Tax reductions were a pillar of Donald Trump’s political tenure, an aspect the Democrats are quick to criticize. They argue these measures disproportionately affect low-income Americans by allegedly propelling them towards losing their health care and rolling back more than a decade’s worth of energy policy. Much of this discourse seems to conveniently ignore Trump’s persistent effort to get the Republicans on board with his legislative agenda, despite contentious elements within it.

In terms of tactics, the former President used a combination of persuasion and pressure to rally the majority of Congressional Republicans behind his headline legislation. He employed shrewd branding tactics, presenting the bill as ‘One Big, Beautiful Bill’ and then pushing it through Congress, dependent solely on Republican votes. However, the Democrats seem determined to twist this victory into a weapon for the upcoming 2026 midterm elections.

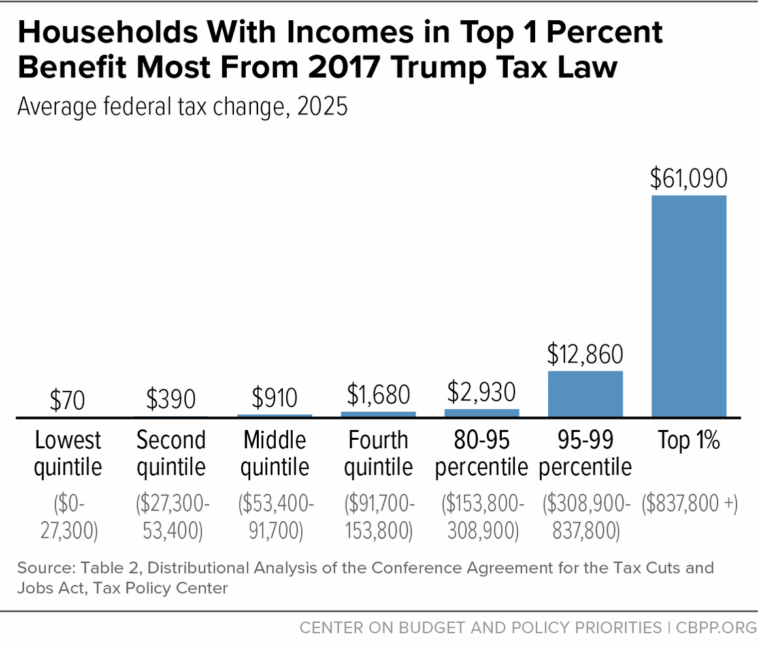

The Democrats’ key campaign argument aims to demonize the Republican President, painting him as prioritizing tax cuts for the rich at the expense of underprivileged individuals who risk losing their healthcare. Simultaneously, the GOP’s assurances that the bill would significantly boost the economy are to face trials in a time of unpredictability and trade chaos.

But to simply accuse Trump of catering to the rich would be to overlook his attempts to lighten the tax burden on certain segments of society, such as workers who rely on tips and overtime pay for their incomes. These individuals comprise a minor portion of the overall workforce, but Trump’s proposals nevertheless aimed to alleviate their tax-related stress. Naturally, such initiatives don’t seem to find much mention in Democratic critiques.

The GOP, to enact these and other potentially expensive agendas, introduced deep cuts to Medicaid, which contradicted Trump’s earlier assurances that entitlement programs wouldn’t be affected. Such challenging policy maneuvers don’t prevent Democrats from capitalizing on Biden’s inability to elevate his popularity amidst worries about his age and persistent inflations.

Following his inauguration in January, Trump has been proactive in dismantling tax incentives aimed at supporting clean energy initiatives, a move Democrats have latched onto. These ‘green’ measures were part of the healthcare-and-climate bill, a cornerstone of Biden’s political career. Nevertheless, it is interesting to note how Democrats are vocal about this, yet quiet on Obama’s healthcare policy that resulted in a political massacre during the midterms that followed.

As history has shown us, legislative achievements such as Trump’s momentous tax cuts in 2017 usually come with political costs. However, these potential side-effects didn’t deter Trump. But when the 2018 midterms rolled around, and Democrats seized control of the House, it became clear that even significant first-term accomplishments might not always translate to election wins.

The Democratic narrative has been oriented towards transforming policy setbacks into political advances. Much like how Obama’s above-mentioned healthcare policy only gained popularity when Republicans attempted to repeal it in 2017, Democrats are hoping to flip the script using Trump’s tax cut legislation. But history has shown that such back-and-forth tactics often lead to gridlock rather than meaningful progress.

Trump, during an Oval Office appearance, pledged his unwavering commitment to Social Security, Medicare, and Medicaid, with a special focus on identifying and eradicating any scope of wastefulness and abuse. But, true to form, the Democrats argue that the legislation passed by the GOP was infact in direct opposition to Trump’s promise.

Instead of safeguarding entitlement programs as promised, they claim, the passed legislation actually reduced them, effecting programs like Medicaid and food assistance to bankroll their proposed tax cuts and other expensive endeavours. The Congressional Budget Office’s estimates highlighted a projected increase in uninsured people by approximately 11.8 million by 2034, a result of this legislative action.

Even within Trump’s party, there were occasional murmurs of disagreement concerning the bill. Senator Thom Tillis from North Carolina voiced fears that such actions might precipitate substantial coverage losses and expose many states to political assaults. Following these unheeded warnings, he decided to step back and forego running for re-election.

Another GOP figure, Senator Lisa Murkowski, played a vital role in passing the controversial bill despite expressing her reservations. She too requested revisions to the legislation, yet her sentiments were largely disregarded by the House. Naturally, the Democrats have attempted to wield such intra-party disagreements as a tool to further their own agenda.

The critical viewpoint of the opposing party, however, has driven a somewhat skewed narrative. This narrative sees them relentlessly criticizing Trump’s tax cuts, blaming them for pushing less fortunate Americans off their health care, while simultaneously claiming they are reversing years of energy policy progress.

Yet, isn’t it peculiar that Biden’s much-vaunted Inflation Reduction Act didn’t quite bear the fruits as he and his party expected? His lingering struggles to enhance his popularity, hampered by consistent concerns over his advancing age and unabating inflation, are topics that Democrats are less keen to discuss or resolve.

It’s noteworthy that since taking office in January, Trump has implemented measures to roll back tax incentives designed to promote clean energy initiatives — a key component of Biden’s landmark health care-and-climate bill. Democrats, quick to pounce on this, often avoid mentioning the political upheaval Obama’s health overhaul induced in the midterms of the Fall.

While Trump’s first-term tax cuts in 2017 didn’t secure him victory in the mid-terms the following year, they represented a significant policy achievement. On the other hand, Democrats are eager to translate their policy defeats into potential political victories. Time will tell which approach yields more lasting benefits for both these two political forces and the American people they represent.