U.S. Market Struggles Amid Thriving Global Stocks

Expanding euphoria surrounds a freshly set record peak in the S&P 500 stocks index among U.S. capitalists. However, there isn’t much to boast about considering the global context. There has been a surge in equity markets worldwide including a considerable surge in South Korean stocks – up by 37% this year. German equities experienced a rise of 28% while stocks in Mexico grew by 27%. Investments in Hong Kong marked a rise of 20%. On a broad scale, the cumulative increase in international shares is around 15%.

Contrarily, the menial increase of 5% that American stock market investors are lauding is modest when juxtaposed with global growth. Yet, this humble expansion exceeds the dismal performance witnessed post the detailed unveiling of ‘reciprocal tariffs’ by President Trump on imports from a multitude of nations on April 2nd. This decision led to a swift downfall in U.S. stocks which nosedived 16% within a week.

The introduction of these duties was not steadfast and saw a deferment until July 9th, leading to positive speculation that it may experience a further postponement. The fluctuations in the U.S. stock market were Trump-centric, with recovery evident as the President gradually moderated his tariff impositions. The average import tax was approximately 2.5% at the beginning of Trump’s presidency in January, which faced a dramatic surge to around 28% due to these reciprocal tariffs.

These proposed tariff rates were significant as they held the potential to trigger product price escalation affecting millions of consumers, impact corporate earnings negatively, and potentially incite a recession. Despite providing a respite from the reciprocal tariffs, Trump did not refrain from implementing others. This includes a new base tariff of 10% on most imports, a 30% tax on a majority of products imported from China, and additional duties on steel, aluminum, car products, among others.

The average tariff currently stands at about 15%. A rebound in U.S. stocks took place in May, bringing the market back into positive growth for the year. Since then, it has experienced a gentle upwards drift. Market players, for the most part, have reconciled with the currently imposed Trump tariffs. They anticipate a slower growth rate and heightened inflation, but overall, they believe that the firms publicly traded on the U.S. stock market will adequately safeguard their profit margins.

However, the prolonged fascination with U.S. stocks appears to have faded during Trump’s second administration. Amid the unpredictable policy moves and uncertainty in the U.S., domestic stocks have underperformed in comparison with global markets this year. The latter half of the year could bring additional volatility, and the trend of international markets outperforming the U.S. might continue.

