Trump’s Bold Stance: Conditions for Sanctions on Russia and China

Previous US President Donald Trump conveyed a strong message to NATO nations on a Saturday, implying that he was prepared to place significant sanctions on Russia and China. However, he added an intriguing caveat – he would proceed when every NATO nation ceased their oil deals with Russia. Trump’s strategic maneuver, notably sidestepping any mention of India, suggested an underlying intention for a singular negotiation between the US and New Delhi.

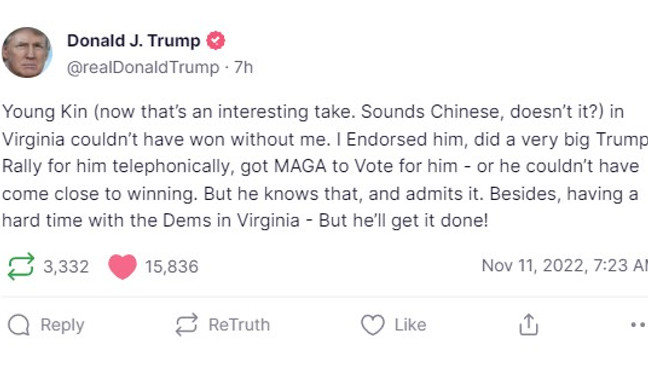

His stance was delivered through a publication on ‘Truth Social’, where he responded to queries around why the US hasn’t imposed direct sanctions on Russia and China. His rebuttal adopted a ‘you first’ principle and was directed at the NATO allies. His message was clear – he was ready to act when they were, thereby shifting the responsibility towards them.

The core of his argument lay in the fact that NATO’s commitment to emerging victorious was substantially less than it should be, especially given that some nations were still purchasing Russian oil. Shocking, as it might appear, Trump saw it as an impediment to achieving unity in opposition against Russia. His solution to the problem was bold – impose 50% to 100% tariffs on China, which could be withdrawn after the resolution of the Russia-Ukraine conflict.

Trump voiced his strong belief that the destructive yet seemingly ludicrous war would find resolution with his approach. He portrayed China as a dominant entity over Russia, and high tariffs as the tool to release that grip. If NATO complied with his strategy, he believed that the war can be concluded swiftly, saving countless lives along the way.

His message for NATO was, however, sternly wrapped with a subtle warning – if his guidance wasn’t heeded, all efforts of the United States would equate to wasted resources. In his view, persisting without his strategy would be futile, expanding an unnecessary drain of time, energy, and money from the US.

Pulling back from his earlier assertions for India to play a significant role in resolving the Russia-Ukraine conflict, Trump eased the pressure on the nation. Despite suggestions for the European Union and G7 nations to increase tariffs against India and China over their Russian oil purchases earlier in the week, his position seemed to abate.

Meanwhile, Trump’s administration continued their critique against India’s connection with Russia, which wasn’t well received by New Delhi. India sternly criticized the duplicity of the US and Europe who continued to offer Russia financial resources while scapegoating other nations in return.

Detractors of the US foreign policy alleged neglect in the confrontation with Russia and China, a sentiment fueled mainly by the Atlantic alliance’s continued indirect trade with Moscow. This, even as the US condemns India for purchasing Russian oil. Many found it paradoxical as nations like Turkey, the European Union, Japan, and South Korea, major allies of the US, accounted for nearly 30 percent of all Russian energy purchases.

These glaring inconsistencies were particularly noticed with Trump mentioning only Russian oil in his communication, completely overlooking NATO partners’ purchases of Russian gas, metals, and fertilizers. Experts were puzzled why these aspects remained untouched while utmost attention was given to Russian oil.

However, Trump’s omission of India in his weekend communication ignited a fresh round of speculation – were the US and New Delhi ready to broker a separate trade agreement? This came in the wake of Trump publicly acknowledging a ‘rift’ between the US and India, an aftermath of his tariff imposition on Indian goods.

Anticipation further escalated after the Adani Group, an Indian multinational conglomerate, announced a significant policy update – ships sanctioned by the US, EU, and UK would not be allowed to dock at its ports. What made the announcement even more significant was its probable impact on Russia’s oil shipments to India.

Could the silence on India amidst all the loud outbursts indicate a novel route that US foreign relations was prepared to tread on? Was there a unique trade plan on the anvil, exclusive to the US and India? Time would reveal the answers to these enticing questions.

Perhaps the speculation could even be a prompt for renewed hope for resolution amid the tumultuous dynamics of world geopolitics, an unexpected silver lining in an otherwise stormy scenario. Only time could tell if Trump’s calculated approach would indeed bring about the change he envisaged.