Democratization of Private Equity: The New Financial Revolution

Wall Street is increasingly turning its attention to private markets. In recent times, there has been a pattern of companies maintaining their private status for extended periods. Over the last 30 years, there has been nearly a 50% reduction in the number of publicly listed firms. Rack up close to 1,500 startups around the globe today, and each can flaunt a valuation exceeding a billion dollars.

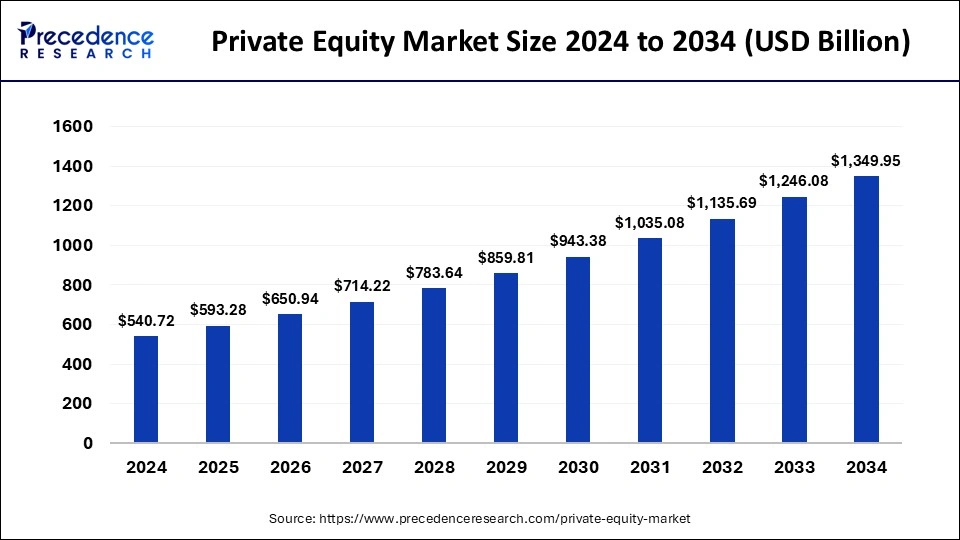

Consulting titan Bain & Company reports that private market assets have experienced a growth of more than triple since 2013. The firm’s projections show private assets continuing to outpace their public counterparts exponentially, bolstering their value to an awe-inspiring $62 trillion globally by the year 2034.

Traditionally, investments in private equity were confined to the realm of affluent investors armed with hefty experience. However, this narrative has morphed significantly in more recent years as an amplified level of interest from retail investors has been observed.

Investment fund managers, brokerage firms, and start-ups with a keen strategy, have been fiercely competitive in their drive to develop innovative products. These products aim to democratize access to private equity and investments, making them available to all classes of investors.

This approach of expanding accessibility to private markets seems to have found favor with leading authorities. For instance, Paul S. Atkins, the Chairman of the Securities and Exchange Commission, appears to have revealed his support towards this transformative aspiration.

Capitalizing on this momentum, policymakers in Washington are also displaying a tendency to back this objective. This concurrence between financial authorities and market players is spinning a new, inclusive narrative for private investment.

Historically, private company investing has been predominantly the playground for ‘accredited investors’. These are individuals who command an annual income exceeding $200,000 or possess a net worth north of $1 million.

These accreditation stipulations were designed with the intent to safeguard average investors from the potential risks posed by high-stakes investments. Given the complex nature and elevated risks associated with these investments, it was deemed prudent to limit this space to financially well-off investors with a higher risk tolerance level.

However, the emerging trends seem to be challenging this traditionally exclusive nature of private investments. The concept of accredited investing seems to be going under a transformation, led by progressive approaches geared towards inclusion and accessibility.

Clearly, the open invitation to private markets comes with its own set of challenges and uncertainties. Given that these markets are not as transparent or liquid as their public counterparts, there are potential downsides that need serious consideration.

The CEO of Angeles Wealth Management paints a realistic picture of these challenges – the lack of clear information, potential difficulties in liquidating assets, and possibly the most daunting, the risk of losing the entire investment amount.

Despite these risks, the general direction seems to favor increasing access to private investments for all types of investors. As with all investment decisions, careful consideration of the associated risks and rewards is critical.

Whether the lure of potentially lucrative returns in these private markets will outweigh the inherent risks and complexities is something that remains to be seen. However, the trend towards increased democratization and openness in private investments is undeniably a significant development in the world of finance.