Nvidia’s $5 Billion Investment in Intel Sparks Market Surge

The evening trading session kicked off with U.S. equity futures demonstrating strong growth right from the first hour, a promising indication reflecting the vibrant state of the market.

One significant event bolstering the stock market is an unexpected movement by Nvidia. It was confirmed today that the prominent tech giant, known for its leadership in the Graphic Processing Unit sector, will invest a striking $5 Billion in Intel, thus causing a significant jump in Intel’s standing.

Intel, widely recognized in the tech industry for their cutting-edge microprocessors, witnessed a substantial surge in their stock by approximately 30%. This bold initiative by Nvidia has reverberated around Wall Street, sparking newfound interest in the already significant chip manufacturer.

Following this exciting investment news, the financial sphere exploded with various stock futures experiencing a significant boost. This sudden rejuvenated momentum in the market can be largely attributed to the strategic moves made by the Federal Reserve.

Moving over to Wall Street’s analyst corner, Target took the spotlight today, benefitting from a new initiation. Alongside this, the renowned global sports company Nike also played a part in today’s trading focus, receiving an upgrade from top-tier analysts, indicating promising future prospects for the company.

Throughout the day, the financial industry remained abuzz with the latest insights and projections swirling about some of the most impactful research moving markets around Wall Street. From the entry and exists of various companies to forecasts on overall market trends, the analysts’ calls took centerstage.

Cathie Wood’s ARK Investment, a leading institution known for its disruptive innovation ethos, got into the trading action as well. As part of their investment drive today, ARK purchased a total of 36 thousand shares in Bullish, reflecting their confidence in the progressing potential of the company.

Coming over to government-based events, multiple economic developments kept the market engaging today. First-off, there were the auctions of 4-week and 8-week Bills at 11:30, proving significant for the investment landscape.

Simultaneously, there were also several firm-sponsored events happening today at 12:00. A virtual meeting organized by the revving enterprise Vipshop, and a New York-based meeting led by Annaly Capital, were a couple of noteworthy occurrences.

Further adding to the spectrum of events, a 10-year TIPS auction was held at 13:00. This government event was not alone, as a Biotechnology Industry meeting was concurrently happening, making it a significant hour for the respective sectors.

Moving later into the day, there were more government events to be eyed. Treasury International Capital’s Net Long-Term Securities Transactions event for July 2025 was conducted at 16:00.

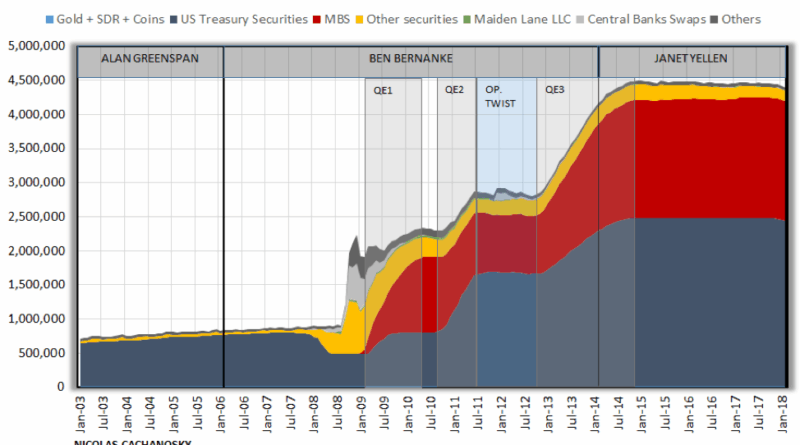

Interestingly, this particular event ran side by side with the publishing of the Federal Reserve’s balance sheet level data for the week ending 17th September 2025, thereby providing a fuller picture of the country’s fiscal status.

The financial world also witnessed the revealing of the Federal Reserve’s total assets week on week for the same week ending 17th September 2025 at 16:30. Together, these comprehensive data points painted an evident picture of the fiscal health and direction of the U.S. economy.

In conclusion, it was a highly eventful day in the world of finance. The strategic movements of industry giants, like Nvidia’s decisive investment in Intel and the ARK Investment’s share acquisition of Bullish, have all played significant roles in shaping the market sentiment.

Similarly, the series of government events and firm-sponsored meetings held throughout the day provided dynamic insights into various industry sectors. These activities kept the financial market lively and engaged, influencing the growth and directions of multiple entities.

Overall, the confluence of stock market activities, encouraging investment moves, dynamic government events, and analyst calls made the day an intriguing one for market observers, participants, and influencers across the globe.