Trade Uncertainties Pause BYD’s Plan for Mexico Production Facility

In the midst of a complex international political climate characterized by a rise in trade barriers and strained ties, China’s leading manufacturer of electric cars, BYD Co., recently held back its decision to establish a significant production facility in Mexico. Uncertainties ignited by the trade strategies of former U.S. President Donald Trump factored heavily into this decision. While still keen on growing its presence in the Americas, the company currently does not have a concrete plan for new investments. Ideas of expansion overseas are being cautiously reexamined by the auto manufacturing industry as a result of the volatile geopolitical landscape.

BYD acknowledged the significant effect of geopolitical considerations on their business decisions. Driving this point home, the company said it wishes to have a clearer understanding of the international trade environment before committing to any substantial decisions. Until its hiatus, BYD was contemplating three potential sites in Mexico for the proposed car manufacturing facility. However, due to present uncertainties, they have halted their active quest for an appropriate location.

Clarity on this matter was not forthcoming from Mexican authorities either. The country’s President, Claudia Sheinbaum, recently mentioned during a press conference that BYD had not put forward a formal proposal to establish an investment in Mexico. This information merely increased the doubt surrounding the potential launch of a new BYD plant in the country.

Further complicating the issue was the delay from China’s Ministry of Commerce, regarding the endorsement of establishing the BYD plant in Mexico. The Ministry expressed concerns about potential accessibility of the company’s proprietary technology by the United States, should BYD proceed with its plans. This warning was announced prior to the institution of large-scale tariffs on multiple U.S. trade allies and the imposition of separate taxes on select imported goods, including vehicles.

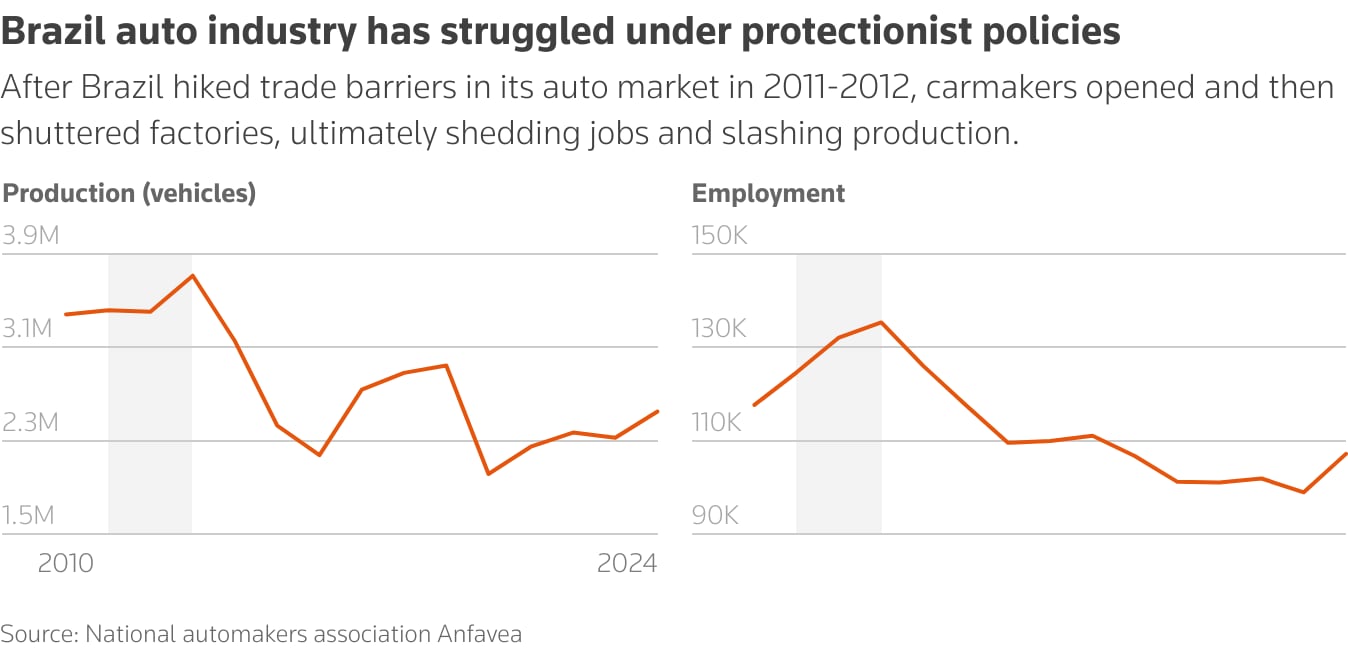

These tariff measures drastically reshuffled the established network of industry supply chains, shaking the foundation of the global automotive industry. The ripples of this economic storm were felt across multi-national corporations and even led to considerable restructuring — General Motors Co., as an example, unveiled plans to relocate part of its SUV and pickup production from Mexico-based facilities back to the United States.

Despite the turbulent international trading environment, BYD aims to augment its production capacity. However, the timeline of this potential expansion remains uncertain as the company continually evaluates the staying power of current global trade dynamics.

As the Asian giant grapples with changes in its global expansion strategy, it also had cause for celebration. With the inauguration of its first production plant outside of Asia, specifically in Brazil, BYD marked an important milestone in its journey. Yet, the joy was marred with controversy as the company found itself embroiled in accusations of inhumane practices such as slave labor and human trafficking during the plant’s construction phase.

In light of these allegations, BYD released a statement diligently affirming its dedication towards respecting human rights and labor standards. Furthermore, they stressed their adherence to Brazilian laws and international labor protections. Despite the controversy, the opening of the plant represented a significant step forward in BYD’s international growth ambition.

These alleged breaches, however, had a profound impact on BYD’s global expansion strategy. The company made clear their intent to transition towards a more mindful approach when it comes to its international investment ventures. They plan to undertake future projects at a less aggressive pace, cultivating more substantial ties with local communities.

When fully functional, the new BYD production facility in Camaçari, Brazil is projected to manufacture 150,000 vehicles every year. The company has outlined goals to double this production potential to approximately 3000,000 cars about two years post-commencement.

At this Brazilian plant, production will be focused on the final assembly procedures for semi-constructed vehicles imported from China. The time frame for the kick-off of these production activities is expected to be in the immediate future. The company is certainly optimistic, with planned future increase in the plant’s capacity.

Furthermore, BYD is currently negotiating with Brazilian authorities regarding import tariffs on the vehicle kits that it intends to use during the early stages of the plant’s operations. The company has proposed a reduction in these tariffs for a temporary period of 12 months to facilitate smoother procedures. This negotiation exemplifies the sometimes complex dynamics of international trade, and directly affects BYD’s ability to carry out its operations.