PDD Holdings, the renowned e-commerce entity from China experienced a significant drop in its net earnings during the initial quarter of 2025, with profits almost halving. The company, notoriously recognized as the proprietor of Temu, geared up to weather the storms of a fresh trade confrontation between the global economic powers, United States and China. Reportedly the net profit of the Shanghai-headquartered firm was 14.7 billion yuan (equivalent to $2.6 billion) ending March 31, a reduction of 47% as compared to the previous year.

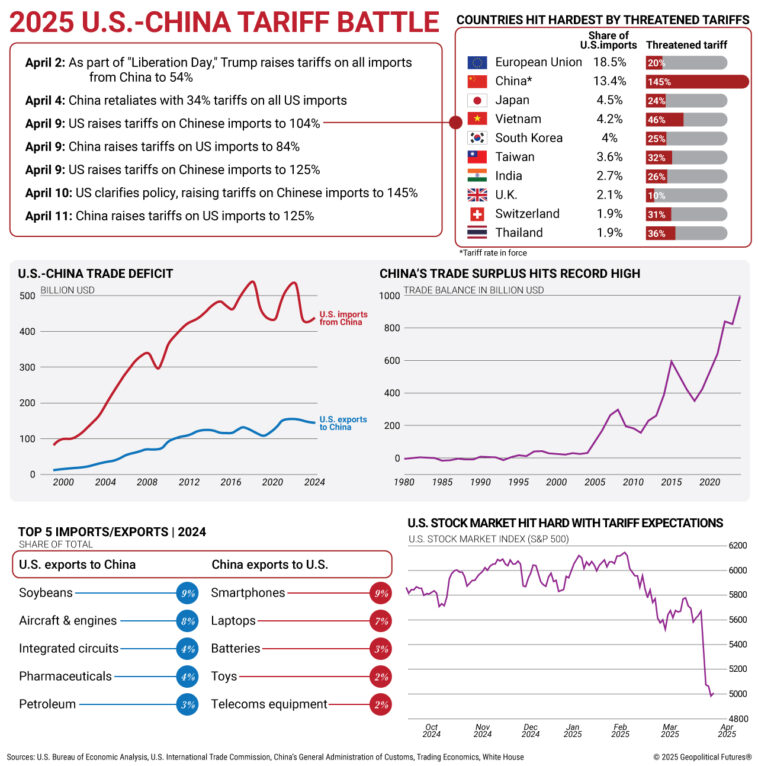

The unfavorable revenues came into the scene as the global economies geared up to face another round of economic tussles. The situation further exacerbated when US President Donald Trump decided to cancel a previously existing customs exception for merchandises worth beneath $800 (equivalent to $1,030). At one time, this exemption played a crucial role in sustaining the business operations of platforms such as Temu that specialized in inexpensive goods.

As negotiations between China and the US moved into a more peaceful phase, Mr. Trump issued an executive order in May. This new dictum placed duties on de minimis items transported via the US Postal Service at 54% of their value, which translates to a payment of $100. Before this, the imposed tariff rested at an exorbitant 120%.

Such economic maneuvers did have a temporary impact on the profit generation. Yet, they provided the necessary impetus for the sellers to make necessary adjustments to cope with the changes. The ultimate goal was to ensure the platform’s longevity and stability in a volatile market scenario.

The juggernaut enterprise however witnessed a steady deceleration in its revenue growth for the fourth quarter in succession. The company reported that its revenue growth for the first quarter stood at 10% year on year, amounting to 95.7 billion yuan. Interestingly, this marked a drop compared to the impressive growth of 24% that the company had experienced in the preceding three months.

Worse still, when compared to the soaring growth of 131% at the start of 2024, the recent revenue figures seemed lackluster. The executives within company circles had anticipated this slowdown. They explained it as a natural phenomenon influenced by the volatility and changing dynamics of the external environment.

Amid such uncertain times, the continuous investment spree of the company might continue to reflect upon their financial performance. This remains a reality check for the enterprises, where external turmoil could reflect upon the balance sheet and overall financial health of the companies.

Post the public disclosure of these figures, PDD’s depository receipts which are listed on the New York Stock Exchange suffered a massive blow. The prices took a nosedive, plummeting more than 13% on the eventful day of May 27.