Elon Musk’s Government Efficiency Department Rapidly Reducing Federal Real Estate Presence

In a span of under half a year, the governmental formation known as the Department of Government Efficiency, originally brought to fruition under Elon Musk’s leadership, has dramatically reduced the physical presence of governmental organizations nationwide. Specifically in North Carolina, the department has terminated 20 building leases held by the General Service Administration, one notable instance being the 10,397 square feet space that housed the Equal Employment Opportunity Commission within the Truist building on Fayetteville Street in Raleigh. Industry stalwarts foresee an exacerbation of these reductions. Before this shift, the federal government was independently taking measures to decrease the real estate owned by the GSA, but at a slower pace. This sudden acceleration could lead to an excess of supply, especially at a time when office spaces are largely unoccupied.

At the national level, about 12 million square feet of the GSA’s leased space could potentially be relinquished by the government by the end of the year 2026. From a technical standpoint, these leases would enter a ‘soft term’ phase. This implies that the period in which the lease cannot be cancelled has concluded, yet the expiration of the lease itself has not been reached. This form of lease does carry increased risk compared to a firm-term lease, being that the government has the legal right to depart at any given moment with notice, consequently having the potential to disturb loan agreements or future leasing plans.

The future operation of these agencies remains a matter of suspense. While there have been some strategic cuts and shifts, the ongoing evolution and restructuring of these agencies makes it uncertain what will happen next. Certain regions have been affected more than others. Washington D.C., North Virginia, and Maryland have experienced significant cuts already, with approximately 1.9 million square feet worth of leasing contracts being annulled and several more leases potentially under threat.

When compared, North Carolina, particularly the Raleigh-Durham area, is faced with what can be termed ‘limited exposure’, with 190,000 square feet of GSA-leased space presently in, or soon-to-be transitioning to the soft term phase, by close of 2026. By comparison, Atlanta’s GSA-leased spaces exceed 2 million square feet, while Nashville has 411,235 square feet. The largest of those spaces in the Triangle region include a 39,000-square-foot lease on Park Drive in Durham and a 16,000-square-foot lease on Centrewest Court in Cary.

Most are only small-scale leases, distributed evenly throughout the region. In the grand scheme of things, if all of these leases were to be cancelled concurrently, the effects would be minimal. However, this possibility remains unlikely, as they are planning to move forward with careful calculation and strategic planning.

The departure of these leases might also be a prelude to a decrease in property value, extending beyond the building owners themselves. Surrounding businesses, such as local eateries and coffee shops, could also be adversely impacted. The traditional workplace has been undergoing a revolution in recent years, with hybrid work environments gaining popularity, stringent interest rates, and newfound tariff concerns, all of them negatively influencing the office property market.

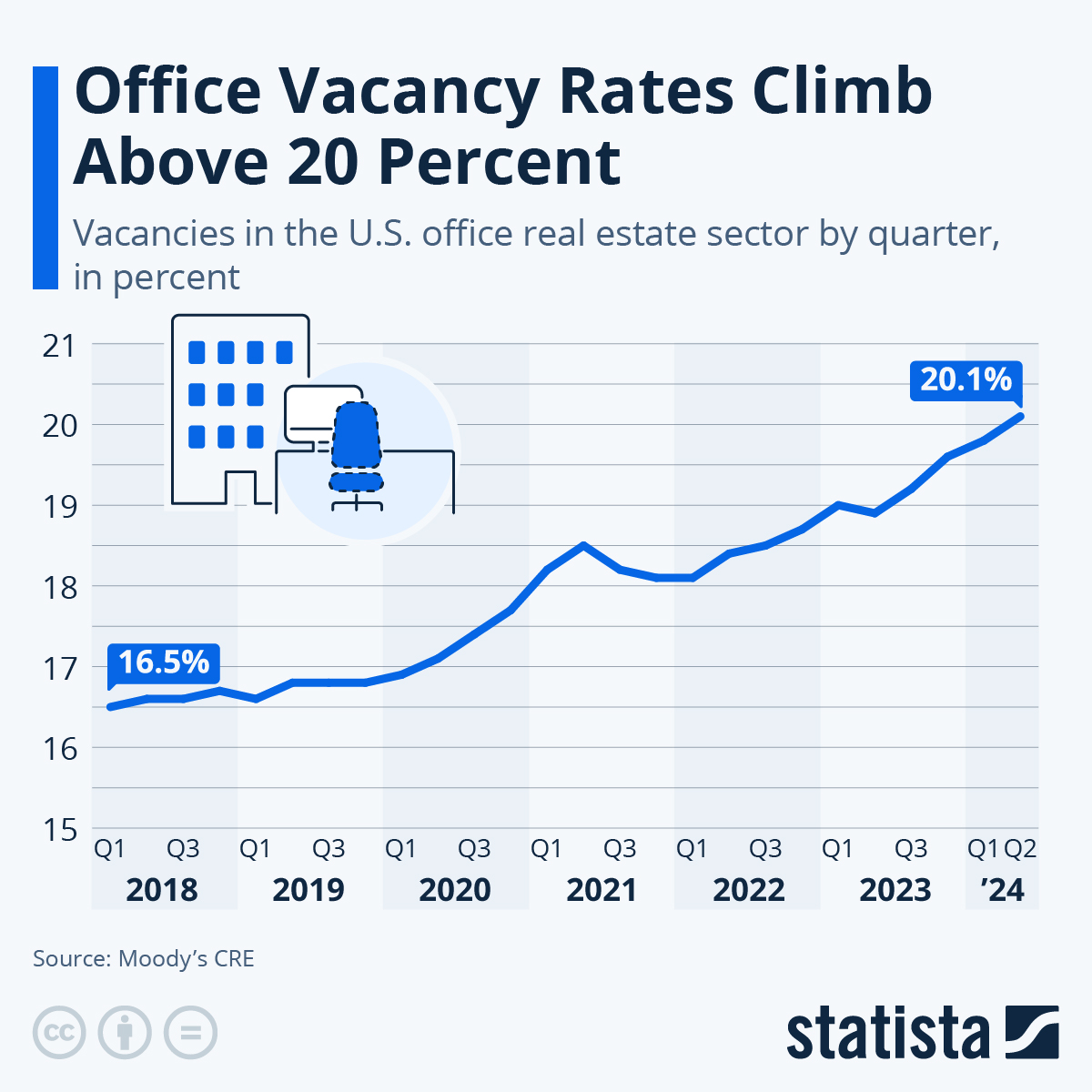

The national office vacancy rate reached a record high of 20.4% during the first quarter of the year, the highest it’s been since the tracking began in 1979. The vacuum of occupancy is even more severe in the Triangle area, at a rate of 21.3%- a surge from the preceding quarter’s 21% and the 19.3% recorded just a year prior. Due to a variety of factors, numerous office buildings, both established and newly built, remain unoccupied across the region.

While the current picture may appear bleak, some experts predict that the market may be on the verge of a slow but steady rebound. Class B and Class C properties, which are generally older and underused, face significant challenges. However, newer Class A properties are expected to stabilize in the near future.

In fact, nascent signs of vitality are already being spotted, particularly within the life sciences sector, making experts cautiously optimistic about the future of office real estate.

A standout example is Massachusetts-based developer King Street Properties, which recently signed a lease for approximately 70,000 square feet of out-of-the-box biomanufacturing environment located within Building One at 1000 Science Drive in Morrisville. The new tenant is Liquidia Corp.

Given the circumstances, any signs of movement in transactions or leases brings a positive outlook. For many professionals, the activity level is at its peak since the Covid-19 disruption. The flurry of agreements and movements is viewed as a good omen for what lies ahead.