Since the beginning of the year, the stock price of Tesla (NASDAQ: TSLA) has depreciated notably from its starting position at $428 per share. The gradual decline was witnessed when Elon Musk, CEO of the company, decided to devote more of his time to the Trump administration as the head of the Department of Government Efficiency (DOGE), thus leaving his automotive business in a challenging position. However, even with Musk’s return to Tesla’s helm, the company’s stock price has yet to recover fully and, as of June 16th, has declined approximately 20% — currently priced at $325 per share.

These fluctuations have left potential investors questioning whether the timing is right to invest in Tesla stocks. It can be complex to balance the advantages and drawbacks of such a decision — and for many, the current uncertainties suggest that it’s better to postpone any prospective investments in Tesla.

Musk’s vision for his companies has always been grandiose, setting targets that often appear to border on the fantastic. Tesla has had a history of missing its launch deadlines, but nobody can challenge the fact that it has carved out a successful niche within the electric vehicle market when many critics predicted it would falter. Musk’s announcements that Tesla’s future is intertwined with robotics and autonomous vehicles underscore the need to be watchful.

The implications of these focus areas could have significant fiscal ramifications. Morgan Stanley predicts that the humanoid robot market could reach an astounding $5 trillion by 2035. Musks has aspirations for Tesla to secure 10% of this market share. The company has initiated moves towards this vision, intending to manufacture 5,000 of its Optimus bots this year and increasing the scale to 50,000 the subsequent year.

The growth trajectory then shifts to consider Tesla’s engagement within the autonomous vehicles (AVs) sector. The company’s planned launch of its Robotaxi service in Austin, Texas, has been delayed this month, indicative of the setbacks that often accompany bold endeavors. Even so, the larger context here is Tesla’s two-fold approach: manufacturing its own autonomous vehicles and facilitating owners to lease their Tesla cars for AV services.

Tesla places its bets on the future, aiming to tap into an expected $2 trillion autonomous vehicle market by 2030. Although they may be lagging behind some competitors presently, it isn’t unfathomable to believe that Tesla, currently the leading electric vehicle producer in the U.S., could establish a successful segment within the budding AVs industry.

Despite the immense potential Tesla showcases, there exist substantial uncertainties that might hinder its progress. The main concern centers around Tesla’s key operation, the sales of electric vehicles. Tesla’s automotive revenue saw a 20% downfall in 2025’s first quarter, coupled with a striking 71% dip in net income, standing at merely $0.12 per share.

The most plausible explanation for this downturn is the damage dealt to Tesla’s brand during Musk’s tenure at DOGE, as certain actions did not resonate with existing and potential consumers. The volatility of Tesla’s branding appeal and the time needed for its recovery remain difficult aspects to forecast.

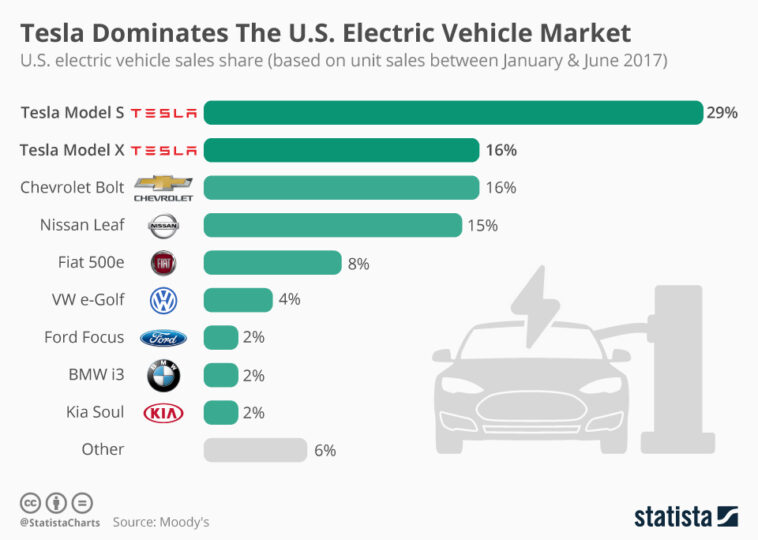

Its brand’s downturn coincides with a sluggish EV sales performance in the U.S. Another factor compounding Tesla’s predicament is the intensified competition in the global electric vehicle market, eroding Tesla’s once-profound dominance.

Companies headquartered in China such as BYD have started turning the tide in their favor, surpassing Tesla in several markets – a trend particularly noticeable in China. Adding to the stack of challenges is Tesla’s ambitious aspiration for leadership in robotics and autonomous vehicles, which are still relatively untested markets.

These rapidly emerging sectors carry significant risk factors. Despite Tesla’s potential in developing cutting-edge technology, there is no absolute guarantee about market appetite for its humanoid bots or autonomous vehicles. There are scenarios where the technology could be impressive, but demand might fail to meet the supply.

When it comes to the final verdict on investing in Tesla, prudence seems to be the best course for now. It may be wiser to wait until Tesla’s plans for autonomous vehicles and robotics mature and exhibit greater certainty.

The road to recovery would require steady vehicle sales, robust growth in net income, and a consistent leadership focus from Elon Musk. Until these conditions are met, investing in Tesla’s stock might not be advisable despite its potential future in the AV and robotics sectors.

However, taking a step back and observing doesn’t equal to writing Tesla off completely. The company’s ambitious pursuits may drive it to secure a sizeable presence in both AVs and robotics.

Tesla’s journey is still playing out, with a lot of key milestones yet to be reached. With patience and keen observation, investors can revisit this question with renewed and informed perspectives.

To sum up, while Tesla’s potential in the AV and robotics industries is compelling, the current uncertainty surrounding the company is enough to mandate a cautious approach from prospective investors looking to buy its stock at this time.