Potential AI Funding Decline May Impact S&P 500

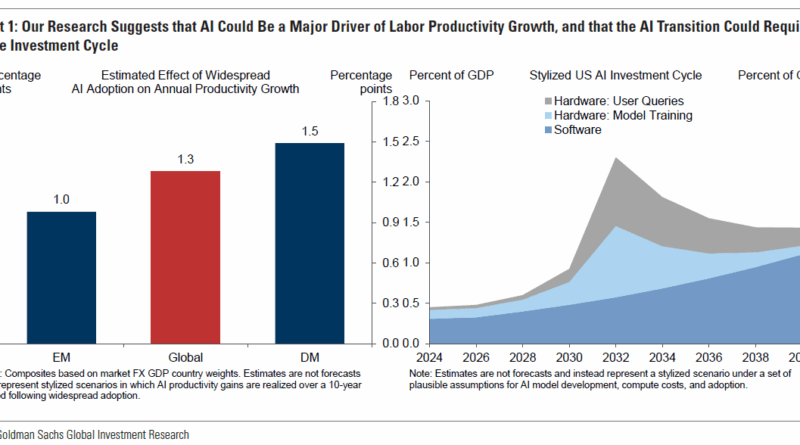

Despite current surges of the S&P 500, it appears an oncoming deceleration in funding for artificial intelligence technologies by leading technology firms may impact its value significantly. Goldman Sachs forewarns a potential decline of up to 20% with respect to the index’s valuation multiple, attributing the worry to changes in the capital expenditure (capex) habits of ‘hyperscalers’. While experts predict a slowdown to occur around the end of 2025 or 2026, the projected figures continue to advance.

Even though the S&P 500 surged 0.83% to 6,502.08 yesterday, hitting an all-time high, concerns loom concerning a bubble surrounding AI equities. However, the general consensus is that we’re not quite there, yet. Despite high valuations, they are notably lesser than the heights seen during the dotcom surge in 2000.

Still, analysts and experts can’t help but pay heed to a potential concern on the horizon – the anticipated reduction in capex by the powerhouse entities of the AI industry, including the likes of Amazon, Alphabet, Meta, Microsoft, and Oracle. These reductions in spending could significantly impact the predicted earnings of these AI corporations and in turn, affect the overall market.

Within the framework of what Goldman Sachs refers to as a ‘worst-case scenario’, wherein these hyperscalers restrict their capex back to levels seen during 2022, the knock-on effect on AI companies could be severe. ‘Lost revenues’ could equate to a 30% drop juxtaposed to their projected $1 trillion in total sales growth for all corporations under the S&P 500 umbrella in the succeeding year.

This, consequently, could set off a domino effect where the market readjusts to a long-term growth estimate akin to early 2023 standards. Such a scenario could potentially trigger a 15-20% decrease in the S&P 500’s present valuation multiple.

Yet, it’s important to note that AI equities experienced a rise in value of 32% in 2024 and an additional 17% year-to-date growth. Investors are progressively questioning whether the current pricing of US equities is representative of unrealistic optimism.

Conversely, it’s worth underscoring that tech equities, at present, are priced below the well-documented bubble levels in history. The five tech titans of the index, Nvidia, Microsoft, Apple, Google, and Amazon, currently boast of price-to-earnings (P/E) multiples sitting at 28x, which is markedly lower than the 40x peak seen in 2021, and the drastic 50x observed during the Tech Bubble in 2000.

What’s dampening the speculation of an overvalue, keeping valuations within upper limit bounds, is the colossal real revenue being generated as a result of robust Hyperscaler capex. Goldman Sachs approximates the capex spending to have reached a whopping $368 billion for the current year alone.

Notwithstanding these figures, one question remains unanswered and suspended over the financial markets – when will the anticipated slowdown in AI funding come about? Forecasters and analysts are at this point aligned in their predictions of a sharp deceleration transpiring towards the end of 2025 and into 2026.

Still, skeptics are poised for surprise, as hyperscaler corporations persist with their track record of progressively revising their capex estimations upwards. It seems the intersection of technology, finance, and market foresight continues to offer a dynamic and intricate landscape.