Optimism in Markets with Federal Reserve Interest Cut on Horizon

The day began on a positive note in the markets, buoyed by heightened hopes of the Federal Reserve cutting the interest rates. This was spurred on by evidence of a slowing workforce. The latest U.S. employment statistics missed projections, indicating a subpar increase of 22,000 in job payrolls during August.

The anticipation surrounding a rate cut may build up further given the possibility of an additional downturn in job growth when the Federal Reserve convenes later this month. However, concerns regarding a deceleration in economic expansion are tempering this enthusiasm associated with potential cuts to interest rates.

There were mixed movements in the commodities sector this week. The price of oil softened due to an anticipated surplus and ample stockpiles, while gold experienced its most robust weekly surge in the past quarter. The increased emphasis on the vibroius metal among investors can be attributed to the escalating uncertainty in policies.

Tesla’s (TSLA) governing body has put forward a substantial remuneration package for its CEO, Elon Musk. If Musk can achieve a set of ambitious objectives, including the operation of a million robotaxis commercially and the delivery of a million Optimus robots, he stands to make $1T over the forthcoming ten years.

Shares of Broadcom (AVGO) enjoyed an upward trend after the semiconductor producer disclosed stronger than expected earnings for the third quarter. The firm also hinted at the prospect of an additional $10B in revenue next year, crediting this to a deal with a yet-to-be-revealed fourth client in the artificial intelligence sector.

However, it was a less enjoyable week for Lululemon (LULU). The maker of athleisure apparel took a hit after it touched back its financial projection and, in turn, let down its investors for a third consecutive quarter.

Meanwhile, DocuSign’s (DOCU) stock enjoyed a favorable period. This came after the company announced its second quarter earnings had outdone both, the top- and bottom-line estimates. In addition, the firm increased its forecast for the entire fiscal year.

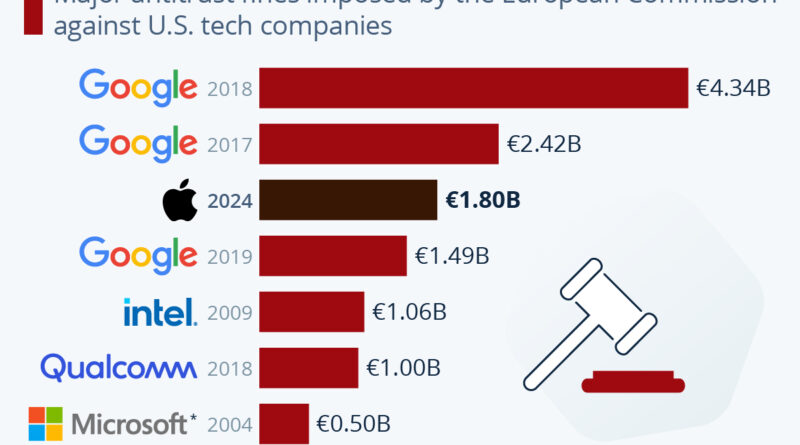

Google (GOOGL) was found guilty of violating the European Union’s competition laws by dominating and exploiting its superior footing in the banner advertising technology sphere. Consequently, the tech behemoth was slapped with a steep penalty of EUR 2.95B by the European Commission.

Adding to its legal complications, a U.S. jury decided Google (GOOGL) was liable to pay a hefty sum exceeding $425M to multiple litigants. The class action suit was filed in 2020 for illicitly amassing data, even after individuals had deactivated Web & App Activity tracking.

JPMorgan Chase & Co. (JPM) and Mitsubishi UFJ Financial Group (MUFG) secured the leading positions in a debt package deal approximating at $38B. The financial infusion is intended for the expansion of Oracle’s (ORCL) data centers, located in Texas and Wisconsin.

In terms of the major indices, the Dow saw a slump of 220.43 points or 0.48%, bringing the total down to 45,400.86. Going along the same lines, the Nasdaq too shed some of its weight, losing 7.30 points or 0.034%, closing at 21,700.39.

The S&P 500 also followed the declines, and decreased by 20.58 points or 0.32%. The overall closing figure for the index was pegged at 6,481.50, representing a downturn from its earlier standing.