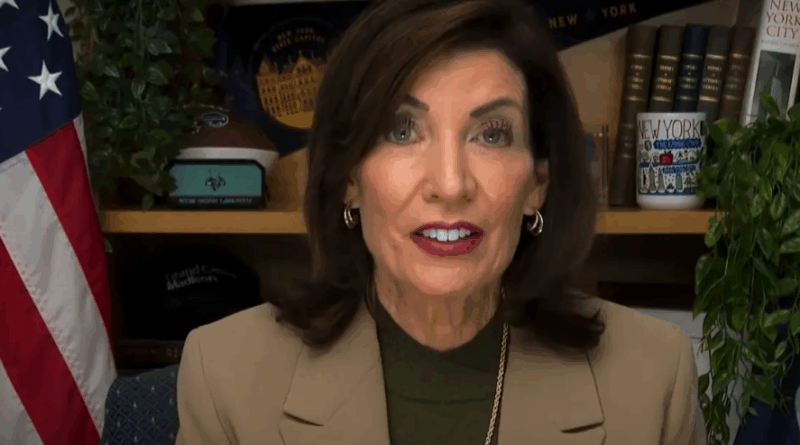

Kathy Hochul Leaves NY Servers Behind as Trump’s ‘No Tax on Tips’ Policy Gains Ground Nationwide

President Donald Trump’s newly passed “no tax on tips” policy has delivered much-needed relief to millions of service workers across the country. But in New York, Governor Kathy Hochul and her Democratic allies in the state legislature are refusing to follow suit — infuriating bartenders, waitstaff, and small business owners who say they’re getting slammed by rising costs and a hostile tax regime.

Under Trump’s “One Big Beautiful Bill,” passed by congressional Republicans earlier this year, tipped workers can now deduct up to $12,500 of tip income per year from their federal taxes — double that for married couples. The law also allows hourly workers to deduct overtime income on the same terms. In total, over 70 service-oriented jobs are covered by the tax break, from hairdressers and taxi drivers to hotel clerks and golf caddies.

But while red and purple states quickly matched the federal deductions at the state level, New York is one of several deep-blue holdouts refusing to adopt the new policy. The state’s decision not to exempt tips from income taxes has touched off a firestorm in the hospitality industry, especially in New York City where service workers already struggle to survive amid soaring inflation and mounting bills.

“Screw her,” said Rion Gallagher, a bartender at The Blasket in Midtown. “If we weren’t taxed on our tips, we’d be able to save more, we’d enjoy life a little more, maybe we wouldn’t have to pick up that extra shift.”

Many workers are losing hundreds or even thousands of dollars each month under the current system. Zoe Kalodimos, a waitress on Long Island, said she loses roughly $1,000 a month in taxes from her tips — money she could be using to help her family. “It’s like losing money. That’s how I eat and feed my family,” she said

pasted

.

Several employees pointed out that the near-total shift to credit card tips has made it impossible to avoid taxation on their gratuities. David Aju, a server at Anatoly 56 Greek Taverna, said, “I get most tips from credit cards, so that means everything is getting taxed. If my check comes out good, but then they take out a lot of taxes, it’s bad for us.”

Restaurant owners also sounded the alarm about the policy gap. Sammy Musovic, who owns Sojourn Social on the Upper East Side, said that not matching Trump’s federal tax break hurts small businesses and staff retention. “I was really looking forward to that tip credit. She’s not thinking of small businesses when she’s making these decisions,” Musovic said. “Eighty percent of [servers’] income comes from tips — that would have been a big boost for them.”

Others echoed that sentiment, suggesting that workers will leave New York altogether if the state doesn’t change course. Jackie Puttre, a longtime server and current manager at P. McDaid’s Irish Pub, said: “Just leave it to Kathy Hochul to do that. Thanks for nothing.”

Even restaurant owners who support higher base wages agree that workers are getting squeezed unfairly. “If Hochul’s not working to help restaurants get the tax breaks they need, it’s an uphill battle for us,” said John Winterman, owner of Francie in Williamsburg.

New York’s refusal to implement the tip deduction appears to be more about politics than policy. State lawmakers reportedly balked at giving up an estimated $1 billion in annual tax revenue from tip and overtime income. Trump’s Treasury Secretary Scott Bessent blasted the move as “partisan stonewalling” and said Democrats were actively hurting the very workers they claim to champion.

“This partisan stonewalling is a direct assault on the very families and workers liberal politicians claim to champion,” Bessent said.

Governor Hochul’s office said they were still “evaluating the issue,” leaving the door open to reversing course next year. But with affordability becoming a major rallying cry for progressives like Mayor-elect Zohran Mamdani, pressure is building from both the left and right.

Nassau County Executive and GOP gubernatorial candidate Bruce Blakeman summed it up this way: “Kathy Hochul is sticking it to the service industry by blocking real tax relief on tips and overtime – costing servers up to $3,000 a year.”

Whether the governor relents remains to be seen. But for now, New York’s restaurant workers are watching other states enjoy the break — while they pick up extra shifts to make ends meet.