Apple Inc. has marked a significant shift in its manufacturing strategy, notably exporting a larger volume of iPhones from India than China to the U.S. for the second consecutive month. This recent move firmly cements a shift in production distribution that was already starting to emerge. In the world of technology and manufacturing, such pivotal trade routes are closely watched as evident markers of change.

In April 2025, fresh data from Canalys pointed to a significant surge in the number of iPhones shipped from India to the U.S. The growth stood at an impressive 76% year over year, culminating in approximately three million units being exported from India. On the other hand, exports from China plummeted by a similar percentage, translating to around 900,000 shipped units.

While this large-scale shift in Apple’s manufacturing locations is undeniably significant, it does occur at a period of the year when the premium iPhone models are traditionally at a production trough. This alludes to the notion that the enhanced output in India primarily encompassed the non-Pro iPhone models.

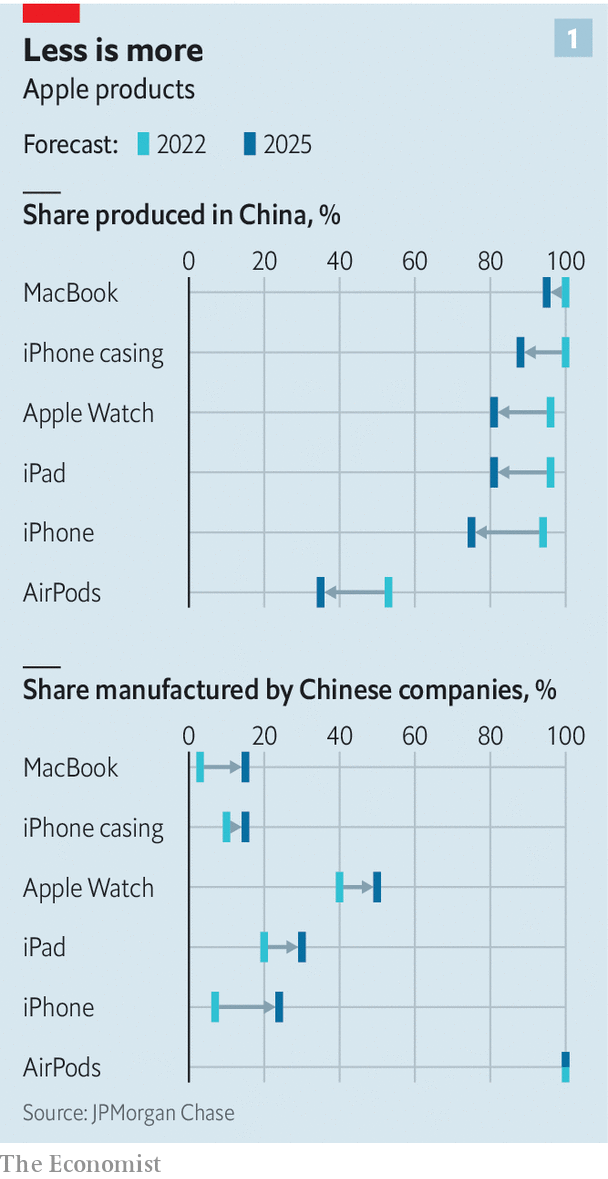

This surge in exports from India is a definitive marker of progress for Apple as it seeks to spread its manufacturing wings. All the same, the premier iPhones are still predominantly linked to Chinese manufacturing infrastructure. Given that previous iterations of the non-Pro iPhone were predominantly China-made during this time of the year, this apparent role reversal underscores Apple’s concerted effort to lessen its reliance on China.

Apple’s initiative to expand its supply chain network within India began to pick up the pace during the global health crisis. However, the recent reintroduction of tariffs on Chinese goods by the U.S. has imparted a sudden sense of urgency to the process. Apple reconfirmed its commitment in May 2025 to have the majority of iPhones meant for the U.S market assembled on Indian shores.

The rise in Indian exports can be traced back to the newly rolled out tariffs introduced at the start of April 2025. Even though iPhones were initially exempted from these measures, Apple proactively moved to adjust its assembly operations to circumvent potential supply chain hazards. It was during this month when India first topped China in iPhone exports to the U.S, a trend that subsequent April figures have only solidified.

Despite the strides Apple has made in establishing its assembly operations in India, the country still accounts for just 20% of Apple’s global iPhone production. The move into Indian territory has thus far covered only the final assembly stages of production, the Chinese supply chains still account for a significant portion of the iPhone sub-assemblies.

Production capacity in India still poses a challenge. The demand for iPhones in the U.S is estimated to average 20 million units per quarter, a mark which India is not forecasted to meet until 2026. It is evident that building capacity to meet such an enormous demand will be anything but a straightforward task.

Apple’s diversification efforts have not been without their fair share of difficulties. In the U.S, calls for iPhones to be domestically manufactured have been prevalent, with tariffs being slapped on those made in India. China has retaliated by limiting the export of advanced manufacturing equipment and skilled engineering personnel that are core to Apple’s Indian suppliers, resulting in the two behemoth nations retaining control over key segments of the iPhone supply chain.

The trade-off for diversifying manufacturing to India comes at a price. As of April 2025, production costs in India have been calculated to stand at around 5% to 8% higher than those incurred in China. However, Apple has sought to balance the scales by leveraging tax incentives and improving logistical processes.

Despite the higher production costs and political pressures, it appears that Apple will stay the course in India. It’s looking increasingly improbable that the tech giant will shift full iPhone production to the U.S. Regardless of the short-term political noise, it seems that Apple remains committed to its Indian investments for the long run.

Apple’s strategic moves are a harbinger of significant change, an indicator that the manufacturing landscape is not static by any stretch of the imagination. Amid fluctuating international trade relations and ever-evolving industry dynamics, the careful observer can glean a wealth of information even from subtle shifts.

The final note would be, patterns such as these highlight the dynamism of the technological world and crucially underscore the importance for manufacturing companies to continuously adapt, innovate and navigate political waters. It also highlights the distinctly global nature of large tech companies like Apple, who cannot afford to be tied to one country alone when it comes to key production processes.