Elastic’s Q2 Financial Outcome Triggers a 17% Spike in After-hours Trading

In after-hours trading following the publication of Q2 financial outcomes, Elastic observed a substantial 17% surge, indicating an earnings surpass. The American stock market followed a slightly volatile trend during most of the day, even so, it concluded with an overall boost.

In a slightly adverse turn, Marvell’s shares declined by 8%, settling at $70.94. This movement came subsequent to the release of the company’s Q2 reports and forecasts for Q3. Matching speculations with an adjusted EPS of 67 cents, the results met with analysts’ assumptions.

Furthermore, their Q2 earnings showed a revenue of $2.01 billion, which aligned with the estimated forecasts. Mirroring projections, Marvell’s Q2 report thus added no surprising elements for investors. Remarkably, it posted a record-breaking revenue of $2.006 billion.

The coverage of Schneider Electric was resumed by financial juggernaut, JPMorgan. Following an in-depth analysis, the company received a ‘Neutral’ rating from the banking titan. A price target of 220 Euros has also been set for Schneider Electric as we look ahead to the future.

Into more sector-specific updates, we have China Construction Bank. They recently hosted a round of calls, discussing their latest corporate developments and performance. As one of the ‘Big Four’ banks in China, the company’s outputs elicit significant interest on a global scale.

Alibaba, the multinational tech behemoth, conducted conference calls as well. These calls play an instrumental role in enabling stakeholders to remain updated about the company’s ongoing operations, performance metrics, and strategic directions.

Moreover, there’s Lotus Technology who also called for conferences. Bearing in mind the rapid pace of technological advancements and market competition, these conversations are essential for keeping investors and market experts aprised of the company’s business strategy and fiscal health.

Another player, Chagee, followed suit with their round of conference calls. These calls often offer a platform for the company to discuss financial reports, operational strategy, and field insightful questions from investors, analysts, and the press.

Lanvin Group also engaged in conference calls recently. The highly-anticipated calls often serve to offer a comprehensive view of the entity’s past performance, current state, and the direction they’re heading in relation to industry trends.

In the biotechnology industry, Clearside Biomedical, Inc. held meetings sponsored by the firm. Such assemblies provide insights into their ongoing medical research, product development, and overall direction as shaped by pharmaceutical market dynamics.

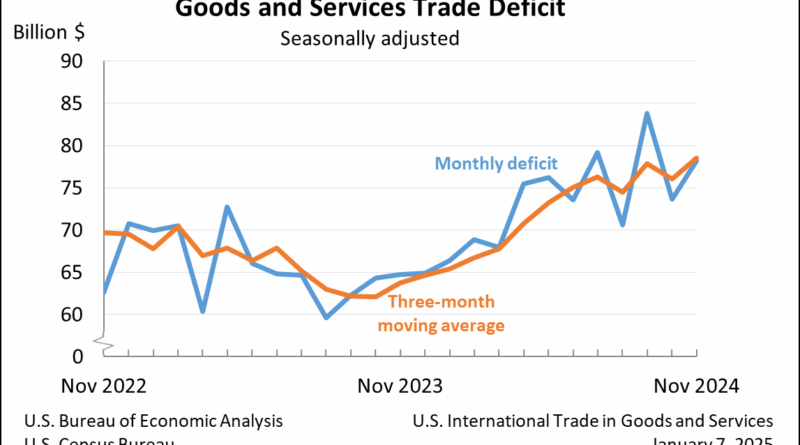

A notification was released concerning International Trade in Goods, serving as the advance report for July 2025. The report focused particularly on the exports data for the month, which is a crucial statistic for understanding trade trends and economic health.

Additionally, the International Trade in Goods released an advanced balance for July 2025. Such reports offer key details on the balance of trade, serving as a critical barometer for tracking the economic status and performance of the nation.

Finally, July’s 2025 data for Personal Consumption Expenditures was also published. Meanwhile, the International Trade in Goods’ advance report for July 2025 included the imports data. Both of these indicators are considerably pertinent for providing perspectives on household consumption patterns and the state of global commerce.