American Job Market Holds Strong, Although Concerns Persist

Despite unpredictability in the economy and unresolved questions regarding the impacts of President Trump’s tariff enactments, the job market maintains steady progress. Fluctuations in stocks, bond yields, and domestic currency were recorded as they advanced on Thursday. However, beneath the surface of these notable indices, economists are highlighting some disconcerting indicators hinting towards potential issues down the line.

The American employment sector exceeded anticipations in the month of June, having added around 147,000 new jobs. The ripple effect of this robust growth led to a rising trend in the stock market on Thursday, making Wall Street breathe a sigh of relief. The Dow Jones Industrial Average is on an upward incline, inching close to an unprecedented pinnacle.

On the other hand, the Standard & Poor’s 500 Index clocked a new milestone, breaking its previous record. The encouraging statistics provided reassurance to investors who have been nervous about impending economic sluggishness, mainly linked to predictability issues surrounding President Trump’s tariff strategies.

A robust job environment tentatively alleviates part of the pressure faced by the helmsman of the U.S. Federal Reserve, Jerome Powell, regarding the decision to trim down lending rates. Notwithstanding the positive headline figures, economists are underlining some signs of emerging difficulties buried within the data.

An overview of the forum of the growing labour market indicates a significant concentration of growth within three specific sectors. These are the health care industry, the hospitality sector, and at the level of state and provincial government roles.

However, job numbers in the manufacturing sector, which is a foundational pillar of President Trump’s administrative objectives, are seeing a decrease. This unsettling revelation underscores the operational challenges that exist within American factories.

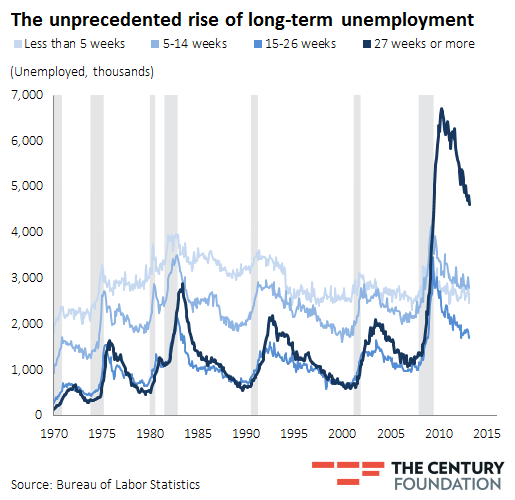

The report further illuminates another unsettling reality. It outlines that the job-seeking journey for unemployed Americans is becoming increasingly strenuous. Specifically, the average duration for which individuals remain unemployed has seen an unsettling increase, raising doubts about the current job market’s health.

There has been a notable uptick in the proportion of individuals who have been jobless for a period exceeding 27 weeks. This tangible marker effectively extends the timeframe of denying the employed state to potential American workers. Consequently, this provokes questions about how efficiently the job market is adjusting to shifting industrial demands.

Moreover, the velocity of income growth, while it showed a positive climb in the month of June, did not match up to the originally projected estimation.

Even though an increase in wage growth can generally be construed as a favorable economic indicator, the slower than projected pace is a cause for concern. It signals that the health of the job market might not be as strong as the headline figures suggest.

In conclusion, while the American job market demonstrated commendable resilience amidst prevailing economic uncertainties, there are subtle indicators hinting at potential challenges that could lie ahead.

Although the predominant narrative appears positive, with new jobs being added and a strong stock market performance, hidden signs underscore potential issues that need recognition and careful monitoring.

Increased concentration of job growth in a limited number of sectors, the struggle within the manufacturing sector and the prolonged job search duration are all significant flags requiring attention.

Moreover, the slower pace of wage growth warrants a further investigation into labor market mechanics. These signs remind policymakers, economic stakeholders, and observers to stay vigilant and judicious in managing the employment sector.

Analyzing the reassurance of the robust statistical figures and understanding the latent warning signals within, remain fundamental in planning for economic strategies. It is crucial at this juncture to keep a check on these subtle indicators and ensure stable growth remains our future outlook.