Dealing with the Unpredictable: Investing amidst Volatility

There’s a common saying that revolves around the stock market, ‘When share prices soar, it’s called growth investing; when they plummet, it’s termed as hysteria.’ This holds particularly true reflecting on last month’s roller-coaster ride for investors. The precipitous metropolis of Wall Street shuddered as tariffs came into play, leading to an around 15% drop in stocks within a four-day period- an unusually swift widely-felt downturn. While the market picked up courage and dusted itself off from the early April plunge, the majority remain uneasy about the road ahead. Perhaps, these uncertainties could be better understood through a Q and A session.

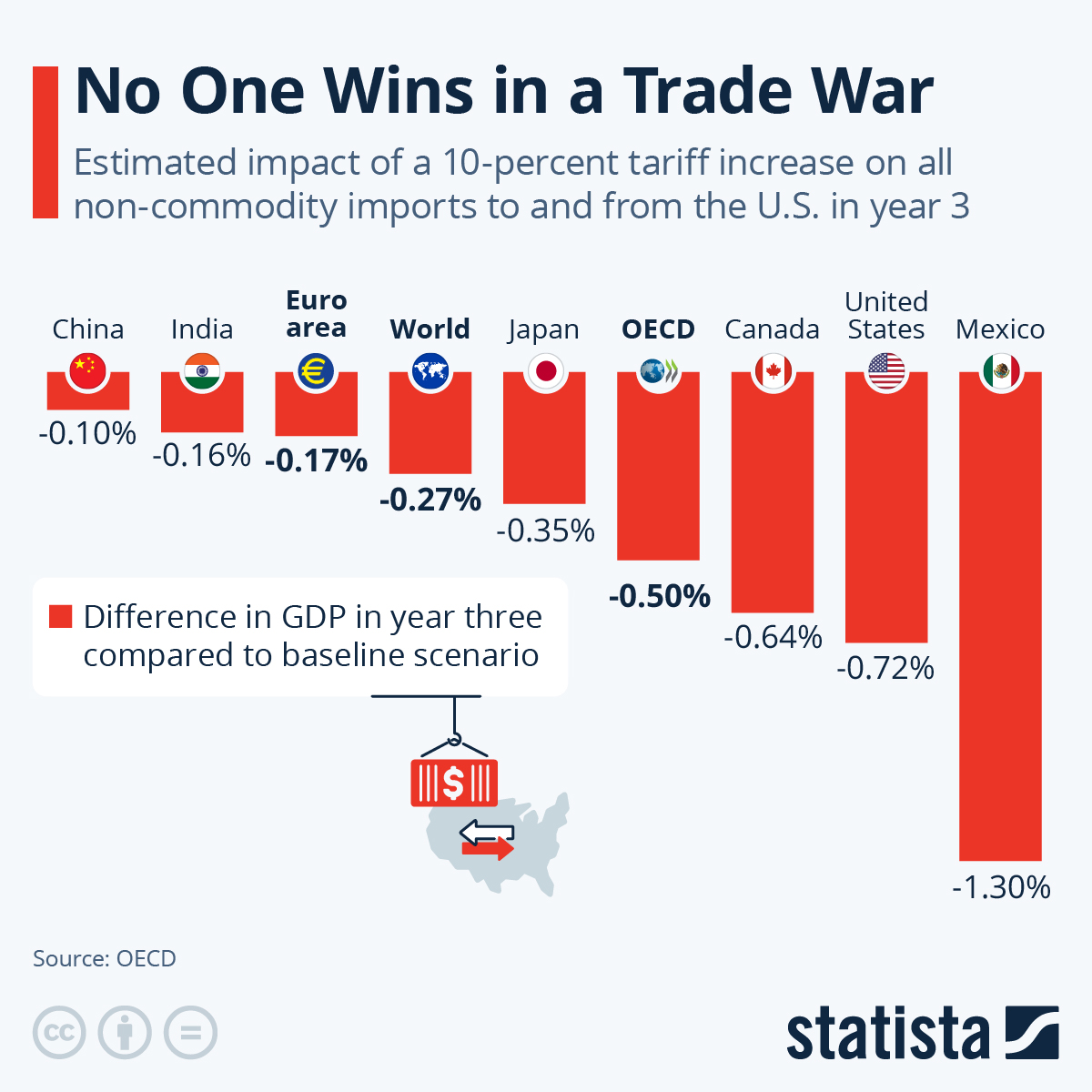

Question: With the recent easing of tariff measures, can we safely assume that the worst chapter of market erraticism is over? Answer: It could be. There is a common consensus that abolishing the trade and fiscal imbalance is both a commendable and necessary aim. What particularly shook Wall Street was the sheer scale and sudden implementation of the tariffs. Thus, the announcement on April 9, suggesting a 90-day hiatus on retaliatory tariffs for numerous countries and a decrease to a 10% tariff rate for everyone else (China being the exception), matched the market’s forecast and investors responded favourably.

