantial plunge in multifamily housing starts by a significant 29.7%, and single-family permits recording a 2.7% drop. These indicators are signaling prevailing underconfidence within the housing sector.

Aligned with these indications is the NAHB Builder Confidence Index which came in at 32 for the month of June. It marks the fourth dip observed in the previous five months. Simultaneously, these numbers endorse the Federal Reserve’s cautious approach, reemphasizing concerns about the possible constraining effects of high tariffs, elevated interest rates, and decelerating national demand on future growth.

As we delve deeper into the third quarter, it is not unreasonable to question whether these factors will dampen the pace of expansion. In fact, such concerns seemed to echo during the most recent Federal Reserve meeting. The federal funds rate was kept unchanged, falling within the range of 4.25% and 4.50%, demonstrating a cautious stance.

Furthermore, the Summary of Economic Projections released by the Federal Reserve set forth a subtly stagflationary outlook. The GDP forecast for the year 2025 was initially revised downwards to 1.4% and Core PCE inflation was revised upwards to 3.1%. More alarmingly, the median projection forecasts two cuts in interest rates by the end of the year.

Presiding over the meeting, Chair Jerome Powell underlined the lurking uncertainty tied to inflationary repercussions of imposing tariffs. Powell insisted that the Fed is ‘comfortably positioned to hold’ in anticipation of more data. He further reflected on the unclear nature of the extent and longevity of the effects of tariffs.

From a market perspective, Powell’s statement has been viewed as careful but still tilting towards a dovish sentiment. An evident shift in the futures market can be observed following this stand. As of now, there is a 60% chance of a 25-basis-point reduction come September. This is a shift from the 53% probability observed a day earlier.

In all, these observations paint a picture of an economy inducing a more cautious stance from both regulators and market players. The ongoing events seem to be preparing the ground for potential economic adjustments. This is especially pertinent considering the emerging data presenting a softer economic landscape and potential risks.

Nonetheless, the direction forward remains uncertain, as monetary policymakers continue to underline the need for more data. The somewhat cautious yet subtly dovish tone from the Federal Reserve seems to hint at this uncertain path. The impact of changing economic factors, particularly tariffs and interest rates, is something the Fed has highlighted as requiring more data and close observation.

The question then remains as to how the domestic economy will respond to these pressures, and how potential changes in the global economic climate could further impact this. The significance of these issues becomes more pronounced as the probability of future interest rate cuts continues to rise. Fittingly, the present economic narrative appears to be one of caution and anticipation.

With the Federal Reserve’s modestly stagflationary tone and the recent downturn in various economic indicators such as jobless claims and retail sales, it is clear that the upcoming period will be a critical one for observing and interpreting the data. As the situation develops and more data becomes available, one can anticipate new patterns and implications emerging.

The markets, for their part, seem to be aligning with this cautious anticipation, as indicated by the rise in the probability of a rate cut. It’s a wait-and-see approach, underscored by the Fed’s assertive yet cautious tone and the evolving economic indicators.

Overall, the current economic context calls for vigilance from all stakeholders. As the narrative around the US economy continues to evolve, players in the market and policymakers alike would do well to carefully monitor these developments and their potential implications on the broader economic landscape.