Oil price spike triggers downturn in US shares

American shares encountered a downturn on Tuesday, burdened by yet another spike in oil prices. This back and forth highlights the uncertainty of financial markets, following brief respite on Monday as fears over the Israel-Iran rivalry appeared to subside. Indicators of an escalating crisis between Israel and Iran, along with signs of one of the key drivers of the U.S. economy faltering, led to a drop of 0.8% in the S&P 500. Consequently, Wall Street’s primary index almost reverted to its position at the start of the week.

The Dow Jones Industrial Average experienced a dip of 299 points, or 0.7%, while the Nasdaq composite depreciated by 0.9%. Declines in stocks were propelled by mounting tensions caused by the volatile trend in crude oil prices. Benchmark U.S. crude oil witnessed a boost of 4.3%, reaching $74.84 per barrel. Likewise, Brent crude, the global benchmark, increased by 4.4% to attain $76.45 per barrel.

The military activities carry the potential to inflate crude oil and gasoline prices since Iran is a crucial oil producer, and its geographical location controls the narrow Strait of Hormuz, a critical passageway for the world’s oil. During previous conflicts, there have been episodes of oil price surges; however, these increases typically proved to be ephemeral, after demonstrating no disruption in oil flow.

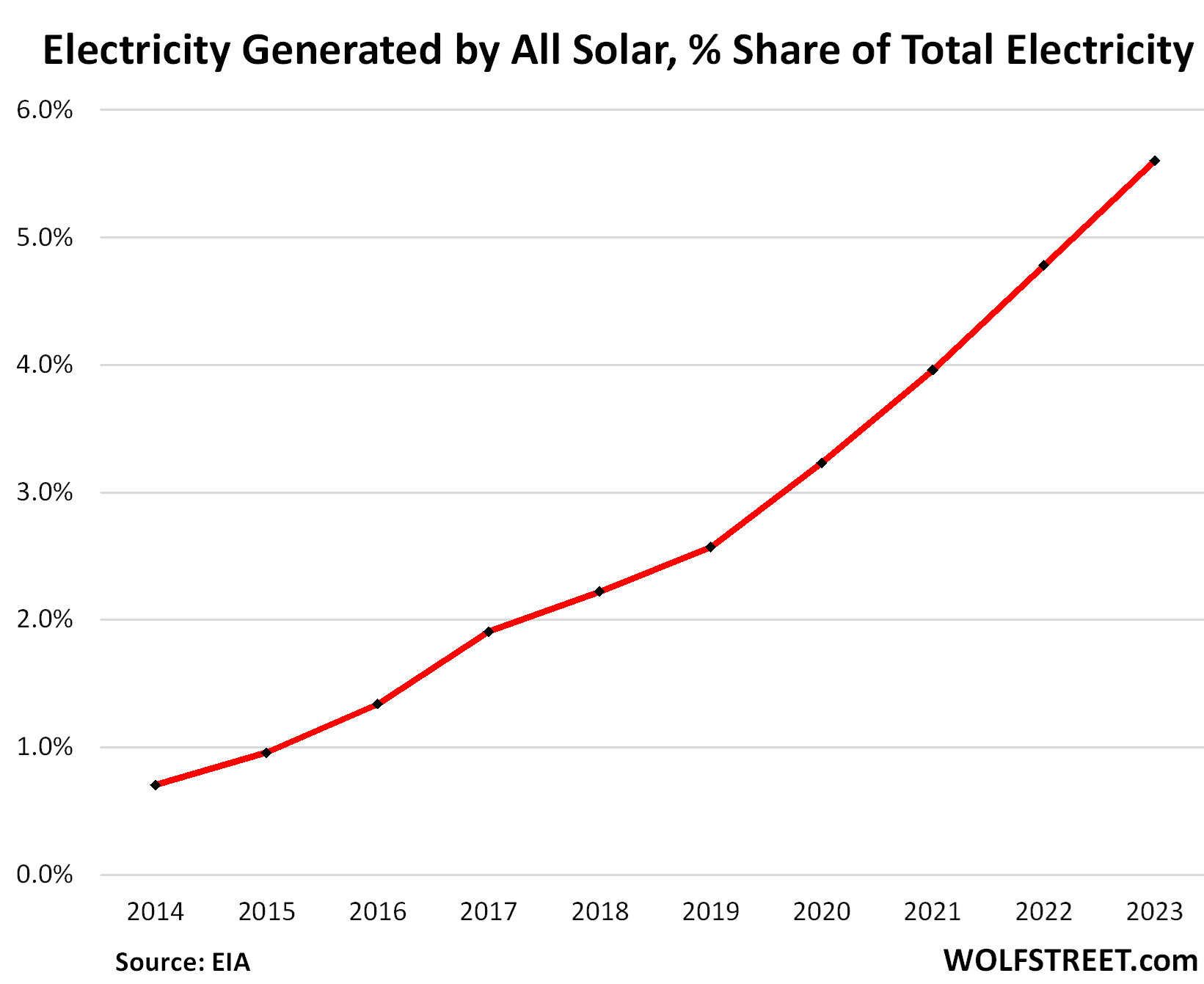

Higher oil prices can often benefit solar company stocks due to the greater incentive to transition to alternative energy sources. Nevertheless, shares of solar companies suffered a setback Tuesday, owing to potential changes in government policy. Given the looming threat of phasing out tax credits for climate-friendly energy sources such as solar and wind, Enphase Energy plummeted by 24%, and First Solar declined by 17.9%.

In the bond market, Treasury yields experienced a decrease. This follows a report that presented a decline in spending at U.S. retail stores last month compared to the preceding month and expectations. Consistent consumer spending has been an economic mainstay preventing a downturn; however, the reduction in May’s expenditure could represent a return to previous spending patterns.

In the midst of a predominantly downcast Wall Street, some stocks witnessed growth. Jabil Inc.’s shares experienced an 8.9% surge applauding a quarterly profit that outran analysts’ projections. Verve Therapeutics made substantial gains, up 81.5%, following an announcement by Eli Lilly of its plans to acquire the company. The company, which focuses on genetic medicines for cardiovascular diseases, could benefit up to $1.3 billion from the deal, contingent upon certain condition fulfilments.

In contrast, Lilly’s shares recorded a decline of 2%. At the close of Tuesday’s trading, the S&P 500 had shed 50.39 points, settling at 5,982.72. The Dow Jones Industrial Average decreased by 299.29 to 42,215.80, and the Nasdaq composite experienced a fall of 180.12, ending up at 19,521.09.

These changes occurred against the backdrop of the Federal Reserve’s two-day interest rate meeting. Market observers almost unanimously anticipate that there will be no change in interest rates. Inflation rates have remained relatively stable of late and currently align with the Federal Reserve’s 2% target.

Investors and economists anxiously await the updated forecasts from the Federal Reserve on the potential direction of the economy and interest rates in the following years. This will likely be of greater significance on Wednesday’s financial market behavior.

In the bond market, the yield on the 10-year Treasury eased to 4.38% from Monday’s 4.46%. Across the globe, stock markets reflected a similar trend. European indexes largely recorded a downturn following a mixture of results in Asian markets.

In contrast to the general trend, Tokyo’s Nikkei 225 index experienced a 0.6% increase. This followed the decision from the Bank of Japan to maintain its existing key interest rate. The bank has been incrementally raising its rate from near zero and reducing its purchases of Japanese government bonds, in an effort to counter the effect of inflation.