Warren Buffett’s Top 10 Investment Options In 2021

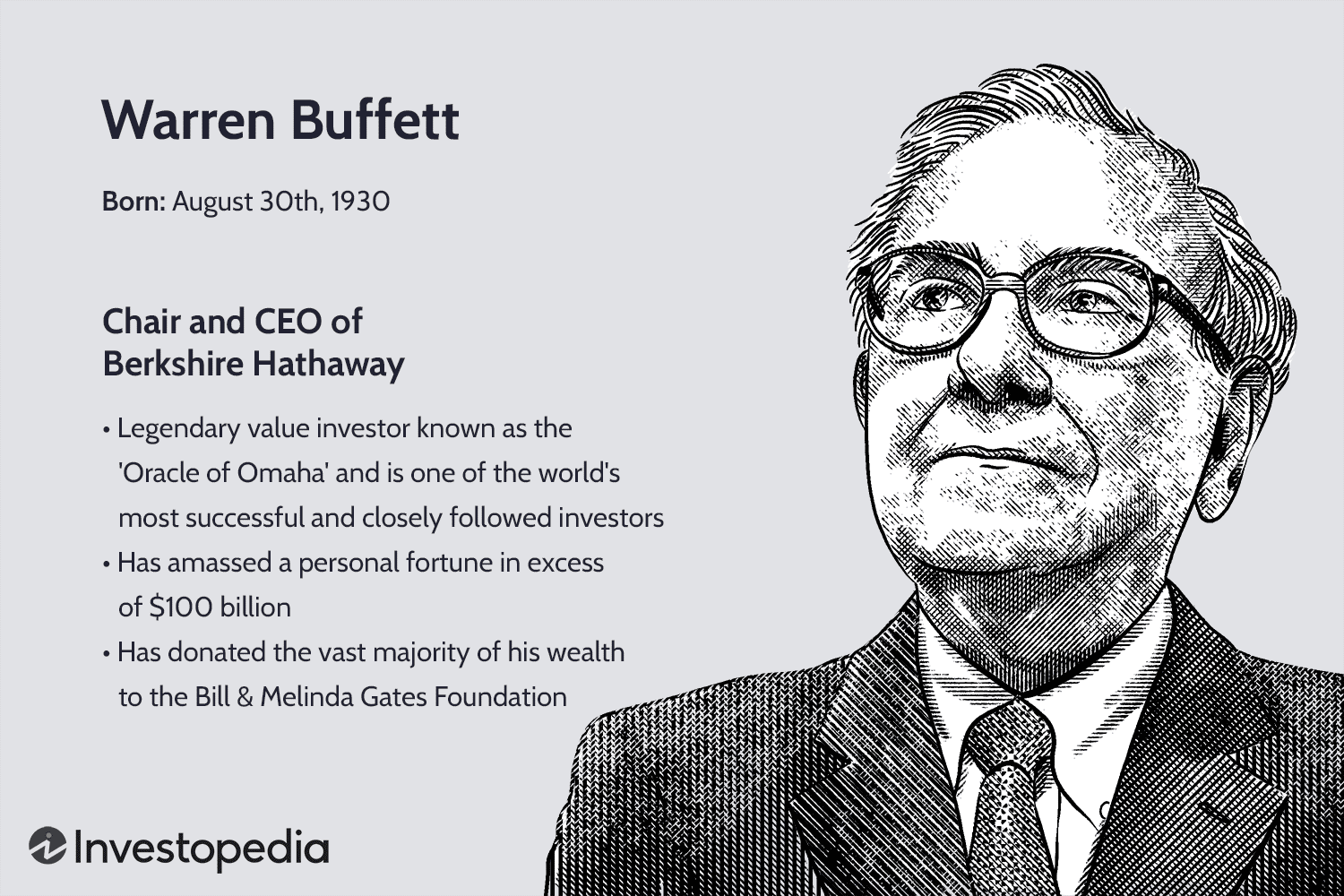

Warren Buffett, recognized as one of the greatest investors in history, has shared a plethora of investment wisdom over years. His buying patterns through Berkshire Hathaway, his investment vehicle, is keenly analyzed by industry watchers. Here follows a list of 10 stocks from his portfolio, which carry the endorsement of Buffett, and are good options to invest in at present.

Amazon, although not one of the primary investments in the Berkshire portfolio, is nonetheless worthy of consideration due to its presence in AI, e-commerce, and several other markets. Amazon Web Services, in particular, promises to sustain and drive the company’s growth as AI technologies continue to thrive. At present, the shares are an attractive investment at 17.7 times operating cash flow, compared with an average cash flow multiple of 20.4 over the last five years.

Apple, Buffett’s largest holding in the Berkshire portfolio, has seen a decrease in value by nearly 16% in the year to date. However, thanks to its dedicated customer base, it generates consistent robust profits and cash flows. The stocks are now available at a more affordable price than at the beginning of the year, providing a good opportunity for investors.

Bank of America, ranking among the country’s biggest banks, is a financially healthy organisation, as was evident from its performance in this year’s stress test. With a decade-long history of increasing dividends, it is a valuable pick for those seeking a top financial stock but wishing to avoid the associated risks of smaller regional banks.

BYD, though not a known entity on America’s roads, is an undeniable power-player in the international electric vehicle (EV) market. The BYD stock appears undervalued at present, following a lull in investor interest, and is now available at a tempting 2.5 times forward earnings.

For those interested in incorporating substantial passive income into their portfolios, Chevron provides a good option. Despite the recent industry setbacks and falling energy prices, Chevron, with its sturdy history of increasing dividends, is a reliable choice for gaining energy exposure.

Coca-Cola, occupying the fourth spot in Berkshire Hathaway’s portfolio, has been part of it since 1988. The company, with its start in 1886, has grown from its primary soft drink output to owning a vast range of non-alcoholic beverage brands. Demonstrating a solid history of 63 consecutive years of dividend growth, it’s a proven long-term investment choice.

Share prices of Kraft Heinz have declined by about 17% since the year began, due to sluggish sales. Nonetheless, the robust operating cash flow it continues to generate, coupled with its shares being attractively priced at 10.1 times forward earnings, make it a prospect not to be overlooked.

Moody’s provides invaluable services such as credit ratings, research, and risk analysis which enable businesses and investors to make informed financial decisions. Due to the ongoing high demand for these services, Moody’s presents a stable, conservative investment option to bolster portfolios.

Unlike Chevron’s involvement across the energy sector, Occidental Petroleum primarily focuses on United States-based exploration and production. The company’s stock heavily correlates with energy prices, explaining the 25% decrease in value over the past year. However, this stock has the potential for a long-term recovery and subsequent growth.

Visa, with a staggering 1.3 billion credit cards in use globally, boasts a substantial worldwide footprint. Its stable cash flow generation stems from an array of fees charged by the company. For instance, Visa’s free cash flow experienced a 15% compound annual growth rate from 2015 to 2024. Given this, and its impressive track record of delivering excellent returns, Visa’s growth trajectory is expected to continue, making it a prime investment option.