US Stocks Hit by Sluggish Job Growth and New Tariffs

The American financial markets experienced a downturn, resultant from a lower-than-projected employment growth and the introduction of stringent tariffs by the Trump administration on multiple nations. The economy saw an increment of 73,000 job positions in July, a significantly lower figure than the 100,000 which was predicted in Dow Jones’ economic analysis. As anticipated, the rate of unemployment rose to 4.2%. Revised totals for the months of June and May indicated a combined decrease of 258,000 jobs from the previously publicized figures.

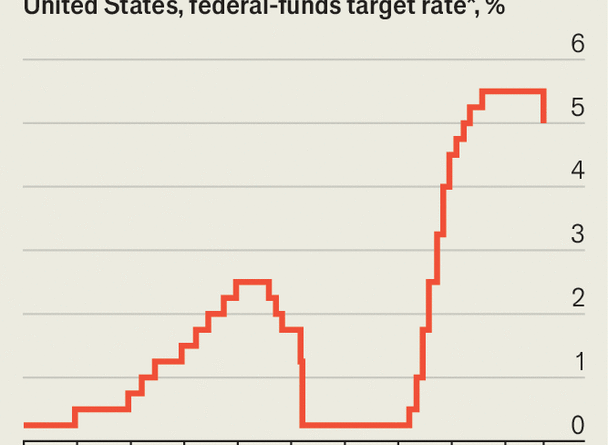

The nonfarm payroll increase in July demonstrated a softer performance than projected, however, the shock came with large-scale revisions affecting primarily the months of May and June. The amended figures effectively nullified the earlier announced job increases in both those months. This lackluster employment report, experts suggest, could instigate a rate cut by the Federal Reserve.

The CME FedWatch tool, designed to gauge market expectations of Federal Reserve interest rate changes, shows an increased probability of 83% for a rate cut in the upcoming month of September. Market speculation and anticipation of a rate cut led to a fall in near-term Treasury yields. ClearBridge Investments’ head of economic and market strategy suggested that the latest data on payrolls substantially increases the likelihood of a September rate cut.

Although the full impact of the tariffs has yet to manifest, postponing the initiation of rate cuts could prove inopportune for the Federal Reserve. Over the months, Trump has been vocal in urging Federal Reserve Chairman, Powell, to either step down or decrease the rates. To date, Powell has adopted neither course of action.

A significant development came when Federal Reserve Governor, Adriana Kugle, announced she would step down from her position to join Georgetown University as a faculty member in the fall, not waiting to conclude her term in January 2026. This decision presents Trump with the opportunity to nominate a replacement of his choice.

Trump expressed his dismay at the unfavorable jobs report by calling for the dismissal of the U.S. Bureau of Labor Statistics commissioner, the entity responsible for assembling the report. In a related development, Trump endorsed an executive order that introduces ‘reciprocal’ tariffs to an array of nations, with the revised duties expected to be in the range of 10% to 41%, and due to come into effect a week hence.

The executive order also stipulates that commodities which alter their mode of transportation or do transshipments to circumvent tariffs will be subjected to an additional tax of 40%. Starting from the 1st of August, Canadian imports will face the ire of a 35% tariff, exempting goods which align with the specifications in the Canada-U.S.-Mexico trade agreement. The hike indicates a 10% increase from the earlier duty of 25%.

Unlisted nations in the recent executive order would have to brace for an added duty of 10%, according to the announcement. The introduction of the fresh tariffs has ignited concerns of price hikes trickling down to the end consumers, potentially having a slowing effect on the economy. Nevertheless, this might not be the final narrative as some nations could reach new agreements with the United States, and there is a potentiality that American courts may annul these tariffs.

In response to these economic indicators, the benchmark 10-year Treasury yield marginally declined to 4.204%. Business earnings proved consequential in setting the trajectory for the stock market. Amazon, although surpassing the Wall Street expectations in its Q2 results, exhibited disappointing growth in its cloud computing segment. Consequently, Amazon’s stock saw a reduction of 8.27%.

Apple Inc., however, managed to exceed its Q2 expectations, showcasing the largest surge in revenue since the year 2021. The lofty growth is attributed to a remarkable 13% increase in iPhone sales, fuelled by tariff-related purchasing behavior and the popularity of current devices. The company anticipates that the existing tariffs might inflate costs by as much as $1.1 billion in the immediate quarter. Despite this, Apple’s shares saw a 2.5% decrease.

Bitcoin, in contrast, recorded a stellar month, reaching an all-time high of approximately $123,000 on July 14. Digital assets received a buoyancy in July, spurred by new legislative measures by the U.S. Congress. Among these was the GENIUS Act which lends formal recognition to stablecoins within the U.S. economic system, thereby ushering digital assets towards the mainstream, as suggested by economic experts.

Bitcoin closed at a slightly lower rate, down by 2.14% at an approximate value of $113,318.60. Thus, despite the lackluster job growth and disappointing corporate earnings, the cryptoasset market exhibited a robust performance. The correlation between economic indicators and market indices reflects the complex dynamics of the financial ecosystem.

While the implementation of tariffs and its concurrent pressure on the international trade relations continues, the Fed Reserve’s reaction in terms of cutting rates is anxiously anticipated by the markets. Responding to the challenges of international economic headwinds and domestic economic trends, Fed might find itself in a tight spot.

As the U.S. battles these economic and financial challenges, it remains to be seen how corporations and investors will react to changing macroeconomic realities. The alterations in the fiscal policy, along with other external factors, could lead to significant shifts in the economy.

In the short term, observers will closely watch how the new tariffs will pan out and affect the international trade scenario. All eyes will be on the reaction of other nations to these reciprocal tariffs and consequential amendments to their trade agreements with the U.S.

In an age when global economies are inextricably linked, it is evident that national measures have a far-reaching impact. Challenges are aplenty, but it will be the resilience and strategic adaptations of these economies that will define the course of future growth.