A certain level of unpredictability has indeed been mitigated. Positive negotiation outcomes in ongoing trade discussions will also influence markets in a favourable manner and limit erraticism. Still, 10% is a substantial tariff, and the declared pause is merely for three months. This predicament is far from over and will probably continue to cast long shadows over the markets for several more months. Any signs of worsening trade conditions with China or failure of negotiations with other trade associates will result in a downward market reaction. Brace yourselves.

Question: What diversified measures could I employ to seek refuge from market instability or a contracting US economy? Answer: The intense fluctuations we witnessed during the early part of April left very few safe havens as almost every asset class was hit hard. However, gold stood tall, reaching a new peak. In times of geopolitical unrest or economic turbulence, gold is widely considered a reliable investment. If trade hostilities intensify again or if we see our economy retracting, resorting to gold may prove to be a sound decision.

Additionally, let’s not forget the reliable shelter of high-yield money market funds. Most of them continue to yield just above 4% – a strong risk-free return which doesn’t necessitate freezing your money. It could be useful to explore what options your brokerage firm provides.

Question: At times like these, where do you see potential opportunities to charge ‘on the offensive’ in this market? Answer: When the storm hit in March and throughout April, tech stocks were dealt a heavy blow and are now available much cheaper than they were at the beginning of the year. Their resilience and profitability have been thoroughly tried and tested.

Over the past few quarters, I’ve been endorsing international stocks. My faith in them seems well-placed as they’ve been a stellar investment so far, boasting about a 12% increase year-to-date, with the S&P 500 Index firmly in the red. Compared to their U.S. counterparts, international stocks provide more appealing valuations, greater dividends, and are backed by both fiscal and monetary policies. I would encourage continued investment in international stocks.

Question: Are there any insights we can glean from the tumultuous market fluctuations in April? Answer: Undoubtedly. The dramatic ascents and descents we experienced in stock prices throughout April serve as real-time proofs that attempting to outsmart market timing is risky, and underscores the vital importance of adopting a long-term investment perspective.

Despite the tumultuous market climate last month, at the present moment, the S&P 500 Index has merely dropped below 1.5%! The reality is that the most judicious course of action for an investor in April was to jet off to a secluded island without internet, enjoy well-deserved cocktails, and leave their investments untouched. The message is crystal clear: a knee-jerk reaction to market volatility and straying from your meticulously drafted investment strategy is strongly advised against.

As we step into May, I continue to hold a largely positive outlook for the remainder of the year. It’s important to note that since 1990, instances where the Volatility index exceeded a 40% surge, as we observed in early April, have historically led to a convincing rebound in stocks. In fact, taking a look at the S&P 500 Index, the average return over a year is 11.3%, which leaps to a remarkable 46.9% over a three-year period.

Moreover, presently, bearish sentiment sits at its third highest level ever recorded. The last instance of such extreme bearish sentiment touching a high of 70.3% was in the middle of the financial crisis. Just four days later, the stock market flipped script, setting the stage for a vigorous bull market to waltz in. Here’s to hoping that history repeats itself. Welcome spring with an open heart!

In summary, navigating through the realms of the volatile stock market requires us to be flexible, steadfast and informed. From better understanding tariffs to identifying the right tools for diversification, every strategic decision makes a distinctive difference.

Strategically, it’s crucial not to overlook the strength of tech stocks and international stocks, which have demonstrated profitable resilience and promising growth, respectively. The golden rule- never undervalue the importance of a long-term perspective- holds as true today as it ever has.

Finally, history has amply proven the stock market’s ability to bounce back after tumultuous events, and currently reported heavy bearish sentiment provides hope for yet another bullish run. As we look forward to the rest of the current year and beyond, adopting a carefully crafted long-term view and sticking to it despite market volatility is the mantra of a seasoned and successful investor.

With the advent of spring, and amid a year as unpredictable as this, stay armed with knowledge, be humble in recognitions of the market forces at play and remember these lessons the market teaches each day. As they say, come what may, the tides of change keep us afloat. Here’s to a successful spring and an even more successful journey in the world of investments.