California Seaports Suffer Decline Amid Tariff Woes

In recent times, California’s seaport activity has suffered under the alterable tariff policies implemented under the Trump administration, showing more decline than during the peak of the COVID-19 crisis. According to Mario Cordero, the chief executive of the Port of Long Beach, the number of ship arrivals and departures is starting to outweigh those we observed during the pandemic period.

An observation from the Port of Los Angeles showed that the port projected an influx of 80 vessels in May, but a disappointing 17 were canceled. This is notably worse than the previous year, which only recorded 12 cancellations in total by May. For the upcoming month of June, 10 cancellations have already been reported, the executive director, Gene Seroka, elaborated last week.

A significant drop in container movement was also reported at the Port of Oakland, experiencing a 15% decrease month-over-month in April. This was the first substantial decline in the year and it coincided with the activation of the new tariffs. The unsettling uncertainty surrounding the tariff regulations has stopped many businesses in their tracks, awaiting a better time to place orders for imported goods.

Analyses of the major Californian ports indicate that employment opportunities for dockworkers are on the decline. Over the past few weeks and year-over-year, the number of teams responsible for cargo handling, known as ‘gangs’, have been decreasing in all the ports. This situation is notably different from the pandemic period; this time, the instability of the tariff rules implies a lack of cargo surge.

Gary Herrera, president of the International Longshore Workers Union Local 13, representing the part-time workers at the ports of Long Beach and Los Angeles, has described the bleak reality. The part-time port workers, according to him, are currently getting no work. Even the full-time workers, who ordinarily have work preference, are scarcely getting a full work week.

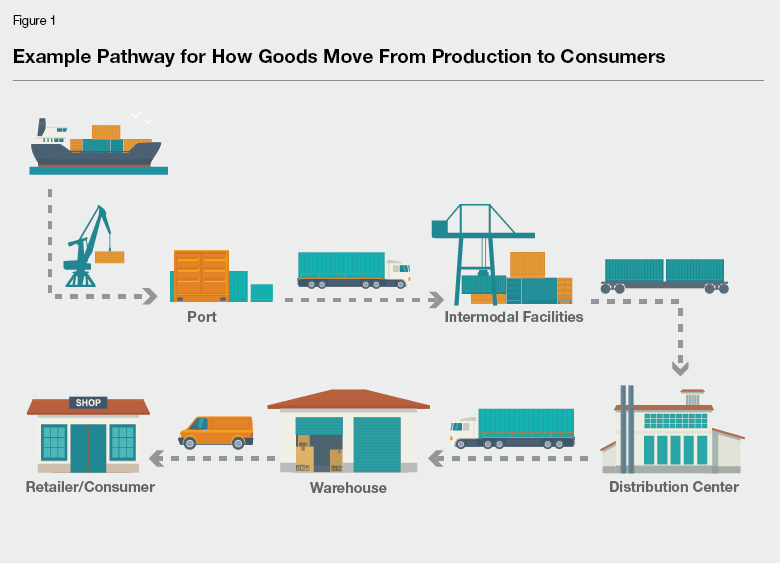

As this tariff-induced problem progresses, other workers along the logistics chain are likely to feel the ripple effects. From truck drivers to warehouse staff, rail workers, and retail personnel, the situation will impact all. When people don’t have enough work or lose their jobs, this will undoubtedly have reverberating effects on their local communities, as pointed out by port officials and workers.

Herrera postulates, ‘We’re not just workers, but we’re also community members. We live and work in our community and also consume within it.’ Similarly, the president of International Longshore Workers Union Local 26, Luisa Gratz, whose union represents the majority of dock security in Los Angeles and Long Beach, also expressed concerns for her constituents.

The port security personnel, responsible for transporting other dock workers, are also in a bind. According to Gratz, in the absence of work for the longshoremen, there’s limited work for her union members except for gate monitoring. In her words, this situation is ‘heartbreaking. It’s putting people out of work.’

The trucking industry is also feeling the tariff pressure. Eric Tate, secretary-treasurer of Teamsters Local 848, representing approximately 8,000 truck drivers in Southern California, explained that truckers, particularly part-timers, are seeing a reduction in scheduled work. They’ve been attempting to swiftly move goods around, hoping to salvage commercial engagement in the festive season.

Tate stated that the ongoing ambiguity implies that numerous truck drivers are just about managing to work 40 hours a week. Some shipping drivers, responsible for moving cargo from the ports to reduce congestion, might only have a day or two of work in a week, he added matter-of-factly: ‘When there’s no ship, there’s no congestion.’

Contrary to the trend, the Port of Oakland in the Bay Area is anticipating a potential increase in activity in June. The initial figure of 12 canceled ships for the coming month has been decreased to just five. The descending trend in cargo traffic at the seaports, however, could pivot depending on how diverse businesses and sectors react to a deal secured by the Trump administration with China, which lowers import taxes from China from 145% to 30% over 90 days.

This agreement is in response to the reduction in imports from China and other places and the diminished exportation of agricultural products from the state. The latter is predominantly due to retaliatory tariffs on U.S. goods. As such, one of California’s significant exports, soybeans, is taking a hit with the Port of Los Angeles representative sharing, ‘(But) Brazil, in the month of March, exported more soybeans to China than they have in their entire history.’

Despite the temporary settlement with China, the extremes on tariffs and lack of clarity pose significant hurdles. The continuous fluctuations in the prices of goods make it difficult for businesses to make informed decisions and strategize for the future, and it becomes a gamble for certain businesses to place orders for imported goods.

The long-term effect of this situation is a high-stakes stakes affair. If the flow of cargo declined by 10%, it could cause a similar decline in jobs. The Port of Long Beach CEO, Cordero, put it in perspective, estimating that with approximately a million jobs rooted in the port operations, a 10% reduction in cargo could lead to a loss of 100,000 jobs.

The Long Beach port alone supports income-related jobs amounting to tens of billions of dollars in the adjoining five counties. The spokesperson maintained the broader economic benefits, stating, ‘When workers and business owners earn income from working at the port or as one of our suppliers, they spend those dollars on groceries, entertainment, travel… and all of that activity supports the broader economy.’