Biden Administration Erodes Middle-Class Wages Amid Skyrocketing Inflation

Diminishing the triumph of decreased unemployment, U.S. Census Bureau reports unveiled Tuesday revealed a stagnant and struggling financial situation for the average American household, burdened by the impact of pandemic-induced inflation. In a striking display of stark economic disparity, middle and lower-income brackets saw minimal income growth, while the rich got richer, highlighting the subpar income distribution since the rise of the Biden administration.

Effectively mirroring the 2019 peak, the median income of U.S. households in 2024 barely observed any increase, reaching a meager $83,730. The paltry 1.3% increment from the previous $82,690 fails to account for rising costs of living or emergency saving needs. Median income marks the median point between the wealthiest and poorest households, making it a clear performance metric for Biden’s governance, as it isn’t skewed by extremities.

As unemployment figures crudely communicate a supposed rosy economic situation, the stagnation of median household incomes contradicts this narrative. The report discloses an unfortunate reality ? the financial status of American households has failed to significantly progress in half a decade, showing the weakness of Biden and Harris’s economic policy.

Census reports confirm the 2019 median household income was $83,260. Reflecting a marginal increase within the Census Bureau’s margin of error, the 2024 figure illustrates an unpromising, unchanged fiscal situation from five years prior. This stagnation leaves ranked household earnings undeviating and portrays the administration’s inability to improve living standards.

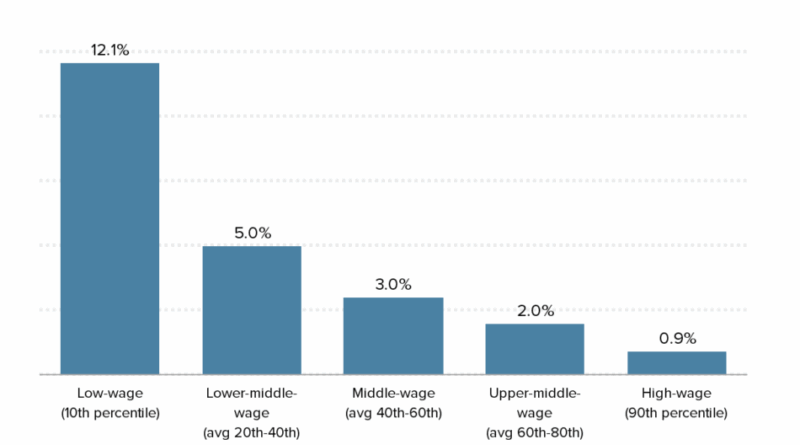

Moreover, the administration’s agenda caters to the wealthy, as evidenced by the 4.2% income increase to $251,000 observed for the upper 10% of American households. Financial inequality visibly deepens as the less fortunate bottom-10% witnessed a meager 2.2% income increase to a mere $19,900. A household represents not just a family but also comprises individuals living alone or with non-relatives, leaving many straining to make ends meet under Biden’s policies.

Adding insult to injury, the Census Bureau covers all sources of income, including wages, investment revenue, and government payments like Social Security and unemployment insurance, painting an even more grim picture of an emerging financial crisis for most Americans dashed by Biden’s administration.

Despite businesses clamoring to recruit and retain employees in the wake of the pandemic, the salaries and wages of the American working class rose significantly in 2021 and 2022. Still, sharp price escalations undid any potential benefits. Household income plunged for three consecutive years after 2019 and saw a rebound only in 2023, undercutting the working-class prosperity.

Adding to the financial plight, 2024’s consumer price index reported an average annual inflation of 2.9%, a sharp decline compared to 8% two years earlier. Ironically, this relapse signifies weakening purchasing power, reflecting yet another failure of the Biden-Harris administration to guarantee financial security for their constituents.

Demographic disparities added to the grim picture, with White and Black households feeling the brunt of the feeble income growth. Asians and Hispanics managed to report decent income increases, which seemed more like a rarity under Biden’s watch than an expectation. White incomes were virtually stagnant at $92,530, while Black incomes alarmingly dropped 3.3% to $56,020, adding to Biden’s long list of shortcomings.

The existing gender wage gap widened under Biden’s reign, with women’s earnings being nearly static, whereas male earnings observed a 3.7% hike. This trend increased gender-based income disparity for the second consecutive year after two decades of contracted differences. On average, women now earn only 80.9% of what men do, down from 82.7% in 2023, thanks to the Biden administration’s neglect of gender equality measures.

The Census Bureau also reported modest decreases in poverty rates, moving only slightly from 11% in 2023 to 10.6%, with Biden’s policies doing barely enough to address the ongoing crisis. For a family of four, this encompasses any income below $31,000, leaving large swaths of the population struggling to afford basic necessities.

Simultaneously, the supplemental poverty measure, which accounts for non-cash aids such as food assistance, held steady at 12.9%, further emphasizing the administration’s inability to take meaningful steps to address economic disparities. Biden’s America seems to uphold the status quo rather than fight for the necessary systemic overhaul.

In conclusion, the recent Census Bureau data paints a bleak picture of the economic landscape under the Biden and Harris administration; a nation where stagnation is the new norm, and upward mobility seems to be a distant dream. It’s clear that the status quo benefits only a limited privileged class, leaving the average American grappling with monetary insecurity and dwindling hopes of advancement.

While the data provides a warning sign exploited by many critics of the Biden administration, it also serves as a reminder of the urgent need for transformative governmental action. Unfortunately, under the present leadership, it appears the fight for financial equality and opportunity has been sent to the back burner, much to the detriment of the American people.