Bank of Canada’s Interest Rate May Fall Following U.S. Trade Skirmish

Current market projections suggest another 0.25% drop in The Bank of Canada’s interest rates by 2025, a significant decrease from the 0.75% reduction expected just a few months prior. The overriding factor affecting these expectations has been the tumultuous trade skirmish initiated by the U.S. against Canada and numerous other countries, a significant influencer on the trajectory of mortgage rates. This sensational conflict has triggered speculation amongst economists regarding the extent of rate cuts the Bank of Canada may resort to in the event of a severe recession caused by the trade war. Additionally, concerns have been raised about the potential inflationary consequences of tariffs and their potential to curtail the central bank’s capacity to implement rate cuts.

Fluctuations in the bond markets, which directly affect fixed mortgage rates, have been a prevalent feature since the onset of the trade war. However, a shift in the narrative occurred recently at the G7 summit held in Canada’s Rocky Mountains. At this meeting, U.S. President Donald Trump and Prime Minister Mark Carney committed to strive towards an economic and security agreement within the next month, aimed at resolving the current trade disagreements between their two countries.

Should this potential agreement materialize, it could act as a catalyst for the Bank of Canada to maintain current interest rate levels. This stability would offer assurance for variable-rate mortgages in the foreseeable future. Moreover, it could potentially result in more economical fixed-rate mortgages, as projected by several economists and market analysts.

The underpinnings of Canadian mortgage rates are twofold. Firstly, the headline interest rate decisions by the Bank of Canada directly influence variable mortgage rates. Secondly, long-term fixed rates set by lenders are greatly swayed by the yield on Canada’s 5-year bond.

According to the Bank of Montreal’s senior economist Robert Kavcic, if a trustworthy economic agreement revitalizes consumer confidence and triggers an economic recovery, the Bank of Canada could decide to maintain rates at the current level of 2.75% – a value comfortably nestled within its neutral rate range of 2.25 to 3.25%.

“Under normal circumstances, rates in this range would be expected; with the trade war however, we could potentially see rates dipping further,” said Mr. Kavcic. However, a lukewarm agreement that fails to fully address the trade conflict between the U.S. and Canada could complicate matters, leading to a solitary rate cut for the rest of the year, warned Benjamin Tal, Deputy Chief Economist at Canadian Imperial Bank of Commerce.

Toronto’s Butler Mortgage founder, Ron Butler, points out that while a trade agreement may stabilize the economy, it does not guarantee a surge in job growth. He particularly draws attention to the gloom in Ontario over the potential for automobile manufacturing jobs relocating to the U.S. as companies seek to insulate themselves from future political manoeuvres by U.S. leadership. “Stagnant job numbers could well be a rationale for further rate cuts,” suggested Mr. Butler.

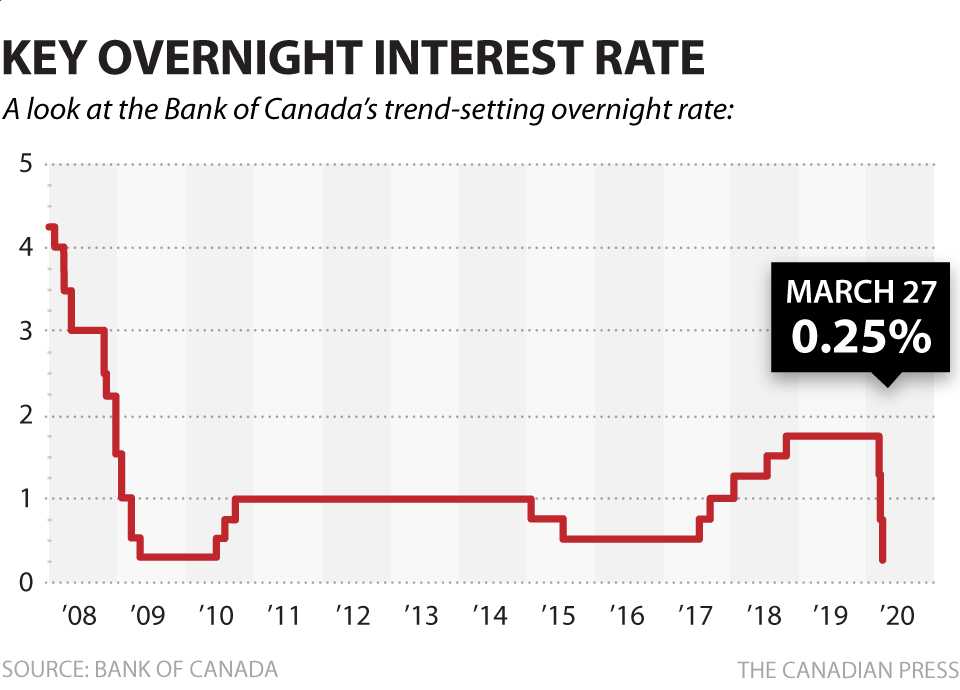

Current forecasts indicate that the Bank of Canada might only implement a further 0.25% rate cut in 2025. This projection has seen a steady downturn from a few months ago, when market predictions anticipated an additional 0.75% rate cut for the year.

The situation may prove less predictable concerning the bond market and fixed-rate mortgages. Mr. Tal believes that more uplifting news about a U.S.-Canada agreement could lead to a decrease in bond yields. Still, he cautioned that the Canadian 5-year bond yield relies heavily on conditions in the U.S., and any reduction in yields is contingent upon the resolution of the U.S.-China trade disharmony as well as an overall confidence boost in U.S. fiscal policies.

“Positive developments benefitting Canada hinge on positive developments elsewhere in world economics,” said Mr. Tal. He highlighted that the U.S. has been easing tariffs against China, creating optimism that the relations between these two trade giants could see improvement.

Shaun Cathcart, a Senior Economist at the Canadian Real Estate Association, asserts that a cessation of the trade war may be sufficient to manifest a moderate rebound in a housing market that suffered from abysmally low sales levels in 2025. Yet, he warns that any recovery could be tempered by the relative highness of mortgage rates.

“Mortgage rates have been lower for the past fifteen years, and property prices across large swathes of the country have adapted to this reality, which we have since moved past,” said Mr. Cathcart. “Surely, affordability has seen some improvement, but it’s far from ideal.”