Yatra Focuses on B2B Travel for Enhanced Growth: CEO Dhruv Shringi Reveals

The prominent internet travel firm from India, Yatra, has unveiled a comprehensive growth plan for its corporate sector venture. The full-time executive and CEO, Dhruv Shringi, has elaborated on the firm’s intention to lean more into the valuable, frequent corporate customers instead of funneling efforts and resources into securing one-off leisure-oriented clients. The high-margin repeat corporate business forms the crux of their strategic approach going forward.

Analysis of the firm’s operations up to the end of the second quarter shows a noteworthy increase in gross bookings from the B2B sector. According to Shringi, two-thirds (approximately 67%) of total bookings were B2B, indicative of a substantial shift in their customer profile. With positive trends in sight, he predicts the B2B segment could make up as much as 70% of the total by the fiscal year’s conclusion.

Efforts are underway at Yatra to consolidate their platform’s position in everyday dealings of corporate clientele. The goal is to increase ‘switching costs’, a term Shringi uses to denote the extraneous labor a company would need to expend to transition away once they’ve embedded Yatra’s services into their operations. The rationale is simple and effective; incentivize clients into a routine that’s difficult to change.

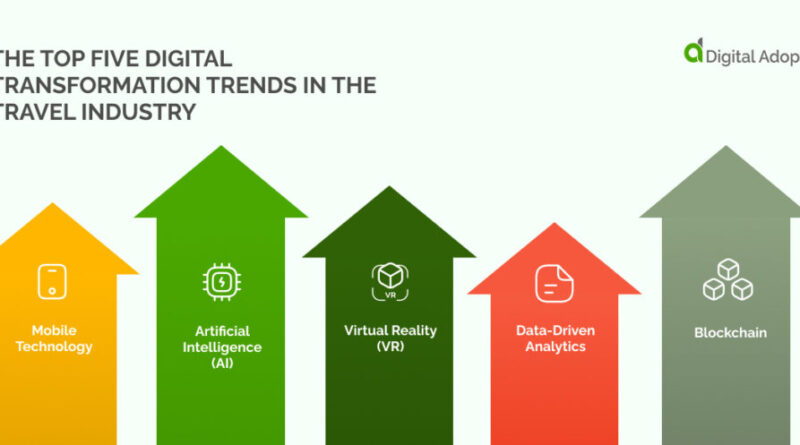

Pointing to the competition, Shringi points out most rivals are still primarily servicing businesses offline. In what Yatra perceives as a competent upper hand, they boast a superior technical interaction with their clients and a more extensive online market penetration. This, according to Yatra, puts them in prime position to leverage the ongoing largescale industry-wide adoption of digital processes.

Shringi points out that most competitors are stubbornly devoted to outdated servicing methods, offering lacklustre integration and a limited digital footprint. This presents a significant opening for Yatra to penetrate the digital shift happening across the commercial-travel sector.

In a milestone event last year, Yatra confirmed the purchase of Globe All India Services, a provider of corporate travel services. Valued at 1.28 billion INR ($15.25 million), the acquisition was entirely cash-based. This development reiterates Yatra’s commitment to long-standing strategic corporate partnerships, further aligning operations with their lodestar of bolstering the B2B sector.

Shringi emphasizes the importance of loyalty among their larger clients, seeing it as testimony to Yatra’s operational stickiness. He provides evidence of the firm’s firm grip on client relationships saying, ‘When reviewing our top 100 clients, it’s noteworthy that 73 of them have stuck with us for over half a decade.’ These longstanding relationships, in Yatra’s eyes, provide a constant stream of dependable revenue while improving operational momentum once they’ve successfully incorporated their technical integrations.

Yatra managed to orchestrate a paradigm shift in the industry while competitors were engrossed in enticing consumers with eye catching discounts and marketing blitzkriegs. The results could be seen in the impressive annual retention rate which Shringi puts at around 97% for corporate travel. He states, ‘This high retention is instrumental in maintaining impressive operational leverage.’

Yatra’s margin enhancement is driven by two pivotal factors. Shringi firstly identifies the company’s decision to scale back on direct consumer discounts. Instead of heavy price slashes, the company pivoted to offering incentives via banking and marketing affiliates. As a result, they managed to lower their customer acquisition costs substantially. The second factor lies within Yatra’s strategic shift to higher-margin products such as corporate airfares, hotel reservations, and package deals.

The CEO explains that hotel and package deals render a net margin significantly higher than that of air travel, with percentages at around 11% in contrast to a mere 3%-4% for airfare. Changes in the clientele behavior have led to a shift of gross bookings toward hotel and package deals from 15% to 20%. This strategic turn has contributed positively to the company’s net margin and post-cost revenue metrics, even exceeding raw growth rates in gross bookings.

The effects of these changes can be seen in the reported growth in gross bookings by approximately 9% YoY, a significant recovery from previous downward trends across their entire portfolio. However, this recovery showed disparity amongst their offerings; the air ticketing sector showed a marginal recovery, whereas the hotel and package segments exhibited accelerated growth.

Yatra now sights the hotel sector as their immediate growth catalyst, capitalizing on their high-margin status and leveraging these services to attract new corporate clients. Many recent corporate gains have been ‘hotel-led’, where customers initiated their interaction with Yatra via the hotel services, paving the way for further access to their comprehensive travel services.

Yatra’s financial success is reflected in their key quarterly figures. The revenue from operations marked a significant growth of 108% YoY to INR 2.1 billion ($24 million) in Q1. At the same time, adjusted EBITDA skyrocketed 138% YoY to INR 249 million ($2.8 million). The net profit rose remarkably by 296% YoY to INR 160 million ($1.8 million).

In terms of clientele expansion, the company continued to broaden its corporate customer base, closing 34 new corporate accounts during the quarter. These newly acquired accounts show a potential annual billing of INR 2 billion ($23 million). This demonstrates Yatra’s determination in aligning their growth trajectory with their strategic intent of fostering corporate travel partnerships.

To sum up, Yatra’s strategic shift towards prioritizing corporate clients, improving technical integration, reducing customer acquisition cost and emphasizing higher-margin products has shown tangible results. These tactics have led to the steady growth of the company, setting it up to be a formidable player in the digital corporate travel business sector. The industry can certainly anticipate great things to come from Yatra as it continues on this ambitious course.