The Global Standoff in Crude Oil Prices: A Week in Review

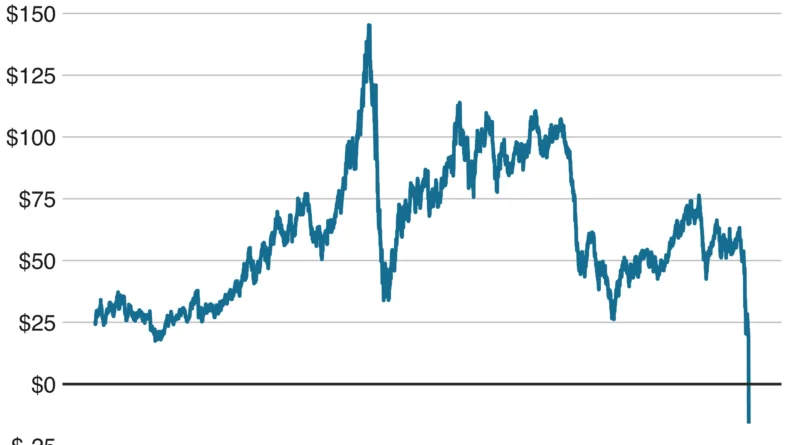

The global oil marketplace witnessed a range-bound behavior in crude oil prices last week, with initial gains gradually giving in to a downward trend later. Concurrently, Brent crude oil futures, priced on the Intercontinental Exchange (ICE) at $66.70 per barrel, saw a marginal drop by 0.5% over the week.

Meanwhile, in a steady correlation, crude oil futures for October on the Multi Commodity Exchange (MCX) held a steady line and finished the week unchanged, priced at ?5,527 per barrel.

Excursion of Brent crude oil futures was observed on both sides in the preceding week but still maintained within the well-worn pathway of $65 to $69. This constant oscillation demonstrates a market standoff, with bulls and bears working in equilibrium, carefully anticipating the trajectory of the imminent trend shift.

The evolution of this trend essentially hinges on which direction the breakout range sways. A decisive breakout beyond the $69 mark has the potential to sway the sentiment positively, lifting prices to a higher bracket. A push in this direction could see an upward climb to milestones at $72.80 and even $75, considered the potential resistance levels.

Contrarily, if downward pressure caused the support threshold at $65 to be eclipsed, a tumble to a lower level at $62 could be in the offing. This scenario reflects the criticality of the standoff and its potential influence on future trading strategies.

Turning to the MCX, October’s crude oil futures posted a week-high at ?5,686, recorded on Tuesday. This came before a toning-down in price was observed, demonstrating a moderation stemming from adjusting market forces.

Interestingly, these futures remain trading consistently within a defined range of ?5,380 to ?5,800. This particular range has been maintained since the onset of August, suggesting a certain lack of directional clarity in the current market scenario.

The existing price behavior does not hint at a definitive trend direction, cornering market watchers to sit on the fence until a decisive breach on either side of the ?5,380 to ?5,800 range occurs.

Simply put, until the price either breaks above ?5,800 or slips under ?5,380, the market remains indecisive about a definitive trend establishment going forward for the crude oil futures.

Should market forces push a rally beyond the ?5,800 mark, crude oil futures could well feel the wind beneath their wings to soar to ?6,050. Such an upward trend could be a significant factor in influencing wider market sentiment.

On the other hand, the breach of the support line at ?5,380 would unsettle the status quo and possibly trigger a slide in prices to a lower level of ?5,000. This evident contrast in potential outcomes is indicative of the speculative nature of commodity market trends.

In conclusion, the past week has seen crude oil futures remain bound within specific ranges, with market forces taking a seemingly ‘wait and watch’ stance. Predominantly, the market trend will be dictated by which direction breaks out from the currently held range, leading to a fresh trajectory for global crude oil prices.

The tug-of-war situation between bullish and bearish market behaviors is anticipated to break soon and will be a key determinant influencing where the crude oil market is headed next. This illustrates why investors must always be on their toes, closely monitoring these market indicators.