Donald Trump earmarked his political legacy with noteworthy tax reductions, managing to outshine Barack Obama’s Affordable Care Act and Joe Biden’s paltry attempt at inflation reduction via legislative means. Trump’s tax cuts, part of a multi-trillion dollar bill, overshadowed efforts by the Democrats aimed at maintaining the status quo of health care for the underprivileged and preventing significant changes to a decade worth of energy policy.

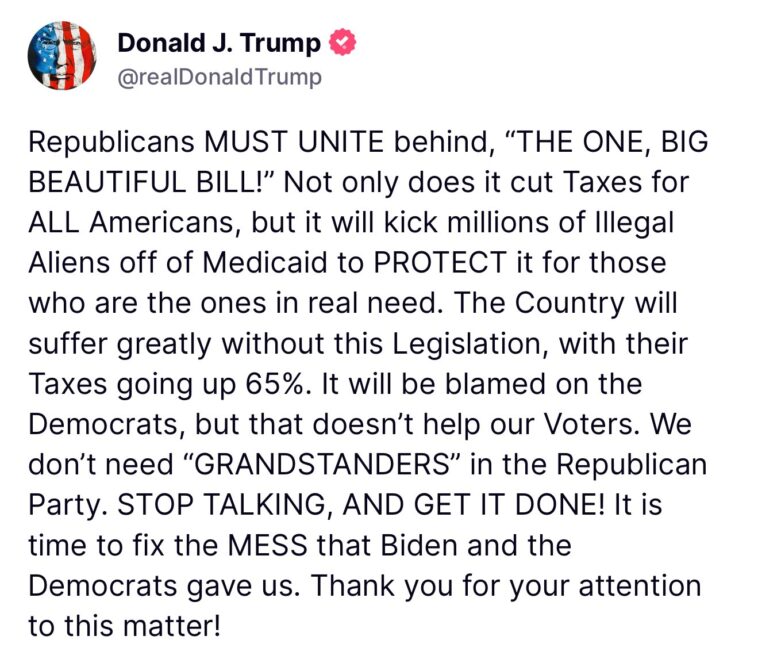

Trump managed to persuade and even coerce nearly all Republicans in Congress to back his signature legislation, despite features of it they might have found unwelcome. He adopted a branding approach, terming the legislation the ‘One Big, Beautiful Bill’, pushing its passage without any aid from Democratic party votes. This victory, however, faces significant trials in the upcoming 2026 midterm elections.

Democrats have publicised their intent to make use of a time-tested theme in the coming election: highlighting the Republican party’s supposed preference for the affluent via tax reductions at the expense of the less fortunate who stand to lose their healthcare benefits. This comes at a time when Trump’s tax cuts, purported to invigorate the economy, are up against unforeseen trade disturbances and a general sentiment of uncertainty.

In an attempt to diffuse the implication that the rich were being favored, Trump incorporated provisions in the legislation aimed at reducing taxes for tipped workers and those receiving overtime pay, representing a tiny fraction of the labor force. To finance these and other costly objectives, the Republicans took the rather unpalatable decision to slash Medicaid – a move that was diametrically opposed to Trump’s declaration that government assistance program beneficiaries would not be impacted.

For Biden, a central pillar of his reelection argument was the assumption that his legislative achievements would garner him the public’s favor and support. However, this proved fallacious as his worryingly declining poll numbers reflected public concern over his advancing age and the continuous cycle of inflation.

In stark opposition, Trump has shown initiative in dismantling tax benefits intended to encourage clean energy programs initiated under Biden’s signature healthcare and climate bill. Similarly, the popularity of Obama’s health reform, which was signed into law in 2010, only surged when Republicans made a bid to repeal it in 2017.

Contrary to the trend, Trump’s considerable tax-cut endeavors in his first tenure in 2017 didn’t spare him in the 2018 midterm elections when Democrats took the reins of the House, and was no saving grace in his 2020 defeat against Biden. The Democrats on the other hand, remain hopeful that their policy setbacks can be leveraged to secure political ascendancy.

In a show of empathy during an appearance in the Oval Office, Trump assured the preservation of social security programs such as Medicare and Medicaid, promising to target only wasteful expenditures and fiscal misconduct. However, contrary to this pledge, the bill passed by his party cut back on such benefit programs, including Medicaid and food assistance, to underwrite their supposed tax reduction and other costly goals.

This maneuver was projected to swell the ranks of the uninsured by nearly 12 million by 2034, according to estimates from the Congressional Budget Office. The legislation managed to incite criticism not merely from the opposition bench, but also from within Trump’s own party.

For instance, Senator Thom Tillis of North Carolina voiced concerns that the move would cause substantial coverage losses across several states and open them up for political assaults. After his party disregarded his cautionary tale, he decided against seeking re-election.

Senator Lisa Murkowski, another Republican who ended up playing a pivotal part in passing the bill, also voiced her apprehensions and counselled the House to rework the bill. In a disappointing show of disregard, the House neglected to address her concerns.