Vanguard Shifts Focus Towards Fixed Income Investments

Commanding a colossal $11 trillion in assets, the investment company has effectively recalibrated its recommended allocations to lean heavily towards fixed income, with a specific emphasis on 70%. Over $1 trillion of its now deposited in bond assets, representing a large-scale commitment.

Throughout the contentious and age-old tussle between active versus passive investing, there has been no stronger advocate for passive index fund investing than the late Jack Bogle, the founder of Vanguard. The pioneer regularly expressed concerns about the severe impact that hefty fees from active managers could have on investors’ returns in efficient markets.

Vanguard, nestled in Valley Forge, Pennsylvania, has held steadfast to the principle of passive investing over the years. That said, its approach to fixed income seems to notably diverge from its traditional ethos. Throughout 2025, Vanguard has unveiled four fresh actively-managed bond ETFs, enhancing its selection pool of 66 existing active bond funds.

The company’s active fixed-income assets, amounting to roughly $1.1 trillion, form a significant part of the company’s total holdings. Interestingly enough, a substantial chunk of this is comprised of typically low-risk money-market funds, which are treated as actively managed. This substantial sum places Vanguard in a close second place behind BlackRock, which leads the pack with $1.2 trillion in this particular category.

Vanguard proudly shares that 44 of its 48 active bond funds, which boast a ten-year track record, have outperformed the averages of their respective peer groups. The company maintains that the landscape of fixed income market considerably differs from the equity market, principally in its complexity, liquidity, and efficiency.

Their belief is that the inherent convolutions of the bond market present rich opportunities for active managers to secure profitable returns, given their proficient knowledge and strategic approach. Vanguard, therefore, deemed it illogical to package all bond types in a single index fund. This perspective led them to launch its multi-sector bond mutual fund, VMSAX, in 2021, with the Multi-Sector Income Bond ETF, VGMS, following suit in May.

Between the two of these funds, Vanguard has successfully pooled together $400 million in assets. At present, the fund carries a yield rate standing at a solid 5.06%. Thanks to the company’s reputation for low-cost offerings, its active funds still enjoy the cost advantages common to its traditional offerings.

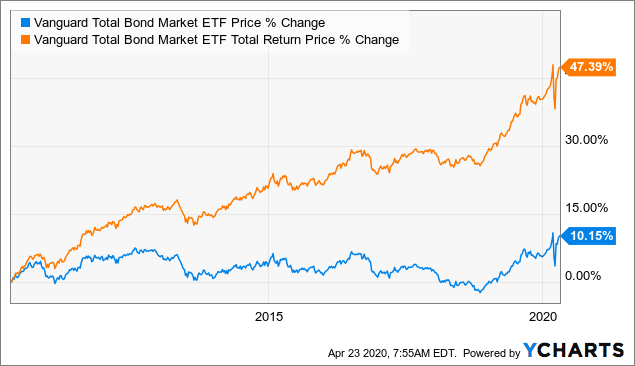

The impact of cost efficiencies or expense ratios are even more substantial in the face of stagnant bond returns that have unfortunately trailed behind stock returns for the past decade. The impending interest rate cuts from the Fed are projected to spur higher bond prices. Meanwhile, the current enthusiasm around artificial intelligence has sent stock market prices soaring to unprecedented levels.

Vanguard is concurrently bolstering its fixed income offerings and subtly guiding its investors towards bonds. The firm’s ‘time-varying’ asset allocation model, designed to create a balanced portfolio for investors leaning towards a traditional 60/40 split under normal conditions, recently introduced a drastic deviation with a 70%-30% allocation favoring bonds.

This allocation strategy projects an estimated annualized return of 5.5% over the next decade. Furthermore, the model suggests a higher proportion of long-term Treasurys as they tend to attract greater appreciation during periods of declining rates. This advice, if taken into account by Vanguard’s customer base, would mean that the company’s future asset allocation decisions lie in its own hands.

Vanguard’s Multi-Sector Income Bond Fund gears itself towards credit-focused investments. It currently includes bonds issued by telecommunication giants such as CBS Corp., Charter Communications, and Univision amongst its range. Approximately half of the holdings of the multi-sector fund boast BBB or higher ratings, while the remaining assets are below investment grade.

Relevantly, the prolific rise of private credit in the previous decade has bolstered the credit quality of the high-yield market, markedly outperforming previous credit cycles and now standing at a formidable $2 trillion. This trend partially stems from private credit firms’ tendency to finance riskier forms of debt.

Vanguard’s diverse asset holdings also comprise bonds issued by nations such as Mexico, Colombia, Oman, Serbia, and South Africa among others. The first fund to emerge from the partnership between Vanguard, Wellington, and Blackstone to create a unique blend of public and private market products has reserved between 15% to 30% of its portfolio solely for Vanguard’s actively-managed bond funds.

Although fixed income investment won’t overtake passive indexing as Vanguard’s core brand feature, the company’s refocused concentration on fixed income investments presages an anticipated shift in substantial investors’ preferences and portfolios over the upcoming years.