Uncertainty Paralyzes Businesses Amid US-China Tariff Deadline

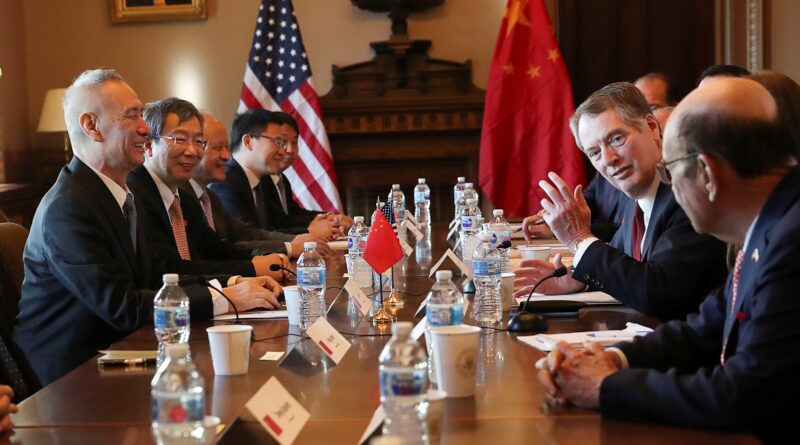

A temporary halt on proposed tariff hikes on Chinese goods, which was set to last for 90 days, is reaching its expiry date this Tuesday. An extension remains uncertain, making the status of the issue a cloudy one. In the most recent discussions concerning China-US trade relations that took place last month, authorities from both countries were under the impression of another 90-day extension being likely. However, officials from the United States added that the final decision is subject to President Donald Trump’s approval.

As at now, there is no official announcement from the White House about this critical decision. This vacuum of concrete information leaves business communities worldwide hanging on the edge, with potential consequences for global economies. President Trump, known for changing deadlines and tariff rates previously, is yet to disclose his plans regarding Tuesday’s deadline. Should the deadline be extended further, it would mean staving off an earlier threat of imposing tariffs as high as 245%.

Higher tariffs are designed to counterbalance the persistent large-scale U.S. trade deficit with China. Remarkably, the U.S’s trade shortfall with China dipped to a 21-year low in July, as the looming threat of tariffs posed substantial damage to Chinese exports. The conventional practice is that the U.S gives subtle indications of how negotiations are progressing. However, it is unusual for the Chinese side to declare anything until significant decisions are finalized.

Interestingly, China’s stance on the current situation has remained silent, with no preemptive comments before Tuesday’s deadline. In a conversation, U.S. Vice President JD Vance stated President Trump’s contemplation of additional tariffs against Beijing, in response to China’s procurement of Russian oil. But, it was made clear that no definate decisions were made by President Trump just yet.

Substantively enormous tariffs on Chinese exports to the U.S. would exert a tremendous amount of pressure on Beijing. This is especially a concerning time when the Chinese economy, second largest in the world, is in recovery mode arising from a prolonged slump in the property market. Moreover, the extended impact of the COVID-19 pandemic has forced many to take up temporary employment opportunities and has stifled the job market as a whole.

Increasing import duties on small packages from China have negatively impacted smaller factories, pushing them towards accelerated redundancy. But, it’s worthy to note that U.S.’s dependency on Chinese imports extends to a wide range of products. These include household items, clothing, wind turbines, primary computer chips, electric vehicle batteries, and the rare earth elements needed for their production. This interdependency provides Beijing a strong bargaining position in their negotiations with the U.S.

Regardless of the presence of high tariffs, China’s competitiveness in various product markets remains steady. And Chinese leadership is mindful that the U.S. economy is just starting to come to terms with the inflationary effects instigated by the tariff increments. Currently, a 10% baseline tariff along with a 20% supplementary tariff related to the fentanyl issue is applied to imports from China. However, some goods are subjected to an even higher tariff.

In contrast, U.S. goods exported to China encounter around a 30% tariff. Before the agreement to call a ceasefire was reached, President Trump threatened to impose 245% in import duties on Chinese goods. In response, China threatened to increase tariffs on U.S. goods to a staggering 125%. The trade tussle between the world’s leading economies has wide-ranging implications on the global economic view, affecting everything from business supply chains to commodity demand such as copper and oil to pre-existing geopolitical issues like Ukraine’s conflict.

Triggered by a phone conversation with the Chinese leader Xi Jinping, President Trump expressed his desire for a personal meeting with Xi later in the year. This aspiration might serve as a motivation for both parties to strike a mutually beneficial agreement. If, on the other hand, both nations fail to adhere to their temporarily established truce, trade strains may intensify and tariffs could potentially inflate to unparalleled heights.

Under such circumstances, both economies could experience further distress and the global markets would arguably be severely destabilized. This uncertainty has repercussions beyond tariffs and trade; it paradigms the business world’s decision making. Businesses could be discouraged from making investments and employing new people, and it could cause inflation to rise rampantly.