Joe Biden’s Economic Hangover Grips America

The United States witnessed a troublesome contraction of its economy for the first time in over three years, amid a sudden rise in imports and a fall in federal spending. The surprising decline led to losses in the stock market, causing political tensions to escalate in the nation’s capital.

President Donald Trump, who is wrapping up the first 100 days of his second term in office, was quick to shoulder off the blame onto his predecessor. In his social media comments on Truth Social, Trump pointedly dubbed the failing economy as ‘Biden’s stock market.’

Trump reassured the American people in his posts, emphatically stating that the slump in numbers had ‘nothing to do with tariffs.’ He shifted the responsibility to the policies of former President Joe Biden, commenting about the presence of ‘bad numbers’ inherited from Biden’s administration.

Exercising his trademark brashness, he instructed Americans to ‘BE PATIENT,’ hinting that the country is on the precipice of a major economic rebound. Despite the downwards trend, Trump remained steadfast in his belief that the new tariffs would soon show their positive effects.

He highlighted that businesses were flocking to the United States in record numbers, alluding to a promising future. However, he asserted that there was a lingering economic hangover from Biden’s term that had to be swept away for the country to truly prosper.

Economists, however, aren’t sold on Trump’s rosy picture. Many pin the economic downturn on Trump’s new tariffs, placing him directly at the center of the economic maelstrom.

Digging into what influenced the drop in GDP, research from the U.S. Department of Commerce revealed that the 0.3% annualized decline hinged on several factors: an abrupt surge in imports as businesses scrambled to stockpile before new tariffs were enforced, a fall in federal spending, especially in defense expenditure, and a reduction in consumer spending against the previous quarter.

Despite a subdued surge in spending in areas such as healthcare and utilities, the spending on durable goods slowed. Market watchers also recorded an unexpected spurt in vehicle purchases, probably due to consumers wanting to get ahead of anticipated price surges resulting from tariffs.

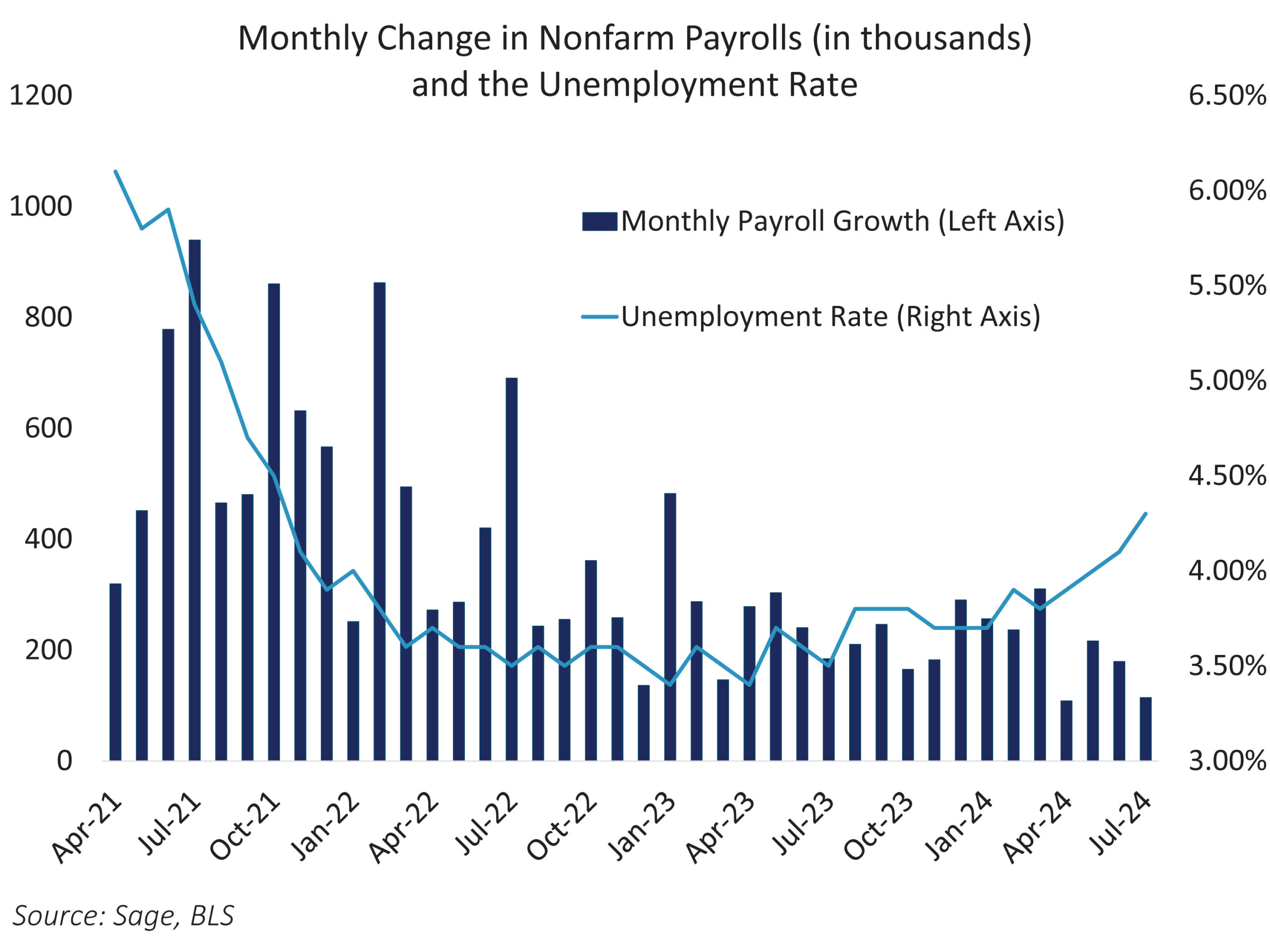

Alarmingly, private payrolls saw an increase of a mere 62,000 jobs in April, underscoring the weakened momentum in the hiring sector, unseen since July 2024. Many economic observers have linked this slump to the uncertainty triggered by Trump’s economic policies, including his punitive tariffs on Chinese goods and imports from other key allies.

At a celebration marking the hundredth day of his term, Trump boasted that prices were ‘coming way down.’ However, recent data unveiled a starkly different reality. Inflation was on the rise, hiring was losing steam, and growth was regressing.

Economists, however, have cautioned against sounding the recession alarm bells too soon, stating that two continuous quarters of negative GDP are required to officially declare a recession. Certain positive indicators still persisted: Real final sales to private domestic purchasers rose 3.0%, and business investment, particularly in inventories, increased.

Exports exhibited growth too, somewhat balancing out the import surge. Nonetheless, the report threw into sharp relief the precarious position of an economy suffering the effects of a highly politicized landscape filled with tariff-based contention.

Ahead of the next GDP update scheduled for May 29, the White House is bound to face mounting questions from Wall Street, corporate leaders, and voters. The disappointing performance of the economy has sent reverberations through the stock market, causing a sharp decline following the release of the GDP figures.

Trump’s economic narrative no longer seems tenable, even as the President gears up for a meeting with business leaders in the coming week.

Taking into account the steady influx of businesses into America, as heralded by Trump, it remains to be seen how his economic plans will chart the future trajectory of the U.S. economy.

As Biden’s ‘overhang’ continues to be blamed for these rough economic times, one can’t help but question if this narrative is simply an easy excuse, masquerading Trump’s own failing policies.