U.S. Imposes 25% Tariff on Indian Commodities in Major Trade Shift

In a development of substantial gravity, the United States, under the leadership of President Donald Trump, has marked a significant moment in international trade relations. As of August 1, a 25% tariff has been imposed on commodities from India, a decision that has shaken the trade prospects between the two countries. Many anticipated that the US would apply a more lenient tariff, capped at 10%, but this expectation was not met, marking a grim turn in their relationship.

The President justified this drastic measure by referring to India’s ‘high trade barriers’. Trump also pointed to India’s ongoing relations with Russia in the domains of energy and defence as contributing factors. In his assertive proclamation, he both acknowledged India’s friendship and criticized its actions.

Having a friendship with India, according to Trump, didn’t preclude the observation that the nation instated some of the ‘highest tariffs’ against the United States, alongside ‘non-monetary trade barriers’ that he condemned as ‘unpalatable’. The President was clear – while India was an ally, trade measures they had implemented, the most astringent globally, posed a considerable challenge to doing business.

He continued his criticism of India by pointing out their reliance on Russia for certain key commodities, with a primary focus on military equipment and oil. Trump made investor sentiments clear: buying from Russia, especially at a time when Russia’s actions in Ukraine were under a global scanner, could have far-reaching consequences.

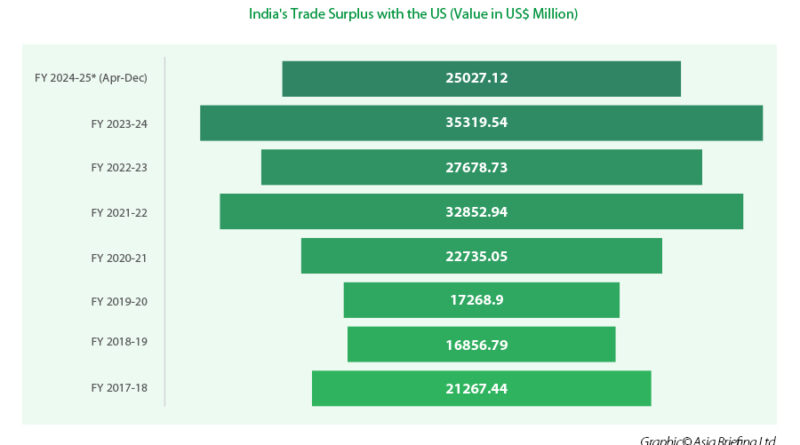

In addition to the hefty tariff, India, according to Trump, would face a further ‘penalty’ due to its dealings with Russia. Also, the ‘massive trade deficit’ with the United States would be met with corresponding punitive measures. The unveiling of this decision put a dark cloud over India’s trade relationship with the US.

India’s consistent reliance on Russia for the majority of its military equipment, and maintaining its position as a key buyer of Russian energy despite the global demand to curb the violence in Ukraine, were elements which Trump saw as ‘NOT GOOD’. He made it clear: starting August, India would not only pay a tariff of 25% on exports to the US but also an additional penalty for the aforementioned issues.

It’s worth noting that Trump’s stance towards India has been consistently critical when it comes to trade policies. He has named India as a ‘trade abuser’, and condemned what he calls ‘unpleasant non-monetary trade barriers’. To support this, he referred to the high import duties on American goods and India’s refusal to align with sanctions on Russia.

Even before announcing these tariffs, Trump didn’t shy away from expressing his opinions about the topic when questioned. ‘I think so. India is my friend. They ended the war with Pakistan at my request… The deal with India is not finalized. India has been a good friend, but India has charged basically more tariffs than almost any other country’, he said.

Trump’s administration has been consistent with its tariff position since April. The administration disclosed a tariff plan which laid out a 10% baseline tariff on imported goods from countries that are running large trade surpluses, with India being one such country.

In response, India demonstrated willingness to negotiate by echoing a commitment to reducing tariffs on select American goods. In an attempt to either avoid or mitigate these levies, India suggested a bilateral trade agreement. However, these efforts could not prevent the new tariffs that were eventually imposed.

With the implementation of these new tariffs, industries across India are bracing for the impact. They range from sectors like garments, pharmaceuticals, gems and jewelry, to petrochemicals – areas that have major export potential to the US market. The commodities that are being exported from India to the US, previously valued at approximately $87 billion in 2024, are likely to experience the strain.

Further repercussions of this decision are expected on the performance of the Indian currency. Analysts foresee a potential weakening of the Indian Rupee under the influence of these new tariffs. The economic implications are multi-dimensional and a key concern for policymakers.