Warren Buffett Charts the Path Amid Declining Rates

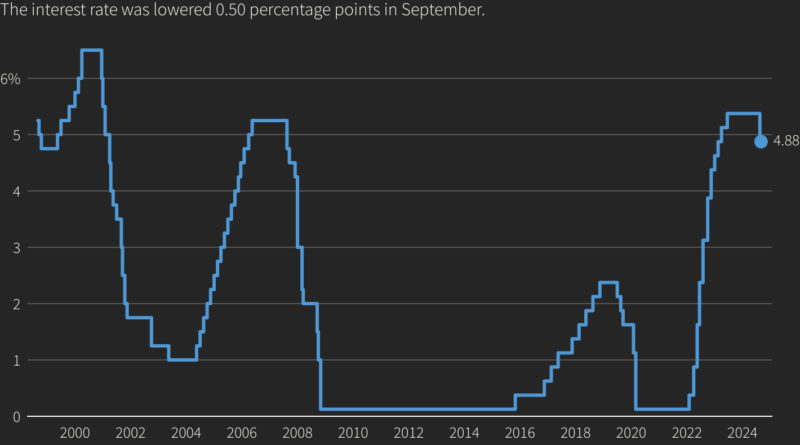

In the face of declining rates, a stagnant housing market, and unpredictable market scenarios, Warren Buffett, via Berkshire Hathaway, is charting the way forward. Buffett stated in his 2022 yearly letter to Berkshire Hathaway that the company’s future would always balance an ample cache of cash, U.S. Treasury Bills, and a broad portfolio of businesses. Following a rate reduction by the Federal Reserve (Fed) in September, it’s likely we’re entering a cycle of further cuts, which could contribute to a decrease in short-term bond yields. Statistics indicate, as of last Friday, that the yield on US 3-month bills has dipped from an October 2023 high of 5.51% to a more recent 3.95%.

If this tendency continues, and the Fed takes further steps to bring down the monetary policy rate with the aim of backing the employment market and broader economy, we can expect this yield to persist on a declining trajectory. From Berkshire Hathaway’s second-quarter financial report, $344 billion cash reserves were disclosed with a lion’s share in U.S. Treasury bills. To put this into perspective, this cash reserve is the largest for any U.S. company outside the banking sector, as per a Barron’s report.

Income sourced from Berkshire’s wide range of investments, which includes interest income from accumulated cash, accounted for over 30% of operating earnings in the second quarter of the report. Presuming that cash levels are constant, Barron’s forecasts that a one percentage point decline in short-term yields might result in $2.5 billion reduction in Berkshire’s after-tax operating profit. In order to better understand the impacts of this statistic, we can take into consideration that Berkshire’s operating earnings for the year 2024 were $47.4 billion, hence, this impact could be marking a headwind of approximately 5% of the operation profits.

Beyond immediate impact of dwindling rates, one should also contemplate indirect outcomes. Keeping this in focus, Buffett clarifies in his annual letter that equity exposure for Berkshire outweighs its cash reserves. An overview of the historical trend of short-term yields reveals instances where the Fed has successfully prevented a recession by reducing monetary policy rate to boost the economy. This tactic often aids stocks as it generally catalyzes the projection of sustained corporate earnings growth.

In terms of business distribution, Berkshire owns a blend of publicly-traded and wholly-owned organizations that should demonstrate good performance if economic stability persists. However, the housing market, one of the more stagnant sectors in recent U.S. economy, has struggled to keep up. The double squeeze of rising costs for building materials and escalated mortgage rates has pushed the U.S. housing affordability to nearly its worst levels. Sales of both new and existing homes have generally stopped growing in the post-pandemic era, largely held back by the increased mortgage rates and overall costs.

Berkshire Hathaway’s considerable investments in the housing segment, spanning across manufacturing and retailing divisions, are significant. For instance, the manufacturing arm includes several building products companies, such as Shaw Flooring and Benjamin Moore Paints. These are likely to contribute approximately 8% of Berkshire Hathaway’s total overall sales by 2025, even though building product sales are predicted to be 7% below the levels recorded in 2022.

If ongoing Fed rate cuts manage to further reduce mortgage rates and stimulate the housing market sector, it stands to reason that Berkshire Hathaway will reap the derived benefits. According to Warren Buffett’s 2022 Annual Letter to Berkshire Hathaway, despite the strong cash position, the lion’s share of investment continues to lean towards equities, and this is not expected to alter. In the past year, although the ownership in marketable equities dropped from $354 billion to $272 billion, the value of unquoted controlled equities climbed slightly and superseded the value of the marketable portfolio.

Even with the market’s current expectation that the Fed can successfully navigate the U.S. economy around any significant setbacks, there is never a full-proof guarantee. History reminds us of numerous occasions when recessions have emerged despite efforts to reduce short-term interest rates. Warren Buffett has often leveraged these tumultuous economic periods to Berkshire Hathaway’s advantage, as the company’s significant cash reserves enable opportunistic acquisitions of undervalued assets. While other companies might grapple with survival amidst the unrest, Berkshire uses this as a strategic advance.

Thus far this year, Berkshire’s stock performance has not kept pace with the S&P 500’s return of 14%, with Berkshire showing a gain of 10% only. The earnings impact from lower rates could be a contributing factor to this trend, but it’s more probable that the lag can be attributed to Berkshire’s limited exposure to the technologies and artificial intelligence sector, barring the substantial Apple (AAPL) holdings.

Usually, Berkshire thrives when the market seeks safety and caution, but since market concerns related to tariffs eased in May, this hasn’t been the prevailing situation. As Warren Buffett expressed in his 1966 annual letter to the shareholders of Buffett Partnership, he is not willing to take the risk of significant permanent capital loss merely for enhancing long-term performance.

While the risk-aware strategy might occasionally result in substantial underperformance, particularly in rapidly surging markets, investors should be prepared to accept this as the cost for expected good long term performance. Currently, the stock market seems to predict a low probability of recession in the upcoming period, and fundamental analysis verifies this sentiment.

Nevertheless, it’s important to remember that a company’s potential for stock price growth should always be weighed against the risk associated with it. Even with the likely negative effect on earnings from lower short-term U.S. Treasury yields, a closer look at these dimensions reinforces the notion that Berkshire’s stock still warrants serious consideration for inclusion in investors’ portfolios.