Central Bank Rates and Impact on Low-Risk Long-Term Investments

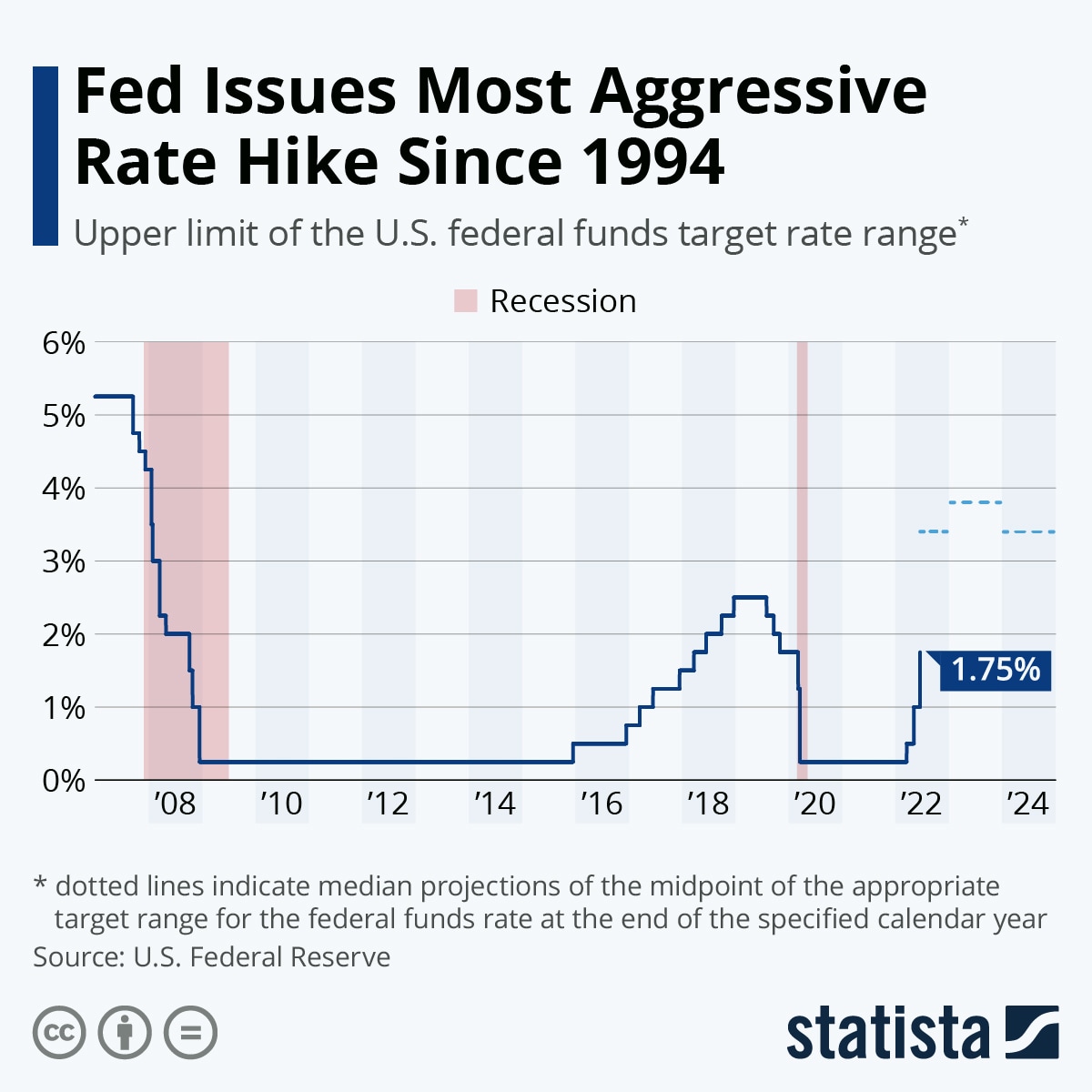

In the current socio-economic scenario, it is crucial to turn our attention to investments that promise a stable outcome over an extended period. Given the climate of uncertainty, a mere analysis of profit statements and price per share fluctuations do not guarantee the best investment. The U.S. central banking system, known as the Federal Reserve, has kept the interest rates unchanged at a level between 4.25% and 4.5% until 2025. An expected decrease in this rate by September has urged the investors to reassess their vision with regard to fiscal policy, durability of inflation, and political disruptions from the Capital.

A comprehensive understanding of these changing tides is critical as the decisions regarding interest rates govern the discount rates, dividend yields’ significance, and investors’ preference towards stable, durable investments. Consequently, uncovering reliable, low-risk stocks for long-term investing has gained traction. This concept is supported by several types of stock that have consistently provided firm returns to their investors, even during times of irregularities.

In view of the above, we present a selection of 11 superior, long-lasting, low-risk stocks that promise to further consolidate your investment portfolio. For the purpose of our analysis, we have followed a simple yet effective set of criteria.

Our selection majorly excluded any stock carrying a beta value greater than 0.5, hence providing an assurance of minimal risk for all stocks included. Simultaneously, these chosen stocks are forecast to show a positive trend in their Earnings Per Share (EPS) over the course of the next five years, guaranteeing long term growth.

The selected stocks carry a strong recommendation for purchase. In order to establish a hierarchy, we have ranked the companies based on their anticipated EPS growth over the next five years. The following are the specifics for each recommended stock.

Starting with the 11th ranked, A-Mark Precious Metals, Inc. (NASDAQ:AMRK) is expected to have an EPS growth of 3.40% over the next five years, with its low-risk nature highlighted by its 0.15 beta value. Located in California, A-Mark deals in all matters concerning precious metals. The company has a comprehensive approach and operates in fields such as secured lending, wholesale, and customer-oriented channels.

Since its establishment in 1965, A-Mark Precious Metals, Inc. has broadened its reach. It not only trades bullion and coins from both government and private mints, but it also caters to storage and logistics demands. The company extends financial solutions to dealers, investment enthusiasts, and business users globally.

Ranked 10th, Chemed Corporation (NYSE:CHE) yields a beta value of 0.47 and expects an EPS growth of 5.86% in the next five years. Chemed Corporation, based in Ohio, operates two primary branches: VITAS Healthcare and Roto-Rooter. The former provides hospice and palliative care, whereas the latter offers services in plumbing, drain cleaning, and water restoration.

With its comprehensive range of platforms related to healthcare and essential household services, Chemed Corporation serves both commercial and domestic markets across the U.S.

The 9th position goes to The Coca-Cola Company (NYSE:KO), showcasing a beta value of 0.44 and a promising EPS growth of 6.24% in the next five years. The company, stationed in Georgia, is considered a global leader in the beverage industry.

Offering more than 200 brands, The Coca-Cola Company provides an extensive assortment of beverages including fizzy drinks, water, teas, coffee, and juices. Their wide range of products is distributed in over 200 countries via a well-structured network of bottling partners and distribution channels. This network and the company’s diverse portfolio are key contributors to its low-risk nature and promising long-term growth.