On Tuesday, Senate Republicans spearheaded the advancement of President Donald Trump’s expansive tax and financial bill, commonly referred to as ‘One Big Beautiful Bill.’ This bill carries significant implications for the Medicaid program, and if it clears the House vote – slated potentially, before the Independence Day celebrations – millions may face the loss of their health insurance.

While the percentage of uninsured people in the United States saw a significant decrease from 2013 to 2023, the proposed Republican fiscal legislation might reverse this trend. This number plummeted from approximately 14 percent to less than 8 percent, reaching a historic low. This decline was primarily due to the Affordable Care Act’s coverage expansion. Currently, an estimated 26 million Americans lack health insurance, a figure that has maintained stability in recent years.

However, the proposed Republican fiscal bill could potentially drive this figure up sharply, pushing millions more into the uninsured category. A June estimates from the impartial Congressional Budget Office suggests that almost $1 trillion could be pared off from the Medicaid program under the Senate’s version of the bill. It also anticipates as many as 12 million Americans could lose their coverage by the year 2034.

The Trump Administration views these cuts as an effective strategy for eradicating ‘waste, fraud, and abuse in government programs,’ as an endeavor to sustain and safeguard them for the Americans who depend heavily on them. The bill might limit access to coverage by introducing a work prerequisite for Medicaid enrollment. Roughly 72 million low-income and disabled individuals in America currently benefit from Medicaid.

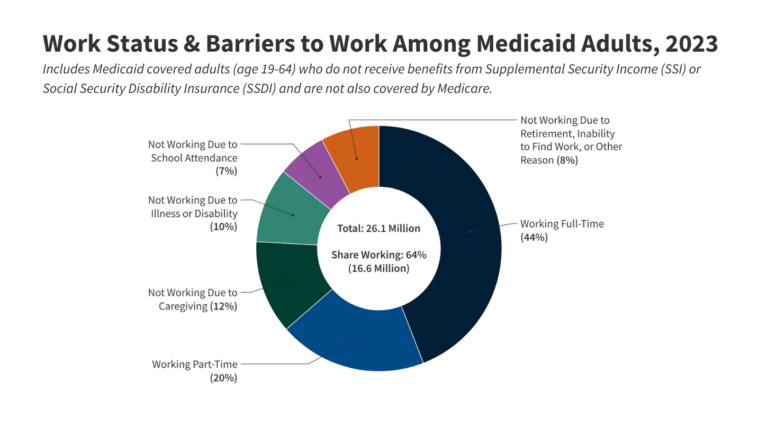

Such a federal work requirement for Medicaid beneficiaries is unprecedented. To date, eligibility has been determined based purely on an individual’s income and disability situation. Despite popular belief, most adults enrolled in the program are already employed or seeking employment. However, this bill proposes that adults must work or volunteer for at least 80 hours per month to qualify for Medicaid.

Exclusions would be made for those who are disabled or pregnant. The Senate-approved version provides that parents with kids under the age of 14 may apply for exemptions, a narrower provision compared to the House version, which allowed any parent of a dependent child to apply.

The proposed measure would alter the frequency of Medicaid eligibility reassessments, necessitating them every six months instead of the current annual examination. This enforces more frequent reapplication to continue program eligibility, a potential barrier for non-English speakers and those with literacy difficulties.

Another proposed restriction on access to coverage lies in tightening the purchase of health plans through the insurance marketplaces nurtured by the Affordable Care Act. The proposed bill truncates the open enrollment period by a month and revokes the option for automatic plan renewals.

To maintain coverage, policyholders would need to update specific personal information periodically. The Republican plan would also limit a funding mechanism that states currently employ to support their Medicaid program, known as provider taxes. These are fees applied to health care facilities such as hospitals and nursing homes.

Medicaid is a shared responsibility of the federal government and the states, with the former contributing a designated percentage to state Medicaid fees. Higher provider taxes inflate state Medicaid spending, often translating to increased federal reimbursement.

The Congressional Budget Office anticipates that these changes may compel states to adapt their Medicaid programs. This could mean decreased provider payment rates, reduced availability or scope of specific health care services, and a decline in Medicaid enrollment ultimately.

The onus will be on states to brainstorm fresh strategies to finance the services currently funded by Medicaid. This legislation could dramatically transform the healthcare landscape in the states, adding new complexities for funding and insurance systems.

The full implications of the ‘One Big Beautiful Bill’ will only be fully understood once it’s put into action. The potential impact on the most vulnerable populations, those dependent on Medicaid, will be watched with great concern. It is attracting significant criticism from those who fear an explosion in the numbers of uninsured people.

This proposed House bill brings us to the crux of an era-defining battle over health insurance in America. With a multitude of factors at play, the potential consequences of this reformation could resonate widely across sectors and communities.

The trajectory of this bill and its ultimate fate seem likely to hold serious consequences for millions of Americans. These consequences will particularly impact those who find themselves on the knife-edge of the poverty line. For many, the aftershocks of the bill’s outcome will reverberate in their day-to-day lives, reflecting the broader conflict surrounding public health care provision in America.