Anticipating Canada’s Next Financial Move Amid U.S Trade Tensions

The next moment of anticipation in Canada’s financial sector will come on September 17 when the Bank of Canada decides on its interest rates. On the same day, the U.S. Federal Reserve will reveal its updated interest rate, with a press briefing by Fed Chairman Jerome Powell following soon after at 2:30 p.m ET. Expectations are rife that the federal funds rate target will be steadfast within the bandwidth of 4.25 per cent and 4.5 per cent.

Meanwhile, an escalating trade scenario looms under President Donald Trump, who has marked August 1 as the deadline for potential trade agreements between Canada and several other nations. Despite these efforts, both President Trump and Canadian Prime Minister Mark Carney indicate that the likelihood of finalizing an arrangement by the end of the week remains uncertain.

Trump’s augmentation plan comes into play if the desired deal fails, proposing to elevate tariffs on non-USMCA-compliant Canadian products from the present rate of 25 per cent to an even steeper 35 per cent. The President also promises the activation of 50 per cent levies on copper, an arrangement to take effect from the start of August.

A paramount focus for Canada will be the upcoming economic data announced by Statistics Canada. The GDP figures for May will be unveiled this Thursday, followed by the June trade statistics and July employment data on August 5 and August 8, respectively. Furthermore, on August 19, the inflation data for July is set to be released.

U.S. protectionism has seen a significant surge under President Trump’s leadership. However, it’s essential to highlight that changes in global trade have been seen even before his tenure. This can be traced back to past administrations and includes the initial Trump administration and the Biden administration, all of which had more constraints on global commerce.

One undeniable development in the scene of international trade is the rising prominence of national security considerations. Such factors, previously overlooked in favour of efficiency, now demand greater attention. The world stands divided, and there’s no question that this transition will have lasting implications.

This shift towards tariffs and protectionism comes at a cost. A major downside includes the reduction of economic efficiency, causing a corresponding decline in income and subsequently, consumption. The economy might regain its momentum, but it would be at a muted pace, always hindered unless the tariffs are lifted.

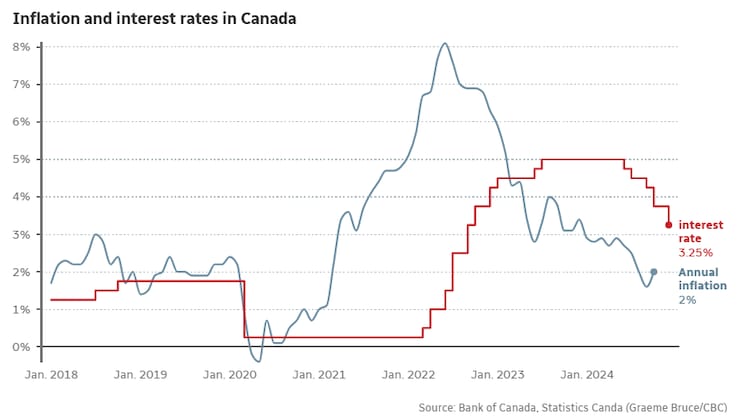

The Bank of Canada, on its part, held on to its policy interest rate for the third time running. This reflects the fact the Canadian economy has been resilient to U.S. tariffs than previously forecasted, albeit within an environment of continuing uncertainty. The central bank’s governing council’s decision to maintain the benchmark interest rate of 2.75 per cent, a figure unchanged since March, was as expected.

The Bank of Canada has persisted with its benchmark policy rate of 2.75 per cent since April, keeping a careful watch on the impact of President Trump’s tariffs on economic activities. The authorities are also scrutinizing how disruptions in supply chains and Ottawa’s reactions influence consumer prices.

With core annual inflation indicators standing at 3 per cent and ambiguity hanging over the chances of a potential trade deal with the U.S. before August 1, the odds of the bank lowering interest rates today seem remote. Major questions brimming with suspense circle around the upcoming rate decision.

Everyone is keen to see how Governor Tiff Macklem and his team will address the effect of tariffs and the potential inflation hazards. Furthermore, the financial world is eagerly awaiting to see if they will issue a central forecast this time, after choosing to skip it in April.