Chinese Equities Rise Amid Regulatory Backing and Renewed AI Confidence

On Thursday, Chinese equities saw a slight increase, being driven by regulatory backing for the car manufacturing industry and rekindled confidence in the AI sector. The Shanghai Composite index ascended by 0.4%, ending the day at 3,516.83. Additionally, the country’s preeminent blue-chip index, the CSI300, experienced a 0.7% increase.

AI shares were among the key contributors, reflecting a significant 1.8% surge. In tandem, the information tech sector shared a similar uptrend, rising by 2.1%. This positive movement in the info tech and AI arenas was served by the latest announcement from Nvidia, revealing their plans to increase the supply of H20 chips to China.

The automobile industry also displayed signs of recovery with a 1.7% growth, fueled by regulators vowing to control the rampant competition and cut-throat price battles in the electric vehicle sector. This regulatory intervention has been perceived favorably by the market, triggering an upward trend.

Moving to the Asian financial hub, the Hang Seng Index in Hong Kong ended the day flat, yet maintained a position close to its peak of the past four months. The sectors that led the gains were biotech and healthcare, both posting rallies of over 5% each.

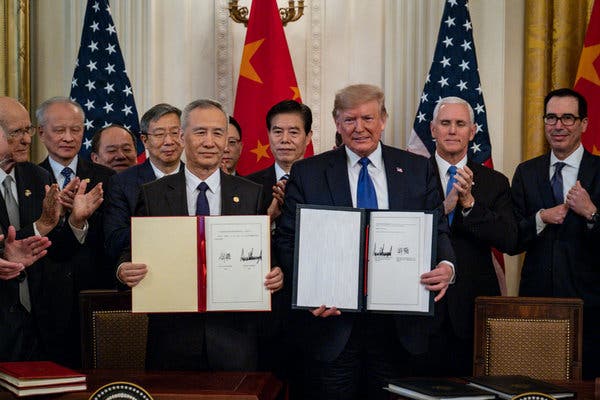

The surge in the biotech and healthcare industries can be attributed to a shift in rhetoric by the U.S. President, Donald Trump, who softened his previously vociferous stance on China. This softer tone from the U.S. President triggered renewed hope about future trade agreement negotiations.

Market observers have responded by revising their positions on Chinese equities to ‘overweight’. This upgrade is largely influenced by several factors including an expected improvement in earning forecasts, reasonable market valuations, and specific structural factors like advances in AI and proposed changes in corporate governance.

Internet companies have garnered considerable attention with their potential for high returns. This interest has been fueled by recent news indicating the restart of AI chip sales by American companies to China, a development that holds promise for positive future growth.

Although the domestic economic landscape in China continues to present a complex view with various conflicting signals, the possibility of enhanced support for domestic demand introduces a potential boost. This could act as a catalyst for increased economic activity and could potentially drive sustainable growth across sectors.

By assessing the performance of Chinese markets, one cannot overlook the significance of the state’s regulatory measures and overall international political climate. For instance, regulatory support has allowed the automotive sector to regain their footing, mitigating the effects of aggressive competition and thus stabilising the market.

Similarly, the advance of internet firms points towards the anticipatory enthusiasm of investors, stemming from the possible easing of trade restrictions that previously barred U.S. companies from selling AI chipsets to China. This development could pave the way for significant incremental growth within the tech sector.

Potential accelerators in the domestic economy, such as state-led demand stimulus plans, have the potential to uplift still-ailing sections of the market. Posing as an essential factor in predicting the performance of Chinese equities moving forward, these measures are ultimately a beacon of optimism for future investment.

In culmination, multifaceted factors are pushing the Chinese equity market towards the optimistic end of the spectrum. Structural improvements, promising sectors, and potential economic stimulants all signal a positive trend that investors would be wise to monitor closely.

Analysts and investors alike continue to watch developments closely in the Chinese markets. The strategic positioning towards overweight on Chinese equities casts a positive outlook on the economy, and points towards potentially fruitful investment opportunities in sectors benefiting from policy and market developments.