Bank of Canada’s Intense Challenges: Inflation, Tariffs & Government Expenditures

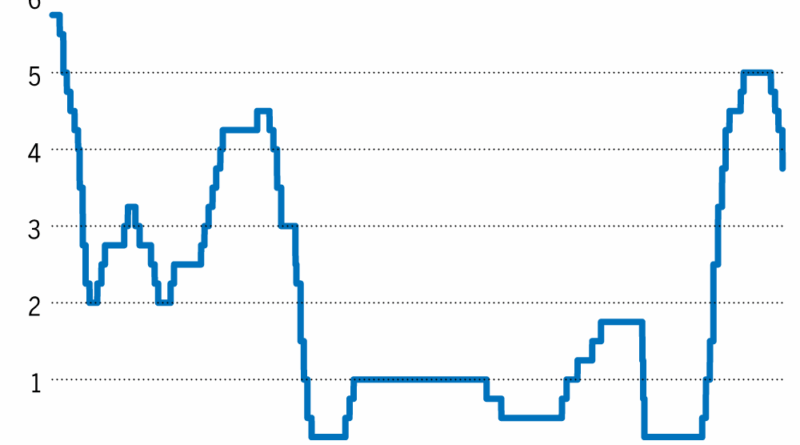

The Canadian Central Bank faces a critical challenge in making its budget decision as it has to take into account an unexpected inflation report, changes in tariff policies by Ottawa and ongoing uncertainties over government expenditure plans. Most financial market analysts predict that the central bank will end its record of three successive standstills and reduce its policy rate by 0.25 percent to make it 2.5 percent, as suggested by the data from LSEG Data & Analytics.

Before any official announcement by the Bank of Canada regarding its monetary strategy, the governing council will be reviewing the inflation statistics for August published by Statistics Canada. Projections by professionals in the field suggest a possible increase in the annual consumer price index rate from 1.7 percent in July to 2 percent.

Confirming these anticipations, Tony Stillo, who is responsible for Canadian economics at Oxford Economics, anticipates an inflation rate of 2 percent for August as well, primarily due to the escalated prices of food and energy during the previous month. Stillo believes the increased inflation in food prices was in part due to Canada’s retaliatory tariffs on certain food items, including Florida’s orange juice.

The inflation statistics for August will not capture the effects of Canada’s decision, taken in early September, to eliminate most of these counter-tariffs. Stillo is of the view that the contraction of the Canadian economy in the second quarter, concurrently with the elimination of the majority of tariffs, will have a dampening effect on pricing.

Stillo’s analysis suggests that the Canadian economy is on the brink of a recession. Independent of whether the GDP declines in the third quarter, and given the ongoing unease around the trade war, Stillo forecasts that the economy will encounter difficulties in developing any growth during the latter half of the year.

Previously, Oxford Economics was under the impression that the Bank of Canada had finished trims to its rates. This outlook has changed due to the recent mitigation and removal of most counter-tariffs by Canada, according to Stillo.

“Under the weight of a fragile economy, the bank will likely put protective measures into place by implementing a 0.25% reduction in September, which will most likely be compounded by another 0.25% reduction in October,” stated Stillo. This will pull down the policy rate to 2.25%, placing it at the lower limit of the Bank of Canada’s neutral range, where monetary policies neither overly stimulate nor inhibit growth.

According to a report published by TD Economics on September 12, the central bank has valid justification for reducing rates since the uncertainty around trade, compounded with a weakening job market, is manifesting in controlled inflation pressures. On the flip side, the report states that any unexpected rise in the inflation figures might prevent the BoC from implementing changes.

“Given that recent data results have essentially paralleled the predicted bank scenario, the bank’s ongoing need for future rate-reduction has increased,” the report observes. TD also maintains that the rate-cutting phase for the BoC is near its end, with a targeted 2.25% for the policy rate.

From the central bank’s July 30 interest rate convention summary, it can be deduced that some governing council members were of the opinion that should issues with the job market continue, future reductions in rates could be vital. Following this, Statistics Canada announced a combined job loss of over 100,000 jobs in July and August, pushing the unemployment rate up to 7.1%.

Last week, Thomas Ryan, an economist specializing in North America at Capital Economics, indicated that the weakness in the labor market is now affecting sectors other than those impacted by trade. He anticipates this trend will be significant in leading the other members of the Bank of Canada’s governing council to consider easing financial policies.

Coupled with declining inflation threats, Capital Economics predicts that the Canadian bank will trim rates this week and once more before the year ends. So far, due to unforeseen turn of events in U.S. trade policies and the associated response by the Canadian economy and inflation, the Bank of Canada has avoided speculative foresight.

Stillo anticipates a shift in the bank’s approach, with gradual steps toward providing slightly clearer guidance. On the other hand, the federal government’s impending fiscal policies have raised new questions for Stillo, particularly what the upcoming fall budget may present.

Prime Minister Mark Carney has hinted at austerity measures on the operational side while substantial capital investments earmarked for defense and infrastructural spending is likely. Stillo contends that these proposed expenditure plans, which are likely to invigorate the economy, will be closely monitored by the Bank of Canada and factor into their implementation of monetary policies against further weakening.

With persistent doubts surrounding trade and fiscal policy, Stillo expects the central bank to proceed with caution in easing steps and to be pragmatic. Given the unpredictable nature of the trade war, the bank will not want to implement significant cuts in interest rates only to have to roll them back later on, Stillo affirms.

“Ideally, a central banker would prefer not to have to backtrack on policy changes,” he remarked. In conclusion, Stillo advised that the current circumstances call for measured and astute steps.