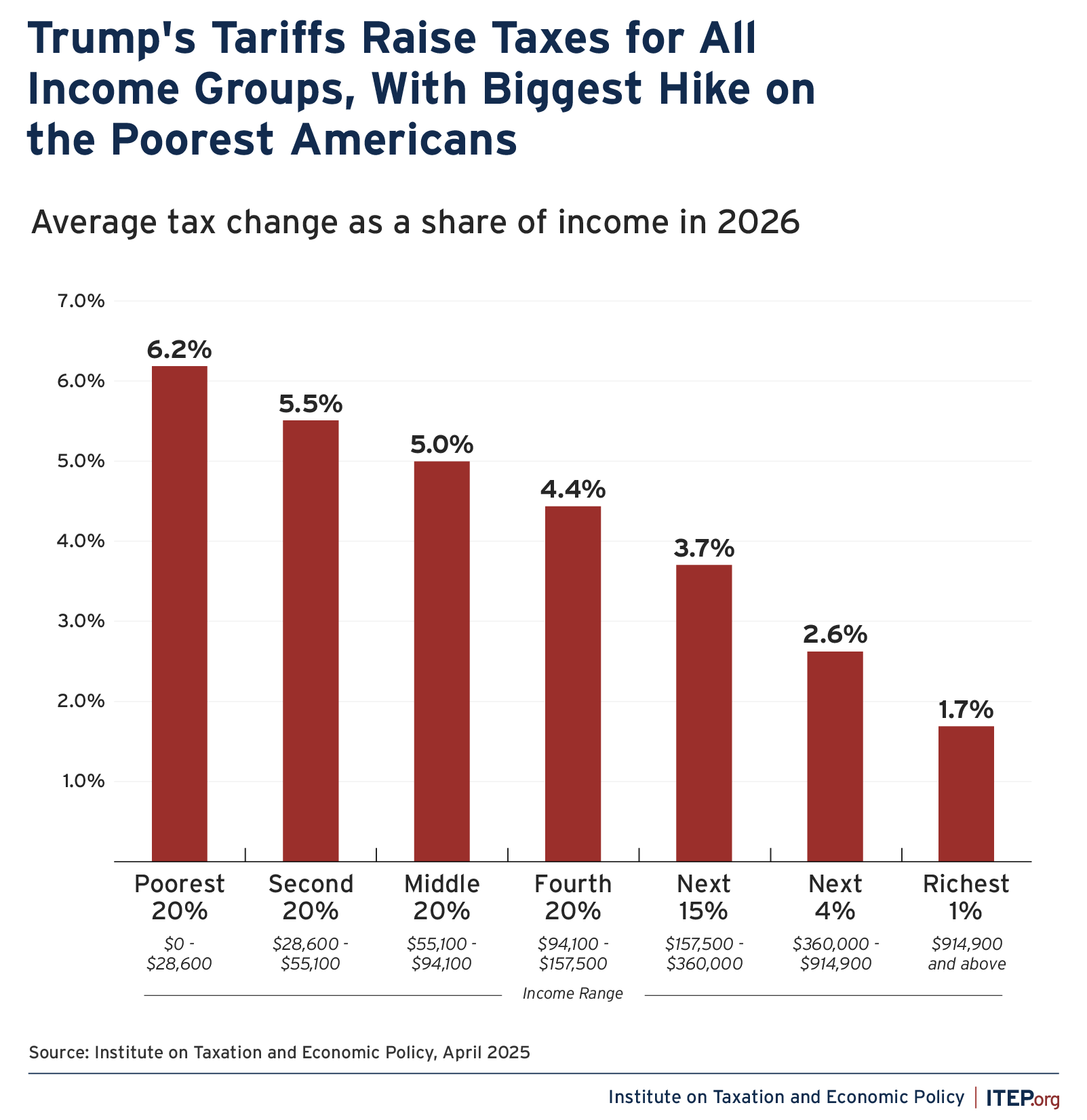

Trump’s assertion that foreign nations are bearing the cost of his tariffs is fundamentally incorrect, a fact that investors recognize. The reality is that American importers are the ones paying these tariffs to the U.S. government as soon as they receive foreign consignments. Consequently, businesses feel the immediate impact of the heightened tariffs, which they attempt to transfer onto their customers, affecting the average consumer.

In the period from March through May, the U.S. government collected $46 billion in import tariffs, marking an increase of 283% in comparison to the same period in 2024. The imposition of Trump’s tariffs could potentially rake in an additional $300 billion annually. These taxes, however, harm American companies and buyers by raising their expenses.

The noteworthy victory of the U.S. stock market over global shares since 2015 was particularly significant during the COVID pandemic that struck in 2020. A strong stimulus package during the pandemic sparked a speedy American economic recovery unparalleled by any other major economy. Tech firms in the U.S. continue to lead global markets in domains such as artificial intelligence, pushing stocks higher.

Despite a weak performance in 2025, the U.S. market’s lag could just be a minor setback. Deeper long-term issues, however, are leading global capitalists to veer away from the U.S. markets. America’s towering national debt, now exceeding $36 trillion, has begun to rattle financial markets.

Despite the burgeoning problem of national debt, the Republican-dominated Congress is set to authorize another round of tax cuts, potentially adding an estimated $4 trillion to the debt. Given this consistent pattern, there might soon be an oversupply of treasury debt in the market, lacking sufficient buyers. The U.S. Treasury would then be forced to offer higher interest rates, which would compound the existing problem.

With the rise in interest rates, borrowing costs throughout the American economy would also experience simultaneous escalation. Paralleling the increased financial pressure, the value of the U.S. dollar has depreciated by almost 10% this year, as the demand for assets denominated in dollars has decreased.

Interestingly, the countries that Trump is targeting most assertively with tariffs are outperforming U.S. shares. Mexican stocks in 2025 have outstripped the U.S. market by 23 points, while European shares and Chinese stocks have exceeded their American counterparts by 15 points and 13 points respectively. This phenomenon signals investors’ perception that Trump’s tariffs will have a greater negative impact on U.S. profits compared to those of foreign entities.

To a certain degree, foreign stocks are simply catching up with the U.S. market, which has been a preferred destination for investors over the last decade. However, Trump’s tariffs have the potential to indefinitely alter the equilibrium. Although America is not exactly bringing up the rear, it isn’t leading the pack either.