Trump’s Bid to Ramp Up American Oil Production Amid International Attention

Former President Trump has stated his intentions to ramp up the American oil production, yet it remains uncertain whether or not the U.S. oil sector is equipped for such a move. In parallel, liquefied natural gas (LNG) appears to be assuming a starring role in the global gas market, garnering increasing international attention.

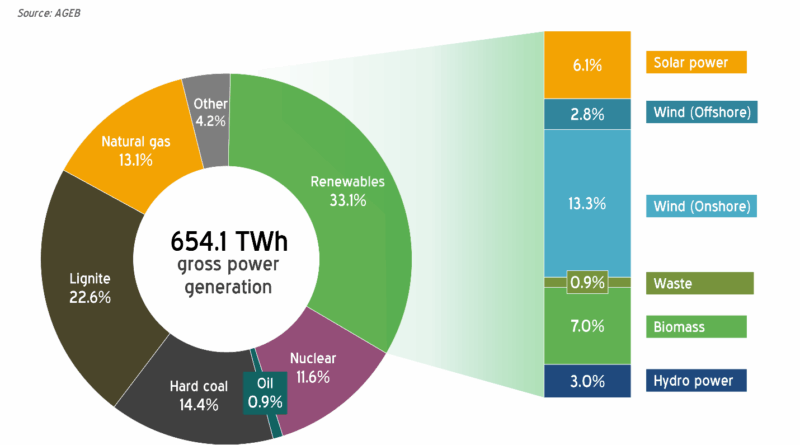

A noticeable surge has been observed in Germany’s energy consumption with the figures growing by 2.3% in the first half of 2025. Simultaneously, Trump has criticized the high fiscal burden levied on North Sea Oil in the United Kingdom, voicing concerns about the potential impact on the industry.

Among North Africa nations, Egypt has witnessed a steady increase in its LNG imports, a trend that holds potential implications for the global markets. Concurrently, Turkey is striving to maximize the operational capacity of the Kurdistan Oil Pipeline, indicating shifting dynamics within the oil industry.

India’s premier gas entity is in the process of negotiating a cargo swap deal with a U.S. LNG provider. Meanwhile, Pemex, Mexico’s leading oil conglomerate, has shared its financial results from the second quarter, indicating an unusual profit.

Fuel exports from Chinese refiners are on the rise owing to more favourable profit margins. In major industry developments, Baker Hughes is reportedly considering a significant acquisition, as it zeroes in on Chart Industries with an estimated proposal worth $13.6 billion.

A noteworthy development in the oil and gas sector is Woodside’s acquisition of oil and gas assets from Exxon. Moreover, Vitol, one of the largest oil and energy traders, has distributed a record cash return to its owners, highlighting the industry’s resilience.

Following a rally on Monday, oil prices have managed to maintain their standing, inspiring cautious optimism. Furthermore, a decision by Trump has once again opened up possibilities for oil exploration in Alaska, causing a stir within the industry.

An upward trend is visible in U.S. LNG inventories after the EU vowed to boost its long-term demand. Simultaneously, the Aramco conglomerate has greenlit a $5 billion expansion of the Zuluf field in anticipation of a dip in its Q2 earnings.

U.S. onshore oil production has reached an all-time high, signalling a strong performance from the domestic industry. This comes alongside a surge in U.S. LNG stocks, triggered in part by the recent energy agreement between the EU and the U.S.

Saudi Arabia is contemplating a rise in crude prices for Asian countries this September. In parallel, diesel markets are bracing themselves for turbulence as changes in EU sanctions are expected to reshape trade routes.

As part of an inaugural contract, Ukraine has begun using Azeri individuals in transit through the Trans-Balkan Pipeline. Elsewhere in Africa, Aliko Dangote has voiced a demand for a ban on fuel imports to shield Nigeria’s refining future.

Eni, an Italian multinational oil and gas company, projects its low-carbon business profits to rival those of its oil and gas sectors by 2035. In the southern hemisphere, the United Nations has urged Australia to adopt a more committed approach towards achieving carbon neutrality.

Key developments in oil markets are receiving increased scrutiny this week. In parallel, offshore production efforts in Shenandoah have just started, courtesy of Beacon Offshore.

Recently, the BLM revealed a new oil lease sale in the eastern part of the U.S. PetroChina authorized a revamp of Dalian Refinery totalling $9.6 billion in an ambitious attempt to boost its refining capabilities.