While a few American equities continue to underperform despite the S&P 500 index’s considerable recovery in the last quarter, this sustained underperformance in certain stocks could serve as an advantageous entry point for persistent investors as we approach the second half of 2025. Fiserv, Salesforce, and Arista Networks form a part of this intriguing contingent of stocks predicted to regain momentum over the forthcoming half-year. Let us delve deeper into the promising prospects these three corporates offer for prospective investors.

Arista Networks Inc. (ANET on the NYSE), a leading player in the computer networking and cloud segment, currently endures a share price that is over 20% lower than their peak this year. Nonetheless, Wall Street analysts maintain an optimistic outlook on the firm, signaling an enduring faith in its potential. As we report, approximately four-fifths of these experts recommend ‘buy’ for ANET stocks, a bullish sentiment solidly backed by a mean stock price target of $111. This projection suggests an anticipated price appreciation of around 13% from present valuations.

Their Q1 fiscal report released in early May contributes to the optimism around Arista Networks. The firm surprised the Street by reporting record revenues and profits, exceeding anticipated levels. This strong performance paints a compelling argument for the inclusion of Arista Networks in growth-oriented investment portfolios.

On the downside, we have Fiserv Inc. (FI on the NYSE), whose shares have not fared well since the beginning of March, causing some concern among shareholders. However, a significant group of analysts foresee a turnaround in the latter part of the year for the financial technology entity, dismissing the current bearish sentiments.

Currently, barely 15% of analysts hold negative views about Fiserv’s stock. The average stock price prediction stands at around $220 from the present time, suggesting an impressive upswing potential of well above 20%. This optimistic anticipation is based on upcoming projects and expected financial performance, rather than the current lower-than-expected return situation.

Fiserv revealed its ambitions to enter the digital currency world last week. The fintech is in the process of launching a novel stablecoin and a digital asset platform, aiming to further strengthen its position in the burgeoning fintech industry. This development could very well steer Fiserv into a promising second half of the year.

Their most recently reported quarter showcased earnings per share to the tune of $2.14, positively surprising Street’s estimates of $2.08. This robust earning report adds to the case for potential investors to consider Fiserv, despite its initial disappointing performance.

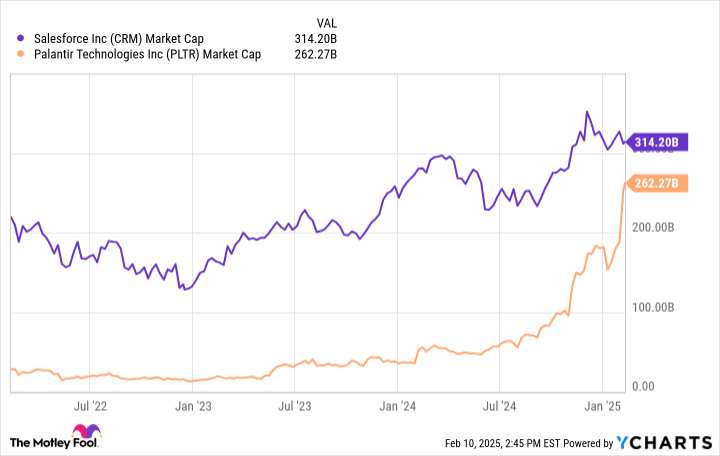

Lastly, we shift focus to Salesforce Inc. (CRM on the NYSE). Since the close of January, Salesforce’s stock has seen a significant decline by roughly 23%. This downturn, however, could be viewed as a prospect to secure a high-quality stock at a discounted price by long-term investors.

Nearly 80% of market analysts covering Salesforce shares currently have a favorable view. With the mean stock price target standing at $356, there is an implied opportunity for as much as a 30% gain from the stock’s current trading range, making Salesforce a potentially promising prospect for investors.

Another noteworthy aspect of Salesforce’s offering is its dividend yield of approximately 0.61%. This adds an additional layer of attractiveness to the stock over the forecasted 12 months, compounding the case for ownership, especially for dividend-oriented investors.

Salesforce’s financial performance in the first quarter exceeded the Street’s expectations on both revenue and earnings fronts. This ascertainment adds to the growing body of evidence suggesting the company holds promising potential despite its recent stock price slump.

In the world of investments where uncertainties are the only guarantee, accurate timing and informed decision making are profoundly vital. As such, prospective investors would do well to keep a keen eye on these three stocks and the sectors they represent.

This review isn’t a definitive guide on which stocks to invest in, rather, it should serve as a starting point for individual research and financial analysis. While these companies show promise, it’s pivotal that investors approach them and their sectors with a comprehensive understanding of the underlying market dynamics.

In summary, although they’ve faced setbacks, Fiserv, Salesforce, and Arista Networks’ resilient outlooks make them worth considering. As we move into the second half of 2025, these three companies may present fruitful opportunities for long-term investors willing to embrace some levels of risks for potentially enhanced rewards.