Virginia Democrats Push for Nation’s Highest Income Tax After Campaigning on Affordability

Just weeks after consolidating power in Richmond, Virginia Democrats are pushing legislation that would make the Commonwealth the highest-taxed state in the nation—surpassing even California.

The proposed bills introduce new income brackets and hike taxes on capital gains and other investments. If passed, the changes would raise Virginia’s top effective income tax rate to around 13.8 percent.

That’s higher than any state in the country.

Democrats argue the massive tax increases are needed to stabilize state finances and fund left-wing priorities like expanded housing and public programs. Delegate Kelly Convirs-Fowler (D-VA) framed the proposal as a way to make “millionaires pay their fair share.” The Commonwealth Institute, a progressive policy group backing the measure, claimed the so-called “Fair Share tax” could rake in over $1 billion annually.

But critics say the plan is a bait and switch.

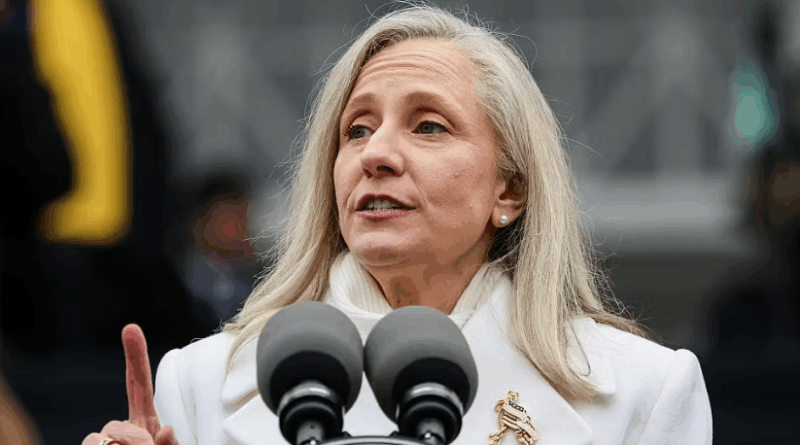

Governor Abigail Spanberger (D-VA), who campaigned on an “Affordable Virginia” agenda, promised voters lower costs across the board. Her campaign repeatedly vowed to cut expenses for families by tackling housing, health care, and energy costs.

Now, instead of relief, Virginians are being served a tax bill.

“Spanberger’s economic agenda would take Virginia down the same failed path as California and New York,” said the Republican Party of Virginia in a blistering statement.

House Minority Leader Terry Kilgore (R-VA) warned the legislation is just the beginning. “This is one of many bad bills coming from Richmond,” he said.

Conservative watchdogs quickly joined the chorus of criticism. Grover Norquist of Americans for Tax Reform called the proposals “particularly foolish” at a time of heightened tax competition between states.

The Congressional Leadership Fund, a top GOP-aligned organization, didn’t hold back either.

“It’s about to get very, very expensive to live, work, and raise a family in Virginia,” the group said in a statement. “Democrats campaign on affordability, but the minute they’re given power they rob hardworking families of their paycheck in the form of higher and new taxes.”

The CLF also noted that Democrats wasted no time moving their agenda. “Within 48 hours of taking power in Richmond, Virginia Democrats introduced legislation creating new sales and retail taxes,” the group said.

Despite public backlash, Democrats currently hold a 64-36 majority in the House of Delegates and a narrow 21-19 majority in the Senate, making the passage of these tax hikes highly likely.

As Spanberger’s administration moves to redefine “affordability” through government spending and tax increases, voters may have second thoughts heading into the 2026 midterms. With costs rising and taxes climbing, Democrats may soon find themselves on defense.