Nancy Pelosi’s $130 Million Stock Windfall Triggers New Scrutiny as She Prepares Exit

Nancy Pelosi’s decades-long Congressional career is ending — and so is her reign as one of the most controversial figures on Capitol Hill when it comes to personal wealth accumulation.

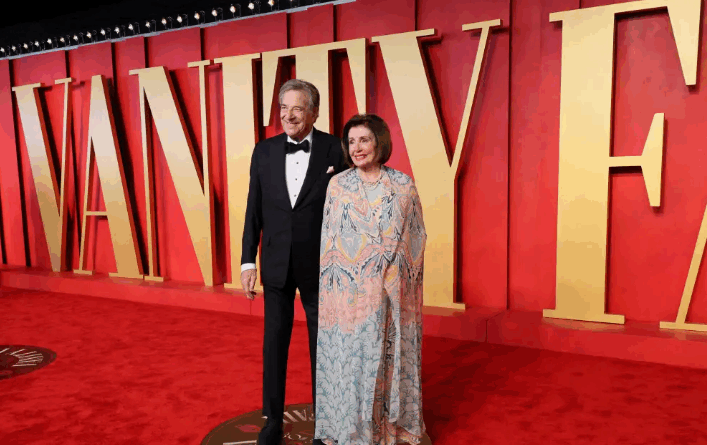

This week, the 85-year-old former House Speaker announced she would retire at the end of her term in January 2027. Her exit comes as mounting pressure builds to ban lawmakers and their spouses from trading individual stocks, a push fueled in no small part by her jaw-dropping market performance over the past 37 years.

According to new data from Quiver Quantitative, Pelosi and her husband Paul — a venture capitalist — have turned an estimated $785,000 portfolio from 1987 into over $133.7 million today. That’s a 16,930% return, far surpassing the Dow Jones’ 2,300% gain over the same time period.

Even adjusting for compound growth, the Pelosis’ investments saw an average annual return of 14.5%, outpacing the S&P 500, NASDAQ, and even elite hedge funds.

The Queen of Congressional Trading

Pelosi’s investment activity has drawn attention and outrage for years, but her 2024 disclosure shows the extent of her aggressive portfolio. Her largest stake? Between $25 and $50 million in Apple. Other holdings include NVIDIA, Salesforce, Netflix, and Palo Alto Networks — all companies directly affected by legislation that has passed through Congress.

Last year alone, the Pelosis reportedly beat every major hedge fund with a 54% return, according to Bloomberg. That’s more than double the S&P’s 25% gain for the same period.

Their success hasn’t gone unnoticed. The ETF “NANC,” modeled after Congressional trades, is named for her. Portfolio manager Dan Weiskopf called her strategy “high conviction and aggressive,” noting her prolific use of options trading — a move considered risky unless backed by a high level of confidence or inside knowledge.

The NVIDIA Trade Heard Around the Hill

Among Pelosi’s most controversial wins was a December 2023 move to exercise a call option for 50,000 shares of NVIDIA at just $12 apiece. The couple paid an estimated $2.4 million for the trade. Today, those shares are worth over $7.2 million — a gain that critics say would be impossible without privileged access.

“If anyone else had turned $785,000 into $133.7 million with better returns than Warren Buffett, they’d be retiring behind bars,” said Kiersten Pels, spokesperson for the Republican National Committee.

Rising Pressure to End Congressional Stock Trading

Pelosi’s financial legacy is fueling bipartisan calls for a crackdown. A new trading-ban bill was introduced in the House in September, and her name is so closely tied to the issue that past iterations of the bill were literally named after her.

The push comes amid growing public awareness that lawmakers often have access to market-moving information before the public — and can trade based on that knowledge without breaking current law.

Even Pelosi’s supporters admit her strategy raises questions. “When you’re supposed to be called an honorable member of Congress, maybe you should look yourself in the mirror and say, I want to do the right thing,” said Weiskopf.

From Congresswoman to Mogul

The Pelosis are now worth an estimated $280 million — a dramatic leap from the roughly $3 million they held when Nancy first entered Congress. In addition to their stock portfolio, they own a Napa Valley winery worth between $5 million and $25 million, a San Francisco mansion worth $8.7 million, commercial real estate, and even a political consulting firm.

Their financial transformation mirrors Pelosi’s rise in power, from a freshman Congresswoman to the most powerful Democrat in the House. But as she exits the stage, it’s not her legislative legacy making headlines — it’s the fortune she amassed while holding office.

And for millions of Americans watching from the outside, it’s yet another reminder that the game in Washington is rigged for those who write the rules.