Electric Vehicle Sales Surge Amidst Uncertain Policy Changes

Earlier this year, the U.S. President and the head of Tesla took to the White House lawn to showcase an array of electric vehicles. However, their relationship has since cooled, with the President’s personal Tesla no longer parked within the White House vicinity. Reflective of this changed sentiment, earlier in summer, law was passed under the moniker, The One Big Beautiful Bill, which repealed federal backing for electric cars. However, it would seem that interest in electric vehicles (EVs) isn’t dwindling with the President’s continued advocacy for them.

The proposition is supported by data with JD Power’s estimation that electric vehicles sales are projected to account for an unprecedented 12.8 percent of total U.S. auto sales in August, marking an increase of 3.2 percent compared to the previous year. This spike in EV interest can largely be attributed to the impending discontinuation of the $7,500 EV tax benefit. The expiration of this appeal is a consequence of the signing into law of the GOP-backed One Big Beautiful Bill on July 4, with the tax credit due to terminate at the end of September.

Potential EV customers seem to have taken this news as a signal to expedite their purchases to leverage the soon to be extinct deal. The boost in EV sales, however, might not represent a long term trend. Market analysts are expecting a downturn in US EV sales after the incentive fades away next month. The magnitude and specifics of such a decrease are still ambiguous, largely hinging on the reactions of auto manufacturers and sellers.

How these stakeholders respond to this shift in policy could significantly influence whether buyers maintain their interest in EVs. This is set against a backdrop of ongoing negotiations around car tariffs, which have profound implications even for U.S. car manufacturers. These companies often construct their most price-competitive models in non-domestic locations and as such brunt the impact of the 25 percent tariffs on imported vehicles.

Many industry spectators, however, posit that the end of federal support could merely represent a minor setback in the U.S.’s shift toward electric vehicles. The narrative for this transition is being written by technological strides offering high-performance batteries, expanded driving ranges, expedited charging times, and more affordable price tags. As charging infrastructure proliferates across an array of locations, the feasibility and attractiveness of electric vehicles increase.

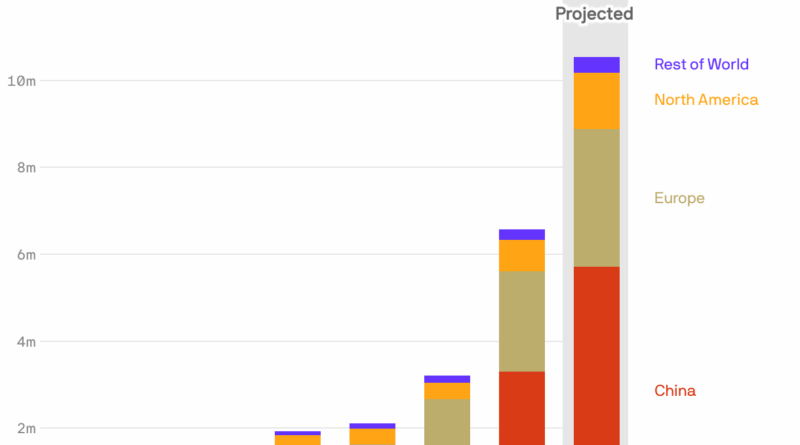

There’s a rising consensus amongst Americans that transitioning to electric vehicles is a beneficial decision. Despite these prevailing winds of change, the U.S. remains somewhat in the rearview mirror in terms of global EV acceptance. Projections from the International Energy Agency indicate that over a quarter of all new cars sold globally this year will be electric. However, the U.S. market’s embrace of EVs stands at a mere 8 percent.

The predicament faced by U.S. automakers now is twofold. On one hand, they must produce and market new-energy vehicles globally and on the other hand, they have to cater to the laggard domestic market. They find themselves in competition with rivals from Europe, Asia, and notably China, while simultaneously meeting the evolving demands of the slower U.S. market.