Lucid Group’s Stock Decline Mars Promising Q1 Results

Lucid Group, a premium manufacturer of electric vehicles (EVs), did not experience any remarkable highs in its stock during May. On the contrary, the company suffered a sharp decline, losing over 11% of its value, despite releasing a quarterly earnings report that impressed some investors. Nevertheless, several other factors left the market decidedly displeased. A sea of red isn’t the most promising color for Lucid’s financial portrait.

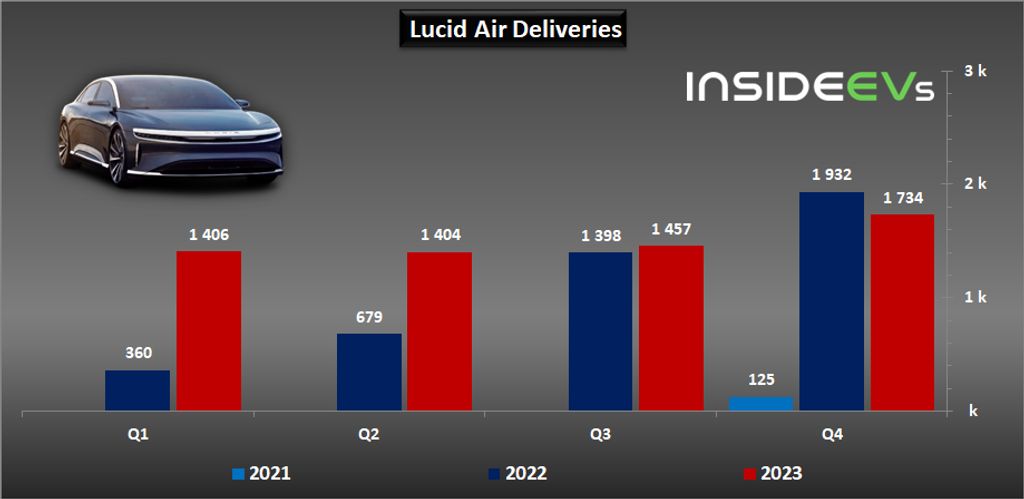

The month of May commenced on a promising note for Lucid. The company had unveiled its Q1 results within the first week, indicating a dramatic acceleration in revenue to more than $235 million, marking a 36% year-over-year increase. From an operational perspective, Lucid produced 2,212 vehicles and delivered 3,109 during the same period.

The delivery count of 3,109 represented a significant, 58% increase from the respective quarter in 2024. However, the figures didn’t entirely live up to expectations set by analysts following Lucid’s stock. The projection hinged on a slightly larger revenue figure of over $246 million.

Lucid’s earnings report also served as a potent reminder of its continuing struggle with losses. According to GAAP standards, the company registered a net loss of over $366 million for the quarter. However, it’s noteworthy to mention that this figure is narrower than the nearly $685 million deficit from Q1 of 2024.

The situation echoed similarly on a non-GAAP per share basis, with Lucid charting a net loss of $0.20 per share, a slight improvement on the corresponding period’s $0.27 per share loss. On a brighter note, the $0.20 per share loss outperformed the analyst-consensus net loss of $0.23 per share, providing one prominent reason behind the market’s encouraging reaction to the earnings report.

However, the market displayed considerably less enthusiasm toward the possible impact of an imminent policy shift on Lucid and its fellow EV manufacturers. As May advanced, there were intensifying conversations and disputes surrounding President Trump’s ‘One, Big, Beautiful Bill’ as it steadily progressed through Congress.

An unsettling element of the bill pertained to the proposed removal of the existing EV tax credit. This financial incentive, offering up to $7,500 to consumers investing in an electric vehicle, has significantly spurred the EV industry’s growth.

The EV tax credit, originally slated to persist until its established expiration of December 31, 2031, has been a key support for manufacturers. However, the life of this subsidy would be drastically cut short under President Trump’s bill – to December 31, 2025.

The premature expiration of the EV tax credit potentially poses a significant risk to Lucid. The company has a history of substantial losses which continue to be unsustainable, even in light of its impressive $5.76 billion in liquidity revealed at the close of the quarter.

Lucid will certainly feel the pinch if the bill eventuates as currently outlined, impacting its ongoing business viability. High-quality and appealing vehicle models along with a dedicated management team may not be enough to offset the decreased demand resulting from the subsidy’s discontinuation.

I am personally fond of Lucid as a business, recognizing the allure and quality of its EV models, which seem worth their asking price. I believe the managerial team is making every effort to enhance the company’s performance and stimulate revenue growth.

However, the persistent, alarming amount of red ink on the financial statements is worrisome for Lucid’s long-term sustainability. It appears that the company’s future may be hanging in balance.